Capital Charge for Credit Risk – Basel III

In banking, managing credit risk is crucial, especially when it involves large amounts of money. The Standardized Approach is often used, where external credit ratings guide how much risk each credit carries. Banks use these ratings to decide how much capital they should set aside as a safety net.

Claims on Domestic Sovereigns

For domestic government claims, the risk is usually considered very low. Investments in central government bonds or loans to the government usually have a zero percent risk weight. The same applies to central government-guaranteed claims. State government loans and securities are also low risk, but state government-guaranteed claims carry a bit more risk, so they’re weighted at 20 percent.

Special guarantees, like those from the Credit Guarantee Fund Trust for Micro and Small Enterprises, attract zero risk if they meet certain conditions. However, if these guarantees have limits, like a cap on the amount covered, the zero percent risk weight only applies up to the covered amount. The rest is treated as a regular loan or investment.

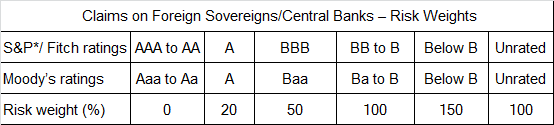

Claims on Foreign Sovereigns and Foreign Central Banks

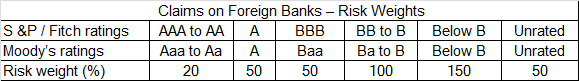

Foreign governments and central banks, risk weights vary based on their international credit ratings. Investments in highly-rated governments are considered very safe, while those in lower-rated governments are riskier. If a bank’s investment is in a foreign currency but funded in that currency, it usually carries zero risk. However, this can change if the local regulatory authority where the bank operates decides on a different approach.

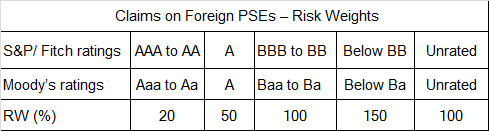

Claims on Public Sector Entities

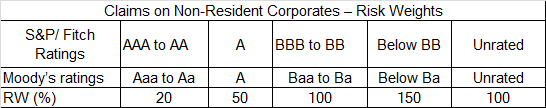

When it comes to public sector entities, both domestic and foreign, they are risk-weighted similarly to corporates based on their credit ratings.

Investments in multilateral development banks, the Bank for International Settlements, and the International Monetary Fund are generally considered quite safe, given a 20 percent risk weight.

