RBI’s Directions for the Investment Portfolio of Commercial Banks

RBI Directions for the Investment Portfolio – Preamble

The Reserve Bank of India’s Directions for the Classification, Valuation, and Operation of the Investment Portfolio of Commercial Banks, established in 2023. These Directions are set to be effective for accounting periods starting on or after April 1, 2024. They apply to all banking companies, including new banks and the State Bank of India, as defined under the Banking Regulation Act of 1949.

In these Directions, various terms are used with specific meanings. For instance, an “active market” refers to a market where transactions for an asset or liability occur frequently and voluminously, providing ongoing pricing information. “Approved Securities” are defined as per the Reserve Bank of India’s 2021 Directions on Cash Reserve Ratio and Statutory Liquidity Ratio, subject to amendments. An “associate,” as detailed in Accounting Standard 23, is an enterprise where the investor has significant influence but not control.

The term “carrying cost” relates to zero-coupon discounted instruments like Treasury Bills, and “corporate bonds and debentures” refer to debt securities issued by companies or financial institutions. A “current and valid credit rating” is a rating given by a registered credit rating agency in India, with specific conditions for its validity.

Other key terms include “Day 1 Gain” and “Day 1 Loss,” which refer to differences between fair value and acquisition cost at initial recognition, depending on whether the fair value is higher or lower. “Derecognition” is about removing a financial instrument from a bank’s balance sheet. A “derivative” has the meaning assigned in the Reserve Bank of India Act of 1934.

“Financial asset,” “financial instrument,” and “financial liability” are defined in the context of banking transactions. “Government security” is as defined in the Government Securities Act of 2006. The term “interest” includes considerations for time value of money, credit risk, and other lending risks.

“Joint Venture,” as per Accounting Standard 27, refers to a jointly controlled economic activity. The terms “Level 1,” “Level 2,” and “Level 3” inputs are used in the context of financial instrument valuation, indicating the nature of the inputs used.

“Listed security” is a security listed on an exchange, while “Low Coupon Bonds” are bonds with very low, non-market related coupons. “Observable inputs” are market data inputs like publicly available information. “Other approved securities” have a specific definition under the Reserve Bank of India’s 2021 Directions.

“Premium” and “Quoted Security” are defined in the context of debt securities and market availability, respectively. “Principal market” refers to the market with the highest volume and activity level for a financial instrument. “Rated Security” means a security with a current and valid credit rating.

“Reconstitution” involves reassembling STRIPS into the original security. “Repo” and “Reverse Repo” have meanings as defined in the RBI Act. “Securities” are as defined in the Securities Contracts (Regulation) Act of 1956. The “Securities and Exchange Board of India” or “SEBI” refers to the board established under the 1992 Act.

“Security Receipts” and “Securitization note” are defined as per relevant laws and regulations. “Short Sale” is as defined in the 2018 Reserve Bank Directions. “Statutory Liquidity Ratio Securities” and “Statutory Reserve” have specific meanings under the Reserve Bank of India’s Directions and the Banking Regulation Act of 1949.

“STRIPS” refers to separately traded registered interest and principal of securities. “Stripping” is the process of separating cash flows from a government security. A “subsidiary” is defined in Accounting Standard 21, with control being a key factor.

“Unrated securities” are securities without a current and valid credit rating. “Unobservable inputs” are inputs without market data, based on market participant assumptions. Lastly, “When, as and if issued” securities refer to a specific type of security defined in the 2018 Reserve Bank Directions.

Other expressions used in these Directions carry their usual meanings as assigned under relevant acts, regulations, or commercial usage.

General Guidelines for Investment Policy Framework

Banks must follow specific terms and conditions outlined in these Directions when engaging in investment activities. Here are the key points you need to know:

- Develop a comprehensive investment policy: Banks should create a detailed investment policy, approved by their Board of Directors.

- Minimum requirements for the investment policy include:

- Clear investment criteria and objectives for both the bank’s own investments and investments made on behalf of clients.

- Types of securities the bank can invest in.

- Dealing with derivatives.

- The authority to conduct deals.

- Procedures for obtaining approvals and conducting deals.

- Adherence to prudential exposure limits.

- Policies for broker dealings, risk management, portfolio valuation, and reporting.

- Ensure that the investment policy promotes sound and acceptable business practices when dealing with securities and derivatives.

- Establish prudential limits for securities investments, including private placements, with sub-limits for various types of bonds and issuer ceilings.

- Implement risk management systems for corporate bond investments, including credit rating requirements, industry-wise limits, and more, to mitigate concentration and liquidity risk.

- Develop a clear investment policy for equities, including risk management. Consider establishing an equity research department.

- Investments in equity shares, preference shares, convertible instruments, and similar products must be decided by the Investment Committee appointed by the bank’s Board.

- Conduct thorough credit risk analysis for investment proposals, similar to loan proposals.

