Capital Charge for Market Risk – Basel – III

Market risk refers to the possibility of financial loss due to changes in market prices. It affects both on-balance sheet and off-balance sheet positions. Financial institutions must manage two main types of market risks: those related to interest rate instruments and equities in their trading book, and foreign exchange risk, which includes positions in precious metals, across their entire operation.

The guidelines for calculating capital charges for market risk cover interest rate instruments, equities in the trading book, and foreign exchange risks in both the trading and banking books. A trading book typically includes securities categorized as Held for Trading or Available for Sale, positions in derivatives, and limits on open gold and foreign exchange positions.

Financial institutions must manage and monitor these market risks daily. For securities that have matured but remain unpaid, only credit risk capital is necessary. However, after 90 days of delinquency, they are treated like non-performing assets for risk weighting.

Measurement of Capital Charge for Interest Rate Risk

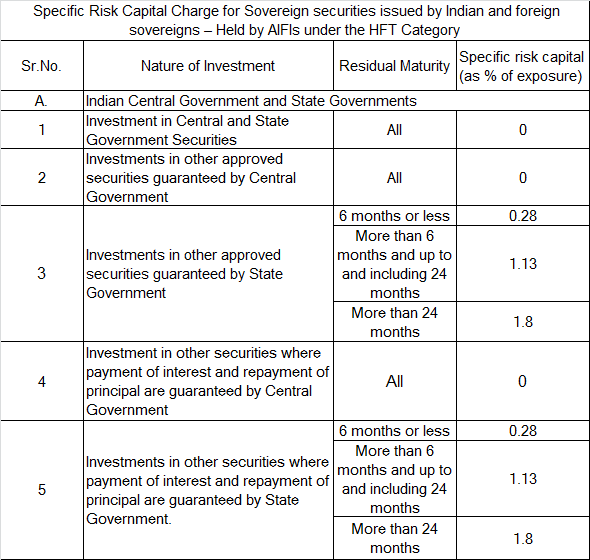

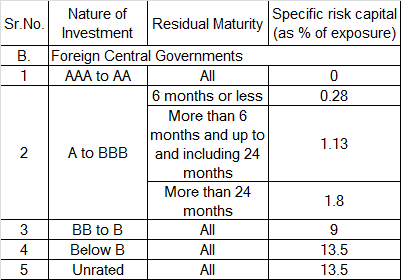

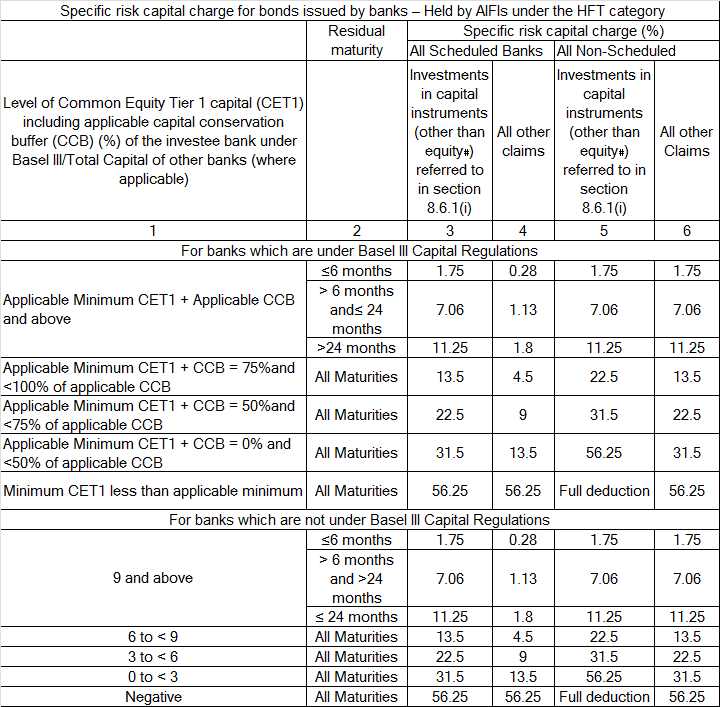

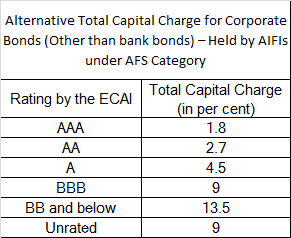

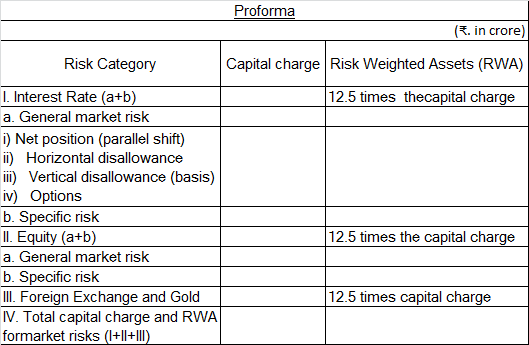

Capital charges for interest rate risk are based on the current market value of relevant instruments in the trading book. This value should be determined daily. Two types of charges are calculated: “specific risk” charge for each security, which addresses the risk associated with the individual issuer, and “general market risk” charge, which accounts for interest rate risk in the overall portfolio.

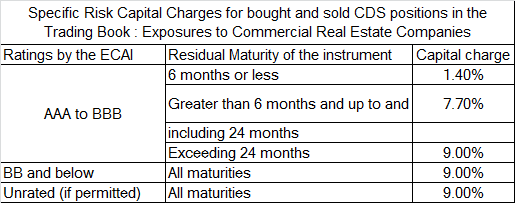

Specific risk charges vary depending on the type of debt security or issuer, with different tables and percentages applied based on the category of the security. For example, different charges apply to government bonds, bank bonds, corporate bonds, and other types of securities. The exact risk capital charge depends on the security’s rating and residual maturity.

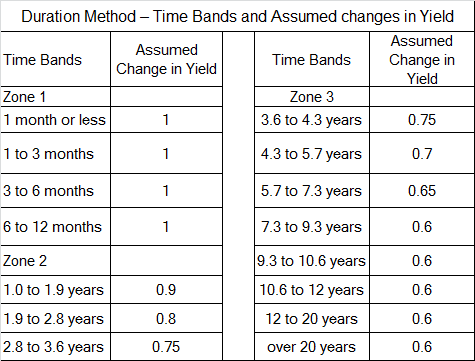