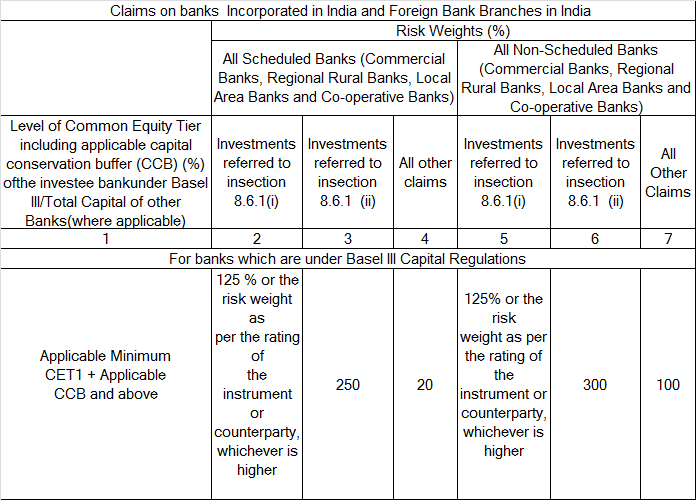

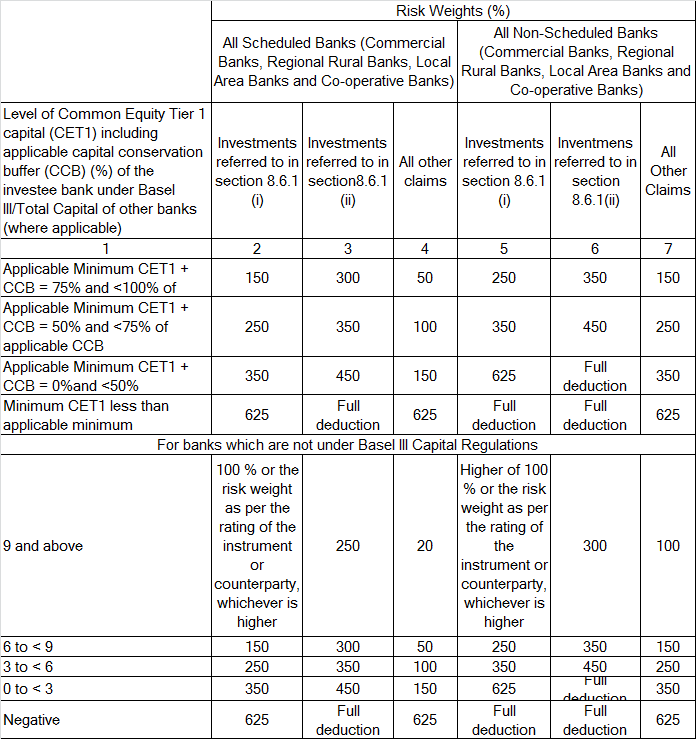

For banks, the risk weight of an investment depends on whether it’s within or beyond 10% of the issuing bank’s equity. It also depends on the bank’s compliance with capital requirements and its credit rating

Claims on Primary Dealers

Claims on primary dealers and corporates, including non-banking financial companies (NBFCs), are weighted according to their credit ratings. Unrated claims have a higher risk weight, especially if the company is large or if it used to be rated but isn’t anymore.

Retail loans that meet specific criteria are generally less risky, so they’re given a lower risk weight of 75 percent. However, this doesn’t include things like investments in securities or mortgage loans.

Loans secured by residential property are also risk-weighted, with the weight depending on the loan-to-value ratio and the type of property.

All these rules help ensure that banks hold enough capital to stay safe and sound, even if some of their loans or investments go bad. It’s a way of protecting the bank and its customers from unexpected financial problems.

Claims secured by Residential Property

Claims that are classified as commercial real estate exposure are defined by guidelines issued on September 9, 2009. These claims have a risk weight of 100 percent. Investments in mortgage-backed securities that are related to these exposures follow the securitization guidelines set by the Reserve Bank of India as of September 24, 2021.

Non-Performing Assets

Non-performing assets (NPAs) are treated differently based on their security and the level of specific provisions made. The risk weight varies from 150 percent to 50 percent depending on the provisions made against the NPA. Unsecured portions of NPAs are risk-weighted based on these specific provisions, and the method to calculate this is detailed.

For secured NPAs, the type of collateral determines the risk weight. Collateral like land and buildings or plant and machinery is considered only under certain conditions. Claims secured by residential property have different risk weights depending on the specific provisions made.

Certain categories of exposures, like those to Alternative Investment Funds or consumer credit, have specific risk weights. For instance, consumer credit, including personal loans, has a risk weight of 100 percent. The risk weights for capital market exposures depend on the external rating of the counterparty. Investments in capital instruments issued by non-banking financial companies (NBFCs) and non-financial entities are also risk-weighted, with the percentage varying based on certain conditions.

Unhedged Foreign Currency Exposure

Exposure to entities with significant unhedged foreign currency exposures is addressed with additional capital requirements to mitigate the risk of default due to currency volatility.

Other assets, including loans and advances to the institution’s own staff, have specified risk weights. Loans fully covered by benefits or mortgage have a lower risk weight, while other staff loans are included under the regulatory retail portfolio with a different risk weight. All other assets generally attract a uniform risk weight of 100 percent.

Off-Balance Sheet Items

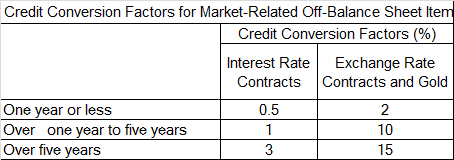

Off-balance sheet items involve risks that aren’t directly visible on financial statements but can affect an institution’s financial health. Calculating the risk associated with these items involves a two-step process. First, the notional amount of the transaction is converted into a credit equivalent amount using a credit conversion factor or the current exposure method. Then, this amount is multiplied by a risk weight that depends on various factors like the type of counterparty or asset.

