Hedge Accounting

Hedge Accounting is not mandatory, but it is in the best interest of the entity that following hedge accounting would greatly reduce the unintended consequences of profit and loss fluctuations on account of hedging instruments.

Hedge accounting is a method of financial reporting that allows entities to reflect the offsetting effects of hedging instruments and the items they hedge in the financial statements.

Schedule an Intro Call

Enter your info and we'll show you calendar options to meet with a member of our team:

Key areas to consider for fair value hedge accounting

Key areas to consider:

Hedge Designation and Documentation: At the inception of the hedge relationship, entities must formally designate and document the hedging relationship.

This documentation should detail:

The risk management objective and strategy for the hedge.

The type of hedging relationship.

The hedged item and the hedging instrument.

How the entity will assess the hedging instrument's effectiveness.

Hedged Item: The hedged item can be either a recognized asset or liability or an unrecognized firm commitment. It's important to identify what specific risk component is being hedged, such as interest rate risk or currency risk.

Hedging Instrument: Generally, for a financial instrument to qualify as a hedging instrument, it must meet specific criteria, including being part of an external transaction (not internal derivatives).

Effectiveness Assessment: For the hedge to qualify for hedge accounting, it must be expected to be highly effective in offsetting the hedged risk, both prospectively and retrospectively. This effectiveness needs to be assessed at inception and throughout the life of the hedge relationship.

Measurement and Recognition of Changes in Fair Value: For the hedged item, any change in its fair value due to the hedged risk is recognized in profit or loss. For the hedging instrument, its entire change in fair value is also recognized in profit or loss. Ideally, if the hedge is perfect, the changes in fair values should offset in profit or loss.

Discontinuation of Hedge Accounting: An entity should discontinue prospectively the hedge accounting if: The hedge no longer meets the criteria for hedge effectiveness. The hedge instrument is sold, terminated, or exercised. The designation of the hedge relationship is revoked.

Documentation and Disclosure: Adequate documentation and disclosure are required in the financial statements about the entity's risk management strategy, the hedging relationships, and their impact on the entity's financial position and performance.

Transitional Provisions: When first applying IFRS 9, there are specific transitional provisions and practical expedients available. These need to be considered when transitioning from IAS 39 (the predecessor to IFRS 9) or when first adopting IFRS.

Hedge Designation and Documentation: At the inception of the hedge relationship, entities must formally designate and document the hedging relationship.

This documentation should detail:

The risk management objective and strategy for the hedge.

The type of hedging relationship.

The hedged item and the hedging instrument.

How the entity will assess the hedging instrument's effectiveness.

Hedged Item: The hedged item can be either a recognized asset or liability or an unrecognized firm commitment. It's important to identify what specific risk component is being hedged, such as interest rate risk or currency risk.

Hedging Instrument: Generally, for a financial instrument to qualify as a hedging instrument, it must meet specific criteria, including being part of an external transaction (not internal derivatives).

Effectiveness Assessment: For the hedge to qualify for hedge accounting, it must be expected to be highly effective in offsetting the hedged risk, both prospectively and retrospectively. This effectiveness needs to be assessed at inception and throughout the life of the hedge relationship.

Measurement and Recognition of Changes in Fair Value: For the hedged item, any change in its fair value due to the hedged risk is recognized in profit or loss. For the hedging instrument, its entire change in fair value is also recognized in profit or loss. Ideally, if the hedge is perfect, the changes in fair values should offset in profit or loss.

Discontinuation of Hedge Accounting: An entity should discontinue prospectively the hedge accounting if: The hedge no longer meets the criteria for hedge effectiveness. The hedge instrument is sold, terminated, or exercised. The designation of the hedge relationship is revoked.

Documentation and Disclosure: Adequate documentation and disclosure are required in the financial statements about the entity's risk management strategy, the hedging relationships, and their impact on the entity's financial position and performance.

Transitional Provisions: When first applying IFRS 9, there are specific transitional provisions and practical expedients available. These need to be considered when transitioning from IAS 39 (the predecessor to IFRS 9) or when first adopting IFRS.