- Refer to defaulter lists from Credit Information Companies and Central Repository of Information on Large Credits (CRILC) when making investment decisions.

- Banks should perform their internal credit analysis and ratings, even for rated issues, without solely relying on external credit rating agencies. Be stricter in the case of non-borrower customer investments.

- Maintain robust internal credit rating systems and monitor the financial position of issuers regularly.

- Settle securities and derivatives transactions according to regulations set by the relevant regulator.

- Hold investments in dematerialized form, whether they are privately placed or not.

- Ensure that offshore branches of Indian banks follow their Board-approved investment policies, considering risk perception, minimum rating requirements, host country regulations, and approval processes.

- Include Primary Dealer (PD) activities in the investment policy where applicable, following Reserve Bank of India’s guidelines.

- These guidelines also apply, with necessary modifications, to the subsidiaries and mutual funds established by banks, unless they conflict with specific regulations of the Reserve Bank, SEBI, IRDAI, or PFRDA.

- Remember to consider these Directions in conjunction with the Directions on Prudential Regulation for Banks’ Investments and Portfolio Management Services outlined in the Reserve Bank of India’s (Financial Services provided by Banks) Directions, 2016, as amended over time.

Classification of Investments by Banks

Banks are required to categorize their investment portfolio (excluding investments in their own subsidiaries, joint ventures, and associates) into three categories: Held to Maturity (HTM), Available for Sale (AFS), and Fair Value through Profit and Loss (FVTPL). Additionally, Held for Trading (HFT) is a sub-category within FVTPL. The categorization decision must be documented.

Investments should be presented in the Balance Sheet as follows:

- Government securities

- Other approved securities

- Shares

- Debentures & Bonds

- Subsidiaries and/or joint ventures

- Others (to be specified)

HTM

Securities meeting these conditions are classified as HTM:

- Acquired with the intention to hold until maturity, aiming to collect contractual cash flows.

- Contractual terms result in cash flows consisting solely of principal and interest payments (SPPI criterion).

- Certain securities are ineligible for HTM or AFS classification, including those with convertible features, loss absorbency features, coupons not defined as interest, preference shares, and equity shares.

AFS

Securities satisfying these conditions are classified as AFS:

- Acquired with the objective of both collecting contractual cash flows and selling securities.

- Contractual terms meet the SPPI criterion.

- AFS category includes debt securities held for asset liability management (ALM) that meet the SPPI criterion when the bank’s intent is flexible regarding holding to maturity or selling before maturity.

FVTPL

Securities not qualifying for HTM or AFS are classified under FVTPL, including:

- Equity shares (excluding those of subsidiaries, associates, joint ventures, or those irrevocably classified as AFS).

- Investments in Mutual Funds, Alternative Investment Funds, Real Estate Investment Trusts, Infrastructure Investment Trusts, etc.

- Investment in securitization notes representing the equity tranche.

- Bonds, debentures linked to a specific index rather than an interest rate benchmark, subject to exceptions for equity as mentioned above.

HFT

Banks establish a sub-category called HFT within FVTPL, following the requirements specified in Annex I for investment classification under HFT.

Investments in Subsidiaries, Associates, and Joint Ventures

All investments in subsidiaries, associates, and joint ventures are held separately from other investment categories (HTM, AFS, and FVTPL), in a distinct category.

Initial Recognition of Investments

When banks first acquire investments, they must initially measure them at their fair value. In most cases, the acquisition cost is presumed to be the fair value unless certain conditions suggest otherwise. These conditions include:

- Transactions between related parties.

- Transactions occurring under duress where one party is forced to accept the transaction price.

- Transactions taking place outside the primary market for that type of securities.

- Other situations where, in the supervisor’s opinion, there are reasons to test the presumption.

For government securities acquired through auctions, switch operations, or open market operations conducted by the RBI, the allotment price will be considered the fair value for initial recognition.

If securities are quoted or their fair value can be determined based on market observable inputs (like yield curve, credit spread, etc.), any gain or loss on the first day shall be recognized in the Profit and Loss Account, under Schedule 14: ‘Other Income,’ within the subhead ‘Profit on revaluation of investments’ or ‘Loss on revaluation of investments,’ as appropriate.

For Level 3 investments, any Day 1 loss must be recognized immediately, whereas any Day 1 gains should be deferred. For debt instruments, the Day 1 gain will be amortized evenly until the maturity date (or earliest call date for perpetual instruments). In the case of unquoted equity instruments, the gain will be set aside as a liability until the security is listed or derecognized.

Subsequent Measurement of Investments

HTM (Held to Maturity):

Securities in the HTM category are carried at cost and not marked to market after initial recognition. However, income recognition, asset classification, and provisioning norms are applied as specified in Chapter X.