General market risk charges are calculated to reflect the risk of loss from interest rate changes. This involves assessing the net position in the entire trading book, matched positions within and across different time bands, and positions in options. The calculations use maturity ladders for each currency, with the risk of change in interest rates reflected in specific percentages in different time bands.

All interest rate derivatives and off-balance sheet instruments in the trading book reacting to interest rates are included in this measurement system. The system should account for a variety of derivatives and off-balance sheet items, including forward rate agreements, bond futures, swaps, and forward foreign exchange positions. Options can be treated in different ways as detailed in the guidelines.

Measurement of Capital Charge for Equity Risk

When calculating the capital charge for equity risk in a financial institution’s trading book, it’s important to consider both the specific and general market risks associated with equity holdings. The capital charge applies to the current market value of equities and similar instruments, excluding non-convertible preference shares.

Specific and General Market Risk:

- Specific Risk: This is akin to credit risk and is set at 11.25% or higher, depending on the external rating of the counterparty. It is calculated based on the institution’s gross equity positions, including both long and short positions (though short equity positions are typically not permitted).

- General Market Risk: In addition to the specific risk, there’s also a general market risk charge of 9% on the gross equity positions. This applies to all trading book exposures, including those exempt from capital market exposure ceilings for direct investments.

Investment in Security Receipts:

For investments in Security Receipts, the specific risk capital charge is 13.5% due to their illiquidity and lack of trading in secondary markets. There is no general market risk capital charge on these.

Specific Risk Charges for Investments in Equity:

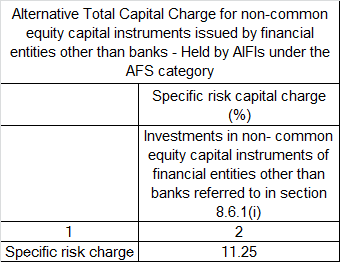

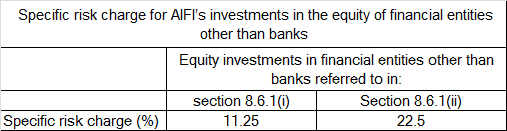

The specific risk charges vary depending on the type of equity investment and the capital level of the investee bank or entity. These charges are outlined in detailed tables and vary based on factors like the level of Common Equity Tier 1 capital and whether the bank is under Basel III Capital Regulations.