Non-market-related off-balance sheet items, such as direct credit substitutes and certain commitments, are also calculated using credit conversion factors. These factors vary depending on the type of instrument and its characteristics.

In cases where off-balance sheet items are secured by eligible collateral or guarantees, specific guidelines on credit risk mitigation apply. For example, guarantees issued by banks or rediscounted documentary bills are treated as funded claims on a bank, and their risk is adjusted accordingly.

Securitization Exposures

The treatment of total counterparty credit risk covers both the default risk and credit migration risk. This involves assessing the current and future market values of transactions, considering collateral, netting, and remargining practices.

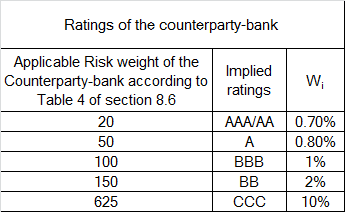

Regarding capital requirements, institutions must hold capital against risks arising from counterparties in over-the-counter (OTC) derivative transactions. This includes a capital charge for the risk of mark-to-market losses, known as credit value adjustments (CVA). The calculation of these charges considers several factors, including the counterparty’s credit rating and the effective maturity of transactions.

For exposures to central counterparties in derivatives and securities financing transactions, different capital requirements apply. These depend on whether the central counterparty qualifies under specific criteria. There are also specific rules for calculating capital charges for failed transactions, including those settled through delivery-versus-payment systems.

The treatment of securitization exposures and credit default swap positions in the banking book is detailed, with specific guidelines on how these should be risk-weighted and how capital adequacy should be maintained. This includes the recognition of external or third-party credit default swap hedges and the treatment of internal hedges within an institution.

Use of Multiple Rating Assessments

When an institution’s claim is not directly rated, but the borrower has a rated issue, certain conditions must be met for the rating to apply to the institution’s claim. This includes parity or seniority in claim status and a matching or shorter maturity. Essentially, ratings play a crucial role in how financial institutions assess and manage credit risk, ensuring a consistent and comprehensive approach to risk weighting.

External Credit Assessment

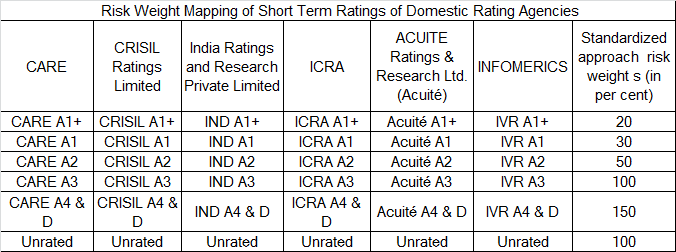

When assessing credit risk, financial institutions use ratings from approved credit rating agencies. The Reserve Bank has listed eligible agencies, both domestic and international, whose ratings can be used for risk weighting. For domestic purposes, institutions may use ratings from agencies like ACUITE, CARE, CRISIL, ICRA, India Ratings, and INFOMERICS. Internationally, they can use ratings from Fitch, Moody’s, and Standard & Poor’s.

Institutions must apply these ratings consistently across similar types of claims, avoiding selective or inconsistent use of different agencies’ ratings. This consistency is key in risk management. They should also disclose which rating agencies they use, along with the risk weights assigned to different rating grades.

Long Term and short Term Ratings

For a rating to be eligible for risk weighting, it must be current, publicly available, and cover the entire credit risk, including both principal and interest. Short-term and long-term ratings are used based on the contractual maturity of the assets. Interestingly, even if a cash credit exposure is short-term, it’s often treated as long-term due to its tendency to roll over.

The ratings from these agencies are mapped to corresponding risk weights. This mapping is reviewed annually by the Reserve Bank. If a claim only has one rating, that rating determines its risk weight. When multiple ratings are available, the higher risk weight is usually applied. Institutions should also treat ratings carefully, using only solicited ratings and ensuring that they reflect the total credit risk exposure.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Elements of Regulatory Capital – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III