Any discount or premium on HTM securities is amortized over the remaining life of the instrument. The amortized amount is reflected in the financial statements under ‘Income on Investments’ in Schedule 13: ‘Interest Earned’ with a contra in Schedule 8: ‘Investments.’

AFS (Available for Sale):

Securities in the AFS category are fair-valued at least quarterly. Discounts or premiums on debt securities acquired under AFS are amortized over the remaining life of the instrument, reflected under ‘Income on Investments’ in Schedule 13: ‘Interest Earned’ with a contra in Schedule 8: ‘Investments.’

Valuation gains and losses from all performing investments under AFS are aggregated and credited or debited directly to an AFS-Reserve, not through the Profit & Loss Account.

AFS-Reserve is considered Common Equity Tier (CET) 1, subject to clause 28. Unrealized gains in AFS-Reserve are not available for distribution as dividends or coupons on Additional Tier 1.

Upon sale or maturity of a debt instrument in AFS, the accumulated gain/loss for that security in AFS-Reserve is transferred and recognized in the Profit and Loss Account under ‘Profit on sale of investments’ in Schedule 14: ‘Other Income.’

For equity instruments designated as AFS initially, gains or losses on sale are transferred from AFS-Reserve to the Capital Reserve.

FVTPL (Fair Value through Profit and Loss):

Securities in the FVTPL category are fair-valued, and net gains or losses are directly credited or debited to the Profit and Loss Account. HFT sub-category within FVTPL is fair-valued daily, while other FVTPL securities are fair-valued quarterly or more frequently.

Discounts or premiums on debt securities in FVTPL are amortized over the remaining life of the instrument, reflected in ‘Income on Investments’ in Schedule 13: ‘Interest Earned’ with a contra in Schedule 8: ‘Investments.’

Income recognition, asset classification, and provisioning norms apply to securities in FVTPL as specified in Chapter X.

Investments in Subsidiaries, Associates, and Joint Ventures:

All investments (debt and equity) in subsidiaries, associates, and joint ventures are held at acquisition cost, following Chapter IV requirements.

Discounts or premiums on debt securities of subsidiaries, associates, and joint ventures are amortized over the remaining life of the instrument, reflected under ‘Income on Investments’ in Schedule 13: ‘Interest Earned.’

When an entity that was not a subsidiary, associate, or joint venture becomes one, the revised carrying value is determined based on the category:

For HTM investments, the carrying value (minus any permanent impairment) is the revised value.

For AFS investments, cumulative gains and losses in AFS-Reserve are reversed, adjusted to the carrying value along with any permanent diminution.

For FVTPL investments, the fair value on the date of the entity becoming a subsidiary, associate, or joint venture is the carrying value.

When an investee ceases to be a subsidiary, associate, or joint venture, investments are reclassified as follows:

HTM investments retain their carrying value.

AFS or FVTPL investments consider the fair value on the reclassification date as the revised carrying value, with the difference transferred to AFS-Reserve and Profit and Loss Account.

Gains/profits from reclassification/sale of investments in subsidiaries, associates, or joint ventures are first recognized in the Profit and Loss Account, then appropriated to the ‘Capital Reserve Account’ net of taxes and required transfers to Statutory Reserves.

Banks must assess investments in subsidiaries, associates, or joint ventures for impairment quarterly or more frequently. Indicators of potential impairment include defaults, loan restructuring, credit rating downgrades, losses, fair value declines, delisting, or delays in achieving breakeven.

If impairment is suspected, the bank should obtain an independent valuation and make provisions accordingly, recognizing the impairment as an expense in the Profit and Loss Account. Reversals may occur if the diminution is subsequently reversed.

Reclassifications Between Categories

The reclassification should be implemented prospectively starting from the reclassification date.

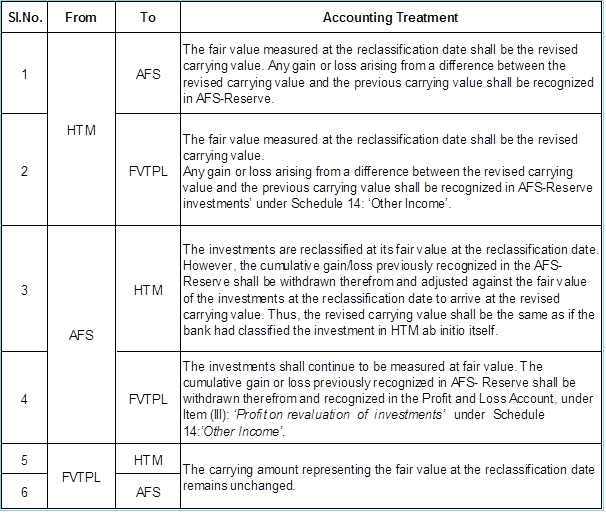

When a bank decides to reclassify investments from one category to another, the accounting treatment should follow the guidelines outlined in the table below. Banks must also provide details of the reclassification, including any adjustments made, in the notes to their financial statements:

Reclassification from HTM to AFS:

- The fair value measured at the reclassification date becomes the revised carrying value.