Foreign Exchange Risk:

The net open position in each currency is calculated by considering various elements like net spot and forward positions, guarantees, future income/expenses, and options. The capital charge for foreign exchange and gold open positions is 9%, in addition to the capital charge for credit risk related to these transactions.

Credit Default Swaps (CDS) in the Trading Book:

- General Market Risk: CDS doesn’t usually create a position for general market risk, but the present value of premium payable/receivable is sensitive to interest rate changes.

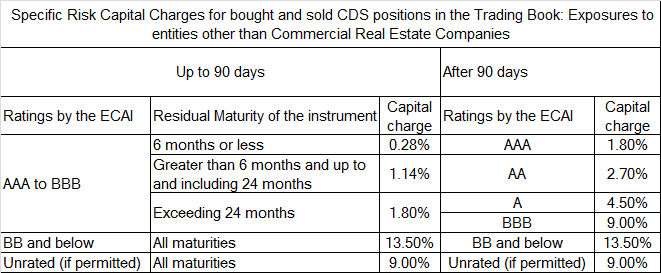

- Specific Risk for Exposure to Reference Entity: The specific risk capital charges for CDS depend on the rating of the reference entity and the residual maturity of the instrument.

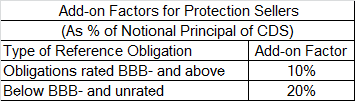

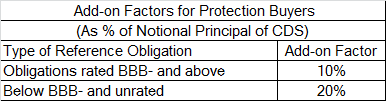

- Counterparty Credit Risk: This includes protection sellers and buyers with different add-on factors based on the type of reference obligation.

- Collateralized Transactions in CDS: The counterparty risk capital charge takes into account collateral under the comprehensive approach.

Aggregation of Capital Charge for Market Risks:

The capital charges for specific risk and general market risk are computed separately before aggregation. The total capital charge and Risk Weighted Assets for market risks are then calculated.

Prudent Valuation Guidance for Illiquid Positions

For positions valued at fair value, especially those without clear market prices or observable inputs, financial institutions must exercise prudent valuation. This is critical for less liquid positions. This guidance is for valuation processes and doesn’t necessarily change how institutions report financial values.

Key Elements of Prudent Valuation:

Systems and Controls:

- Financial institutions should have robust systems and controls for valuation. These systems need to be integrated with other risk management systems and include:

- Documented policies and procedures for valuation processes, including clear roles and responsibilities, market information sources, guidelines for unobservable inputs, frequency of valuation, and adjustment procedures.

- Independent reporting lines for the valuation department, separate from the front office.

Valuation Methodologies:

- Marking to Market: Valuations should be based on daily available market prices, using independent sources. Institutions should use observable inputs as much as possible. In cases where markets are inactive or in distress, these inputs should be considered but may not be solely relied upon.

- Marking to Model: When market prices aren’t available, institutions should use valuation models, ensuring they are prudent and conservative. Important considerations include:

- Senior management’s awareness and understanding of model-based valuations.

- Regular review of model inputs and methodologies.

- Independent development and testing of the model.

- Formal procedures for model changes.

- Regular model performance review.

- Appropriate valuation adjustments for model uncertainties.

Independent Price Verification:

This process, distinct from daily mark-to-market, involves regularly verifying market prices or model inputs. It should be performed independently of the trading department and at least monthly.

Valuation Adjustments:

Institutions must consider necessary adjustments during the valuation process. These adjustments may include costs related to credit valuation, closeout, operational risks, early termination, funding, future administrative costs, and model risk.

Adjustment for Illiquid Positions:

- Financial institutions must establish procedures to adjust the valuation of less liquid positions, reflecting their current illiquidity. This adjustment should be reviewed regularly.

- For complex products, institutions must assess the need for adjustments due to model risk, both in terms of methodology and calibration parameters.

- The adjustment made for less liquid positions should be deducted from the Common Equity Tier 1 capital while calculating the Capital Adequacy Ratio (CAR).

- Operational Risk:

- Operational risk is the risk of loss from inadequate or failed internal processes, people, systems, or external events. This includes legal risk but excludes strategic and reputational risk. Legal risk encompasses exposure to fines, penalties, or punitive damages from supervisory actions and private settlements.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Elements of Regulatory Capital – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III