Lease Accounting Software Computation Process

Generate cash flows

Based on the start date, effective date, end date, frequency of the lease, payable at beginning or end etc, cash flows for the entire period is generated as follows:

Change the following data – only start from 1-4-2019 onwards

Variable cashflows

If you upload lease with Cash flow as “YES” then click the export cash flow. If the Cash Flow field is not ‘YES’ then the ‘Upload Cash Flow’ and ‘Export Cash Flow’ buttons will not be active. The Status of the record for which Cash flows should be updated will be shown as ‘New’.

A csv file “allcashflow.csv” will be downloaded by the system with the pre fixed lease id and lease payment schedule.

Update the variable cash flows in the same file

Open the All cash flow and update the amount column alone and save the file in the same format as shown below. Do not change any field or content of this file. Only the cash flow amount should be updated before uploading the same.

Now select the Upload cash flow icon and upload the “AllCashFlow.CSV’ file

Status is now changed to ‘Processed New’ as shown below:

Pandemic cash flows

The lessor may provide some relief considering the pandemic situation. If so you can upload the revised cash flows taking into account the concessions so that the system will provide the necessary accounting treatment of the same.

Step 1

Get the revised cash flows where COVID concessions are available. The input format is the same as the cash flow input format. Based on this, the present value of the cash flows is computed. Then get the difference between the present value and the value of the liability just before the COVID concessions are granted.

Step 2

Add another column for COVID Concession which would show the number as derived in Step 1.

Pass an entry for that amount as Debit Liability and Credit Covid Concession (P&L) Account

Export Pandemic cash flows

Export Pandemic cash flow for the concerned lease for which pandemic concession is given by the lessor. This will download a file ‘All Pandemic Cash Flows.csv’ showing the existing cash flows for the lease selected.

Update Pandemic concessions

Update the file with the concessions that are provided by the lessor. Please note that only the ‘Concession Amount’ field should be updated and no other field should be tampered with.

Upload ‘All Pandemic cash flows.csv’ file

View Pandemic Cash flows

Computation for Right-of-use

Compute the Right-of-use – Asset

Important points to be noted:

1. If ‘Avail exemption’ = Yes then the record is ignored.

2. The schedule of rental payments is prepared based on the start date and the end date of the lease. The payment dates is based on Monthly, Quarterly, Half Yearly or Yearly and also based on when it is payable – at END or at BEGINNING.

4. Rent escalation is taken care of. The escalation percentage and the tenure are considered in the schedule.

5. Discount factor is calculated based on the incremental borrowing rate given in the input file. Calculate the discount factor based on the formula

6. Dismantling costs should be treated like lease payments.

Asset – Right to Use

Prepare the schedule of dates first.

1. Right to use balance = Take the amount from ‘Right to Use Valuation’ tab.

2. Amortization also taken from that tab.

Liability

Prepare the schedule of dates first.

1. Starting point is the Right to Use value taken the amount from ‘Right to Use Valuation’ tab.

2. Find the Finance cost – Use the incremental borrowing rate from input file in the formula

Lease Liability Opening balance * EXP (Incremental Borrowing rate / total number of days in the year * (Current entry date – previous entry date) ) – Lease Liability Opening balance.

3. All other columns are self-explanatory.

Journal entries

Balance Sheet

1. All the journal entries are aggregated lease ID wise. Then each account is posted with all the journal entries as shown below:

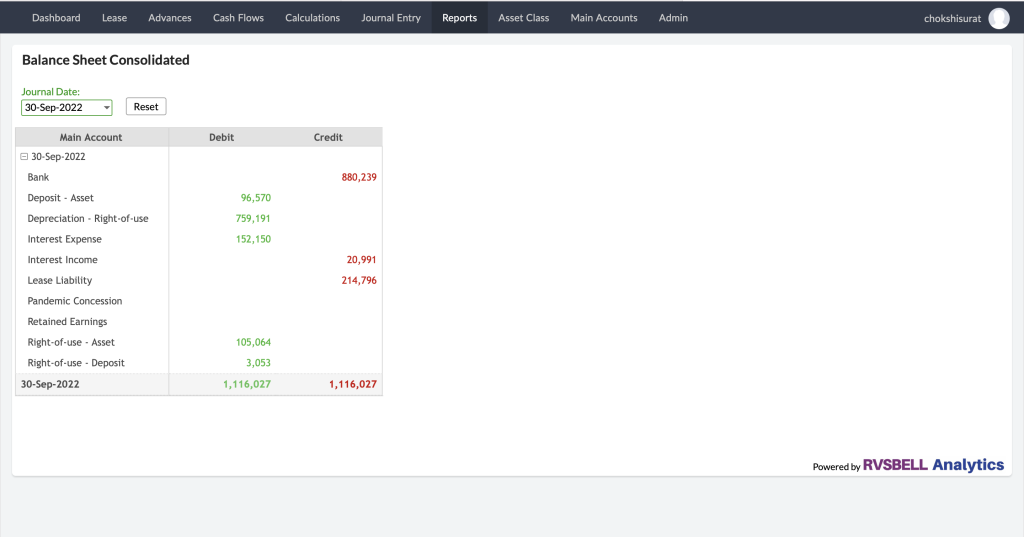

Consolidated Balance Sheet

Lease Id wise summary for any given date should be prepared like shown above.

Main Account

No post found!