- Any gain or loss resulting from the difference between the revised carrying value and the previous carrying value should be recognized in the AFS-Reserve.

Reclassification from HTM to FVTPL:

- The fair value measured at the reclassification date becomes the revised carrying value.

- Any gain or loss resulting from the difference between the revised carrying value and the previous carrying value of the investments should be recognized in the Profit and Loss Account under Item (III): ‘Profit on revaluation of investments’ within Schedule 14: ‘Other Income’.

Reclassification from AFS to HTM:

- The investments are reclassified at their fair value on the reclassification date.

- However, the cumulative gain/loss previously recognized in the AFS-Reserve should be withdrawn and adjusted against the fair value of the investments on the reclassification date to determine the revised carrying value. Thus, the revised carrying value should be the same as if the bank had initially classified the investment in HTM.

Reclassification from FVTPL to HTM:

- The investments continue to be measured at fair value.

- The cumulative gain or loss previously recognized in the AFS-Reserve should be withdrawn and recognized in the Profit and Loss Account under Item (III): ‘Profit on revaluation of investments’ within Schedule 14: ‘Other Income’.

Reclassification from FVTPL to HTM:

The carrying amount representing the fair value at the reclassification date remains unchanged.

These guidelines ensure proper accounting treatment and transparency when banks reclassify investments between different categories in their financial statements.

Sale of Investments from HTM

Sale of investments from the Held to Maturity (HTM) category, there are some important guidelines to follow:

- Any sales from HTM should be in line with a policy approved by the Board of Directors. Details of such sales must be disclosed in the financial statements’ notes, following the specified format in Annex II.

- In a given financial year, the total carrying value of investments sold from HTM should not exceed five percent of the opening carrying value of the HTM portfolio. If a sale surpasses this limit, prior approval from the Department of Supervision (DOS), RBI, is required.

Situations where the sale of securities is excluded from the five percent limit

- Sales to the Reserve Bank of India (RBI) as part of liquidity management operations, such as Open Market Operations (OMO) and Government Securities Acquisition Programme (GSAP).

- Repurchase of Government Securities by the Government of India from banks under buyback or switch operations.

- Repurchase of State Development Loans by respective state governments under buyback or switch operations.

- Repurchase, buyback, or exercise of call options of non-SLR securities by the issuer.

- Sale of non-SLR securities following a downgrade in credit ratings or default by the counterparty.

- Sale of securities as part of a resolution plan under the Prudential Framework for Resolution of Stressed Assets for a borrower facing financial distress.

- Additional sale of securities explicitly permitted by the Reserve Bank of India.

Any profit or loss resulting from the sale of investments in the HTM category should be recognized in the Profit and Loss Account under Item II of Schedule 14: ‘Other Income’. Profits from the sale of HTM investments should be allocated to the ‘Capital Reserve Account’ below the line in the Profit and Loss Account, after deducting taxes and the required transfer to the Statutory Reserve.

Fair Value of Investments

The fair value of investments, these guidelines need to be followed as laid out in this chapter:

Quoted Securities:

For quoted securities, their fair value is based on prices declared by the Financial Benchmarks India Private Ltd. (FBIL) in line with RBI circular FMRD.DIRD.7/14.03.025/2017-18 dated March 31, 2018, and subsequent amendments. If FBIL doesn’t publish prices for certain securities, the fair value can be based on quoted prices from recognized stock exchanges, reporting platforms, or trading platforms authorized by RBI/SEBI. Alternatively, prices declared by the Fixed Income Money Market and Derivatives Association of India (FIMMDA) can also be used.

Unquoted SLR Securities:

(a) Treasury Bills should be valued at their carrying cost.

(b) Unquoted Central/State Government securities should be valued based on prices/YTM rates published by FBIL.

(c) Other approved securities should be valued using the YTM method with a 25 basis points mark-up over the yields of equivalent maturity Central Government Securities published by FBIL.

Unquoted Non-SLR Securities:

For unquoted debentures and bonds, their valuation should consider:

(a) Applying an appropriate mark-up over YTM rates for Central Government Securities published by FBIL/FIMMDA, with the mark-up determined based on credit ratings assigned to them. The markup should be at least 50 basis points above the rate for rated debentures/bonds, and for unrated ones, it shouldn’t be lower than the rated equivalent.

(b) Where debentures/bonds are quoted, the valuation shouldn’t exceed the recent transaction rate on authorized platforms.

(c) For Ujjwal DISCOM Assurance Yojana (UDAY) bonds and certain other bonds, specific mark-ups apply based on YTM rates for Central Government Securities.