Hedge accounting aims to reduce the volatility in profit or loss by matching the gains or losses on the hedging instrument with the corresponding losses or gains on the hedged item

Without hedge accounting, the derivatives used as hedging instruments might be marked to market each period with fluctuations recognized immediately in profit or loss, potentially causing a mismatch with the hedged item's accounting treatment.

Talk To An ExpertHedged item and hedging instruments

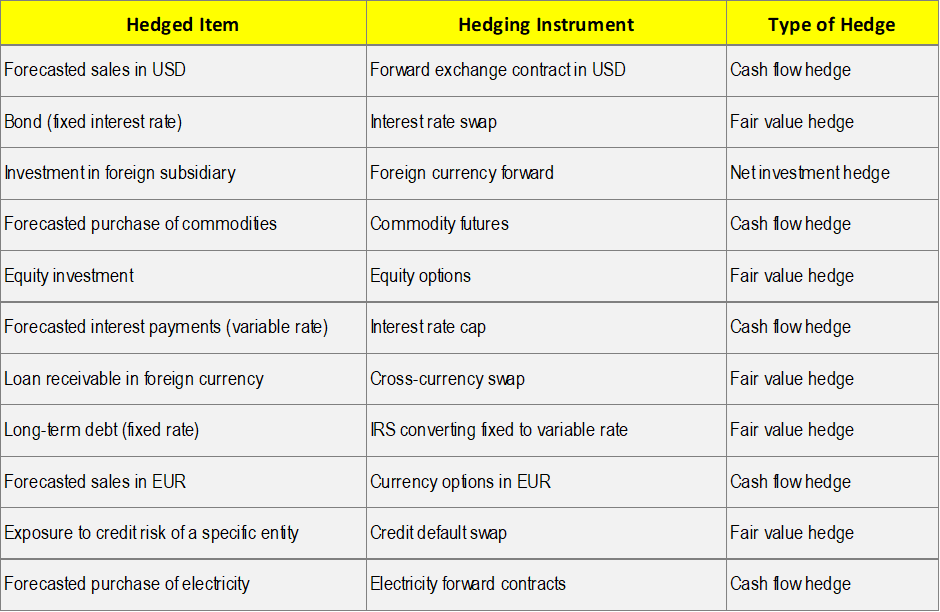

The type of hedge chosen (fair value, cash flow, or net investment) depends on the nature of the underlying risk and the specific risk management objectives of the entity. Hedge accounting is now tightly dovetailed into the risk management strategy of the entity.

This table shows a partial range of hedging possibilities available to an entity.

The hedging strategy is determined by the financial / risk management experts of the entity after considering the specific risks and objectives.

This table shows a partial range of hedging possibilities available to an entity.

The hedging strategy is determined by the financial / risk management experts of the entity after considering the specific risks and objectives.

View all the lease details in one place

You can also conveniently view all of your lease details in one place – so no more frantic searches when you need information fast! As if that weren’t enough, Lease Accounting Software also allows you to generate journal entries at the lease level, get a trial balance for any given date, or review general ledger information for any range of dates. So for companies struggling with compliance requirements or simply looking for an easier way to manage their leases – Lease Accounting Software is here to help!

Cash Flow hedge

A cash flow hedge is used to hedge the exposure to variability in cash flows that is attributable to a particular risk associated with an asset, liability, or a highly probable forecast transaction.

The effective portion of the change in the fair value of the hedging instrument is recognized in other comprehensive income and accumulated in equity, while the ineffective portion is recognized immediately in profit or loss.

When the hedged item affects profit or loss, amounts deferred in equity are reclassified to profit or loss in the same period to offset the effect of the hedged item.

The effective portion of the change in the fair value of the hedging instrument is recognized in other comprehensive income and accumulated in equity, while the ineffective portion is recognized immediately in profit or loss.

When the hedged item affects profit or loss, amounts deferred in equity are reclassified to profit or loss in the same period to offset the effect of the hedged item.

Disclosures in financial statements

Fair value hedge accounting under Ind AS 109 / IFRS 9 is centered around properly documenting the hedge relationship, ensuring its effectiveness, and appropriately measuring and recognizing changes in fair values.

Proper disclosures in the financial statements are also vital to provide users of financial statements with insights into the entity's hedging activities and their impact

Proper disclosures in the financial statements are also vital to provide users of financial statements with insights into the entity's hedging activities and their impact