Simple Guide on Minimum Capital Requirements – Basel III

Let’s break this down. Financial institutions like banks and investment firms around the world follow certain rules to manage risks. These rules are pretty similar everywhere. One popular set of rules is Basel III. It’s like a safety net for these institutions. It helps them stay strong in tough times and keeps an eye on risks in the financial world. The main goal? To make sure these institutions have enough money to handle losses, whether things are going good or bad.

In India, institutions that help with development and growth are getting more important. So, India is now applying these Basel III rules to them as well.

How to Put This into Action and When

These institutions, viz., All India Financial Institutions (AIFIs), need to start following three main parts of Basel III. They’ll measure risks in lending, investing, and day-to-day operations. Here’s the plan:

AIFIs need to check their financial health in two ways:

Group Level: This means adding up everything from their subsidiaries (except insurance and non-financial ones) and checking if they’re strong enough together.

Solo Level: Here, they just look at themselves, without their subsidiaries, to see if they’re financially healthy on their own.

And yes, if they have operations in other countries, these rules apply there too.

Capital Adequacy at Group / Consolidated Level

In assessing capital adequacy at the group level, it’s essential to fully integrate all financial subsidiaries, excluding those involved in insurance and non-financial activities. This comprehensive approach ensures a thorough evaluation of the group’s financial resilience, taking into account the risk profile of both assets and liabilities within the consolidated subsidiaries.

Regarding insurance and non-financial subsidiaries, including joint ventures and associates of an AIFI, a different approach is warranted. These entities should not be consolidated for capital adequacy purposes. Instead, investments in these subsidiaries should be deducted from the group’s consolidated regulatory capital. This also applies to investments in unconsolidated insurance and non-financial entities related to the AIFI, which are addressed in specific sections of the regulatory framework.

It’s also necessary to apply all regulatory adjustments to the consolidated Common Equity Tier 1 capital of the parent AIFI as outlined in the relevant sections. This includes recognizing minority interests and other capital from consolidated subsidiaries held by third parties in the parent AIFI’s consolidated regulatory capital, subject to specific conditions.

Furthermore, AIFIs must ensure that their majority-owned financial entities, which are not consolidated for capital purposes, comply with their respective regulatory capital requirements. Should there be any capital shortfall in these unconsolidated entities, it must be fully accounted for by reducing the parent AIFI’s Common Equity Tier 1 capital.

Capital Adequacy at Solo Level

When evaluating an AIFI’s capital adequacy on a solo basis, it is imperative to apply all regulatory adjustments as indicated. This includes deducting investments in the capital instruments of subsidiaries, which are part of the group’s consolidated financial statements, from the AIFI’s own capital instruments.

In instances where there is a shortfall in the regulatory capital requirements of an unconsolidated entity, such as an insurance subsidiary, this deficit must be fully offset by a reduction in the AIFI’s Common Equity Tier 1 capital.

Composition of Regulatory Capital

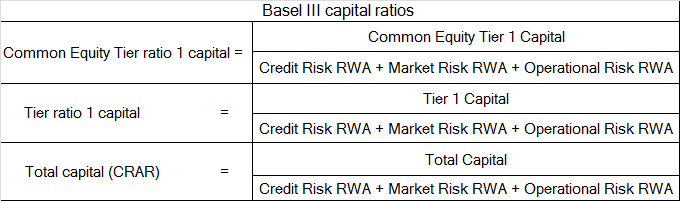

All-Inclusive Financial Institutions (AIFIs) are required to maintain a certain level of capital compared to their risk-weighted assets, known as the Capital to Risk-weighted Assets Ratio (CRAR), set at a minimum of 9%. This is to ensure they have enough capital to cover various risks like interest rate changes, liquidity issues, and more. The Reserve Bank may ask for a higher capital ratio based on the AIFI’s risk profile and management.

Basel III Reforms – Introduction

Elements of Regulatory Capital – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III