(d) Special securities directly issued by the Government of India, not carrying SLR status, should be valued at a 25 basis points spread over the corresponding yield on Central Government securities.

Zero Coupon Bonds (ZCBs):

In the absence of market values, ZCBs should be marked to market based on their present value. Any valuation gain or loss should be compared with the carrying cost to determine its impact.

Preference Shares:

(a) Traded preference shares should be valued at their trading price.

(b) Untraded preference shares should be valued on a YTM basis with a mark-up over YTM rates for Central Government Securities, considering credit ratings. A negative mark-up isn’t allowed.

(c) In cases of arrears in preference dividends/coupons, no credit should be taken for accrued amounts, and further discounts may apply based on the arrears’ duration.

(d) Project finance preference shares can be valued at par for up to two years after production commencement or five years after subscription, whichever is earlier.

Equity Shares:

Equity shares without current quotations or listed on recognized exchanges should be valued based on their break-up value from the latest audited balance sheet, which should not precede the valuation date by more than 18 months. If this balance sheet isn’t available or is out-dated, a value of ₹1 per share applies.

Mutual Funds Units (MF Units):

(a) Unquoted MF units should be valued based on the latest re-purchase price declared by the MF.

(b) For funds with lock-in periods or where repurchase price/market quotes are unavailable, units should be valued at the scheme’s Net Asset Value (NAV) or cost, until the lock-in period ends.

Commercial Paper:

Commercial paper should be valued at its carrying cost.

Investment in Security Receipts (SRs) and Other Instruments Issued by ARCs:

For investments in SRs and other instruments issued by ARCs, banks must comply with RBI’s “Transfer of Loan Exposures” Directions, 2021, as amended.

Investment in Alternative Investment Funds (AIFs):

(a) Quoted equity shares, bonds, and AIF units in the bank’s portfolio should be valued as per the instructions for quoted securities.

(b) Unquoted AIF instruments should be valued based on the NAV, but if an AIF fails to disclose its NAV as required by SEBI regulations, a value of ₹1 applies.

Operational Guidelines

Government Securities

- Transactions through SGL/CSGL Accounts: Banks must conduct transactions in Government Securities through Subsidiary General Ledger (SGL) or Constituent Subsidiary General Ledger (CSGL) accounts, following the Delivery Versus Payment (DvP) System guidelines issued by RBI.

- Short Sale in Central Government Securities: Banks can engage in short sale transactions in Government securities as long as they adhere to the requirements specified in the Short Sale (Reserve Bank) Directions, 2018.

- When Issued Basis Transactions: Transactions made on a ‘When Issued’ basis in Government securities must comply with the guidelines outlined in the When Issued Transactions (Reserve Bank) Directions, 2018.

- Value Free Transfer (VFT) of Government Securities: Value-free transfer in Government securities should follow the guidelines detailed in RBI circular IDMD.CDD.No.S930/11.22.003/2021-22 dated October 5, 2021.

- STRIPS (Separate Trading of Registered Interest and Principal Securities): Stripping or reconstitution of Government Securities must adhere to the conditions specified in RBI guidelines IDMD.DOD.07/11.01.09/2009-10 dated March 25, 2010, and follow prescribed accounting and valuation methods.

- Repo Transactions in Government Securities: Banks engaging in Repo transactions (including reverse repo transactions) with Government securities should follow the guidelines outlined in the Repurchase Transactions (Repo) (Reserve Bank) Directions, 2018.

- Retailing of Government Securities: Banks can choose to undertake retailing of Government securities, provided they follow certain conditions, including transacting on an outright basis, using on-going market rates/yield curves, and adhering to RBI guidelines.

- Settlement of Government Securities Transactions: The settlement of Government securities transactions should be in line with the instructions provided in the Master Direction – Operational Guidelines for Primary Dealers issued by RBI.

Non-SLR Securities

- Investment in Listed Non-SLR Securities: Banks are allowed to invest in listed non-SLR debt securities of companies that comply with SEBI requirements, except in specific cases.

- Investments in Unlisted Non-SLR Securities: Investment in unlisted securities should meet certain criteria, including issuer compliance with SEBI disclosure requirements and adherence to prescribed limits based on the previous financial year’s total investment in non-SLR securities.

- Investment in Unrated Bonds: Banks are generally discouraged from investing in unrated non-SLR securities. However, there is an option to invest in unrated bonds of infrastructure companies within specified limits.

- Investment in Liquid/Short Term Debt Schemes: Banks should not invest more than 10% of their net worth in liquid/short term debt schemes with a portfolio weighted average maturity of not more than one year.

- Repo in Corporate Bonds: Banks can undertake repo transactions in corporate bonds as per RBI guidelines.

- Other Requirements: Banks should actively monitor credit risks associated with their non-SLR investments and ensure compliance with statutory and regulatory requirements. Investments should generally be in securities with a current and valid credit rating not less than investment grade.

