Elements of Regulatory Capital – Basel III

Criteria for Inclusion in the Definition of Regulatory Capital

The regulatory capital is divided into two main types: Tier 1 and Tier 2. Tier 1 Capital, also known as going-concern capital, includes Common Equity Tier 1 and Additional Tier 1 capital. Tier 2 Capital, or gone-concern capital, is another component.

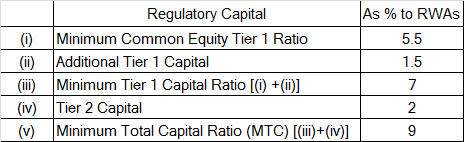

For Common Equity Tier 1 (CET1) capital, the minimum is set at 5.5% of risk-weighted assets. Tier 1 capital should be at least 7% of these assets, and Total Capital (Tier 1 plus Tier 2) must be at least 9%.

The CET1 capital comprises various elements like paid-up equity capital, share premium, reserves, and revaluation reserves, which must meet specific conditions. Foreign currency translation reserves can also be included, with certain criteria. Profits from the current financial year can be considered for capital adequacy calculations, subject to conditions.

Additional Tier 1 capital includes instruments like Perpetual Non-Cumulative Preference Shares, share premiums from these instruments, and other notified types. These must comply with regulatory requirements for loss absorption.

Tier 2 capital consists of provisions and reserves for potential losses, debt capital instruments, preference share capital instruments, and share premiums from these instruments. All of these need to meet specific criteria for inclusion.

Recognition of Minority Interest and Other Capital Issued out of Consolidated Subsidiaries Held by Third Parties

When a subsidiary of a financial institution has minority investors, their contribution to the subsidiary’s capital is recognized in certain conditions. This is especially relevant under Basel III regulations.

For Common Equity Tier 1 capital, the portion of minority interest is included only if the subsidiary is a bank and the capital meets specific criteria. If a subsidiary is not a bank, its minority interest isn’t counted in the group’s regulatory capital.

The recognition of minority interest from common shares in a subsidiary is a bit technical. It’s included in the parent company’s Common Equity Tier 1 capital only if it meets certain conditions. These include the instrument being eligible if issued by the parent company and the subsidiary being a bank. The amount recognized is the total minority interest minus the part of the subsidiary’s surplus capital attributable to minority shareholders.

For Tier 1 capital, instruments issued by a subsidiary to third-party investors are recognized if they meet the criteria for Tier 1 capital. The amount recognized is the total Tier 1 capital issued to third parties minus the surplus Tier 1 capital of the subsidiary attributable to these investors.

Similarly, for Total Capital, which includes both Tier 1 and Tier 2 capital instruments, the same principle applies. The amount recognized is the total capital issued to third parties minus the surplus capital attributable to them.

Regulatory Adjustments

In financial regulations, there are specific rules for what needs to be adjusted or removed from a bank’s capital calculations, both for individual banks and their group of companies. These adjustments are crucial to ensure that a bank’s reported capital is a true reflection of its financial health.

Firstly, any goodwill and intangible assets must be deducted from the bank’s core capital, known as Common Equity Tier 1. This includes goodwill from investments in other financial and insurance entities not covered by the bank’s group. The full amount of intangible assets, minus any related deferred tax liabilities, should also be deducted.

Deferred Tax Assets (DTAs) get special treatment. DTAs from accumulated losses are fully deducted. For other DTAs, a bank can choose to include them up to a certain limit, but their total, combined with certain other assets, must not exceed a specific percentage of the bank’s core capital.

Cash flow hedge reserves need careful handling. The part of these reserves linked to items not valued on the balance sheet is adjusted to ensure it doesn’t artificially inflate the bank’s capital.

Gains from securitization transactions are also deducted. This follows specific guidelines laid out in a Master Direction from the Reserve Bank.

Any gains or losses from changes in the bank’s own credit risk, related to its financial liabilities, are not recognized in the capital calculation. This avoids the bank’s capital being influenced by changes in its own creditworthiness.

Lastly, for banks with defined benefit pension schemes, liabilities are fully recognized in the capital calculation. Any pension assets on the balance sheet are deducted, considering any related deferred tax liabilities.

These adjustments are applied both to individual banks and to their consolidated group entities. This ensures that a bank’s reported capital levels are not inflated by these factors and truly reflect its financial strength.

Investments in the Capital of Banking, Financial and Insurance Entities

Financial institutions like banks and insurance companies must be careful about their investments in other financial entities. This is to avoid risks like overexposure or double counting of capital.

There are limits on how much a financial institution can invest in other banking, financial, and insurance companies. For instance, they shouldn’t invest more than 10% of their capital funds in such entities. Also, they must avoid owning more than 5% of another bank’s equity. When investing in non-financial companies, they should keep it below 49%, and if they acquire more due to debt settlement, they need to reduce it to less than 10% within three years.

For equity investments in subsidiaries and related financial services entities, the limit is 20% of the institution’s own capital. There are also specific guidelines for considering investments in financial institutions for capital adequacy purposes, like asset management companies and non-banking finance companies.

Investments made by a banking subsidiary in its parent institution should be deducted from the subsidiary’s capital. The approach is similar for non-banking financial subsidiaries.

These investments are subject to strict rules for how they affect the institution’s regulatory capital. Investments in insurance subsidiaries, for example, are fully deducted from the institution’s core capital. Cross holdings in other financial entities are also fully deducted to prevent artificially inflating capital figures.

For investments in entities where the financial institution doesn’t own more than 10% of the capital, there are specific adjustments and risk weightings. If investments exceed 10% of the institution’s core capital, the excess must be deducted.

The rules apply to both direct investments and indirect ones through funds. At a consolidated level, these rules mean aggregating investments across the group and applying deductions or risk weightings as appropriate.

Intra-group transactions and exposures are also regulated, and any exposures beyond permissible limits must be deducted from the core capital.

Transitional arrangements for AIFIs

Regarding transitional arrangements, any capital instruments issued before Basel III that don’t meet the new criteria can still be counted as Tier 1 or Tier 2 capital until their maturity. However, any new instruments must comply with the current guidelines.

These regulations help ensure that financial institutions maintain a healthy level of investments in other entities and avoid excessive risk-taking.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III