Role of Boards

The bank’s board is responsible for proper risk management in non-SLR investments and should conduct quarterly reviews on various aspects of these investments.

Internal Control System

Banks must establish robust internal control mechanisms, including functional separation, deal slips for transactions, reconciliation of investment books, and compliance with regulatory requirements.

Engagement of Brokers

Banks can engage brokers for transactions but should ensure that brokers’ roles are limited to bringing parties together.

Prudential Limits

Banks have prudential limits for transactions through brokers, and these limits should not exceed 5% of total transactions per broker in a financial year.

Audit, Review, and Reporting

Banks should conduct regular internal and external audits, review investment portfolios, and report to the Board. Reconciliation of holdings and compliance certificates must be submitted as per RBI guidelines.

These operational guidelines are designed to promote transparency, accountability, and prudent management of investment portfolios by banks. It is essential for banks to adhere to these guidelines to ensure the stability and security of their investments.

Income Recognition, Asset Classification, and Provisioning

Income Recognition

Banks should recognize income based on the following criteria:

- For Government Securities, corporate bonds, and debentures with predetermined interest rates that are regularly serviced and not in arrears, income should be recognized on an accrual basis.

- Income from units of mutual funds, alternative investment funds, and similar pooled investment funds should be recognized on a cash basis.

- Dividend income from equity investments held under Available for Sale (AFS) should be recognized in the Profit and Loss Account.

Accounting for Broken Period Interest

Broken period interest paid to the seller should not be capitalized as part of the cost but treated as an expenditure item under the Profit & Loss Account for securities investments.

Non-Performing Investments (NPI)

Investments meeting the criteria for classification as Non-Performing Assets (NPA) should be classified as Non-Performing Investments (NPI). The classification criteria should follow the guidelines specified for NPAs, and NPIs can only be upgraded to standard when they meet the NPA criteria. The following criteria apply:

- For debt instruments like bonds or debentures, an NPI is one where interest or instalment is due and remains unpaid for more than 90 days.

- Similar criteria apply to preference shares with unpaid fixed dividends, equity shares with a valuation of ₹1 due to the unavailability of the latest balance sheet, and situations where any credit facility availed by the issuer is classified as NPA.

- When debt is converted into equity or other instruments, they should be classified similarly to the original loan.

- Once classified as NPI, it should be segregated from the rest of the portfolio, and no income or appreciation should be accrued.

- Provision for impairment should be recognized in the Profit and Loss Account, and the higher of the provision required as per norms or depreciation on the date of classification as NPI should be considered.

- For AFS investments with cumulative gains, the provision may be created from AFS-Reserve to the extent of available gains.

- For AFS investments with cumulative losses, cumulative losses should be transferred from AFS-Reserve to the Profit and Loss Account.

- Upon upgrading, any previously recognized provisions should be reversed.

Investments in Government securities, including those guaranteed by the Central or State Government, should not be classified as NPI. However, investments in State Government guaranteed securities may be classified as NPI if payments remain unpaid for more than 90 days.

Investment Fluctuation Reserve (IFR)

Banks should maintain an IFR until it reaches at least two percent of the AFS and FVTPL (including HFT) portfolio. IFR should be funded by transferring to it an amount equal to the lower of:

- Net profit on the sale of investments during the year.

- Net profit for the year, less mandatory appropriations.

IFR is eligible for inclusion in Tier II capital, and the cap on recognizing General Provisions and Loss Reserves as Tier II capital does not apply to IFR.

Banks may draw down the balance in IFR in excess of two percent of the portfolio for credit to the profit/loss balance at the end of any accounting year, but subject to certain conditions. If the IFR balance falls below two percent of the portfolio, a drawdown is permitted to meet minimum CET 1/Tier 1 capital requirements, but subject to specific conditions.

Small Finance Banks and Payments Banks

Small Finance Banks (SFBs) and Payments Banks (PBs)

The rules outlined in these Directions apply to SFBs and PBs unless they conflict with the Guidelines for Licensing of Small Finance Banks (Payments Banks) in the Private Sector and Operating Guidelines for Small Finance Banks (Payments Banks) issued on October 6, 2016, and any subsequent amendments.

Derivatives

Banks are required to follow the Guidance Note on Accounting for Derivative Contracts (revised 2021) issued by the Institute of Chartered Accountants of India, with the exception of paragraph 6334. When reporting their derivative assets and liabilities, banks should list them separately under Schedule 11 as ‘Other Assets’ and Schedule 5 as ‘Other Liabilities,’ respectively. Banks may adjust the carrying value of their investments in line with the hedge accounting requirements mentioned in the Guidance Note.

Banks must categorize their derivatives portfolio into three fair value hierarchies: Level 1, Level 2, and Level 3, as defined in Clause 4. These categorizations should be disclosed in the notes to the financial statements, the template outlined in Annex II.

It is important to note that following banks should refrain from distributing dividends using the net unrealized gains recognized in the Profit and Loss Account, which arise from the fair valuation of Level 3 derivative assets and liabilities on their Balance Sheet. Furthermore, any net unrealized gains on Level 3 derivatives accounted for in the Profit and Loss Account should be subtracted from CET 1 capital.

Penal Consequences for Non-Compliance

The consequences that banks may face if they fail to comply with the Directions outlined in the document. The Directions represent the rules and guidelines that banks are expected to follow in their financial operations and management.

Review of Implementation:

The chapter starts by stating that the implementation of these Directions will be regularly reviewed. This means that banking authorities or regulatory bodies will periodically assess whether banks are adhering to the rules and guidelines set out in these Directions.

Supervisory Process:

The term “supervisory process” refers to the on-going oversight and monitoring conducted by regulatory authorities to ensure that banks are operating in a safe, sound, and compliant manner. During this process, regulators may examine banks’ financial records, practices, and operations to verify compliance.

Non-Compliance:

If, during the supervisory process, it is discovered that a bank is not following the Directions as prescribed, it will be considered as non-compliance. Non-compliance typically means that the bank has violated or failed to meet certain regulatory requirements or standards.

Appropriate Action:

The chapter emphasizes that appropriate action will be taken in response to non-compliance. This means that regulators or supervisory authorities will take steps to address the issues related to non-compliance. The nature of these actions can vary and may include warnings, fines, penalties, or even more severe measures such as revoking a bank’s license, depending on the severity and frequency of the non-compliance.

In essence, this chapter serves as a reminder to banks that they are obligated to adhere to the Directions, and any deviation from these guidelines can result in regulatory action. It underscores the importance of banks operating within the framework of established regulations to maintain the stability and integrity of the financial system.

Transition and Repeal Provisions

The Transition process for banks as they move to comply with the new Directions and the repeal of previous guidelines. Let’s break it down in simpler terms:

Transition to New Directions (Effective April 1, 2024):

- Banks must reclassify their investment portfolio as of March 31, 2024, based on the guidelines outlined in Chapter III of these Directions.

- Any balance in the provision for depreciation as of March 31, 2024, will be reversed into the Revenue or General Reserve.

- Balances in the Investment Reserve Account (IRA), if there are any, as of March 31, 2024, will be transferred to the Revenue or General Reserve if the bank meets the minimum regulatory requirements of Investment Fluctuation Reserve (IFR). If the bank doesn’t meet these requirements, the balances in IRA will be transferred to IFR.

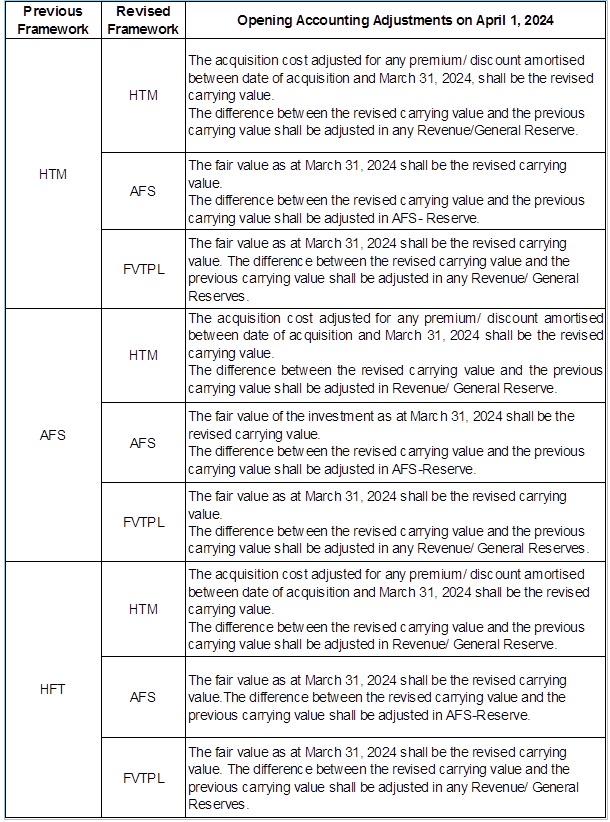

Accounting Adjustments on April 1, 2024:

Different types of investments (HTM, AFS, FVTPL, HFT) will have specific adjustments:

- For HTM investments, the revised carrying value will be the acquisition cost adjusted for any premium or discount amortized between the date of acquisition and March 31, 2024. Any difference between the revised and previous carrying values will be adjusted in Revenue or General Reserve.

- For AFS investments, the fair value as of March 31, 2024, will be the revised carrying value, and any difference will be adjusted in AFS-Reserve.

- For FVTPL investments, the fair value as of March 31, 2024, will be the revised carrying value, and any difference will be adjusted in Revenue or General Reserves.

- Similar adjustments apply to other investment categories (AFS to HTM, AFS to AFS, FVTPL to HTM, FVTPL to AFS).

- Disclosure Requirement: Banks are required to disclose these transitional adjustments in the notes to their financial statements for the financial year ending March 31, 2025.

Repeal of Previous Guidelines:

- The Reserve Bank of India (Classification, Valuation and Operation of Investment Portfolio of Commercial Banks) Directions, 2021, dated August 25, 2021, will be repealed.

- All the circulars that were previously in effect are considered to have been in force before the new Directions came into effect.

In simple terms, this chapter outlines how banks should adjust their investment portfolios and provisions during the transition to the new Directions. It also officially repeals the previous guidelines, making the new Directions the current and applicable regulatory framework.

Held for Trading (HFT)

Held for Trading (HFT) is a subset of Fair Value through Profit and Loss (FVTPL). It includes all instruments that meet the specified criteria for HFT instruments, as outlined below. Any instruments not meeting these criteria are excluded from HFT.

Banks can include financial instruments in HFT only when there are no legal constraints preventing their sale or full hedging.

Banks are required to assess the fair value of HFT instruments on a daily basis and recognize any changes in valuation in their profit and loss accounts.

When a bank first recognizes an instrument on its books, it must designate it as an HFT instrument if it serves one or more of the following purposes:

a) Short-term resale

b) Profiting from short-term price movements

c) Locking in arbitrage profits

d) Hedging risks arising from instruments meeting (a), (b), or (c) above.

The following instruments are included in HFT:

a) Instruments in the correlation trading portfolio

b) Instruments leading to a net short credit or equity position in the banking book

c) Instruments resulting from underwriting commitments related only to securities underwriting, expected to be purchased by the bank on the settlement date.

The following instruments are not included in the HFT category:

a) Unlisted equities and equity investments in subsidiaries, associates, and joint ventures

b) Instruments designated for securitization warehousing

c) Direct holdings of real estate and derivatives on direct holdings of real estate

d) Equity investments in a fund unless specific conditions are met

e) Derivative instruments and funds with specified underlying assets

f) Instruments held for the purpose of hedging a particular risk of a position in the specified instrument types above.

The following instruments are presumed to be in HFT:

a) Instruments resulting from market-making activities

b) Equity investments in a fund,

c) Listed equities

d) Trading-related repo-style transactions.

Banks have the option to deviate from the presumptive list by following a defined process:

a) Banks must request explicit approval from the Department of Regulation, RBI, providing evidence that the instrument does not meet the criteria.

b) In case approval is not granted, the instrument is designated as HFT, and banks must maintain detailed documentation of any deviations.

Supervisory Powers

RBI may require banks to provide evidence that an instrument designated as HFT serves at least one of the purposes specified. If sufficient evidence is not provided, or if the instrument does not customarily belong to HFT, RBI may require the bank to reclassify it.

RBI may also require banks to provide evidence that an instrument outside HFT is not held for any of the purposes listed. If banks fail to provide enough evidence or if RBI believes the instrument typically belongs to HFT, the instrument may be assigned to HFT.

Documentation of Instrument Designation

Banks must have clear policies, procedures, and documented practices for determining instrument inclusion or exclusion from HFT. Compliance with these policies and procedures must be documented, subject to periodic internal audits, and available for supervisory review. The bank’s internal control functions should evaluate instruments both within and outside HFT in line with the bank’s trading activities.

Separate Trading of Registered Interest and Principal Securities (STRIPS)

Banks have the option to convert eligible Government Securities from their investment portfolio, which are held under the AFS or FVTPL categories (including HFT), into STRIPS. STRIPS are treated as zero-coupon bonds and are accounted for according to the guidelines in these Directions.

The discount rates used to value STRIPS at the beginning should be based on market rates. If market-based zero-coupon rates are not available, then the zero-coupon yields published by FBIL should be used instead.

On the day when the conversion into STRIPS takes place, the participant will record STRIPS on their books at their discounted value, while at the same time, the original Government Security will be removed from the books. The accounting process for reversing this conversion (reconstitution) is the exact opposite of the conversion process.

The conversion or reconstitution of securities into STRIPS should not result in any profit or loss. The present value of the STRIPS, including both coupon and principal, is discounted using the Zero Coupon Yield Curve (ZCYC). This value is then normalized using a factor that represents the ratio of the carrying value or market value of the security (whichever is lower) to the total market value of all STRIPS created from that security.

Normalization is also applied when reconstituting STRIPS, even if they were acquired from the market.

The book value of STRIPS (Zero Coupon Bonds) is determined and marked to market as per the guidelines provided in these Directions. Consequently, the book value of STRIPS is adjusted to reflect accrued interest before Mark-to-Market (MTM) calculations are applied.