Exemptions, Interpretations and Repeal – Basel III

Exemptions

The Reserve Bank has the authority to offer flexibility when it comes to following these Directions. If it finds that there’s a significant reason – like preventing hardship or for other fair reasons – it can decide to give more time to an All-India Financial Institution (AIFI) to comply with these rules. Additionally, the Reserve Bank can exempt an AIFI from some or all of these provisions. This could be a general exemption or for a specific time period. However, it’s important to note that the Reserve Bank may set certain conditions when granting these exemptions. This approach ensures that while flexibility is provided, it’s done in a structured and responsible manner.

Interpretations

In order to ensure that these Directions are applied correctly, the Reserve Bank has the authority to provide clarifications. If there’s any aspect of these rules that needs further explanation, the Reserve Bank can step in to clear things up. This is important because it helps everyone understand and follow the rules accurately. Also, it’s crucial to know that any interpretation of these provisions by the Reserve Bank is final. This means that their explanation or clarification is the one that all parties involved must follow. This approach ensures consistency and clarity in how these Directions are understood and implemented.

Repeal

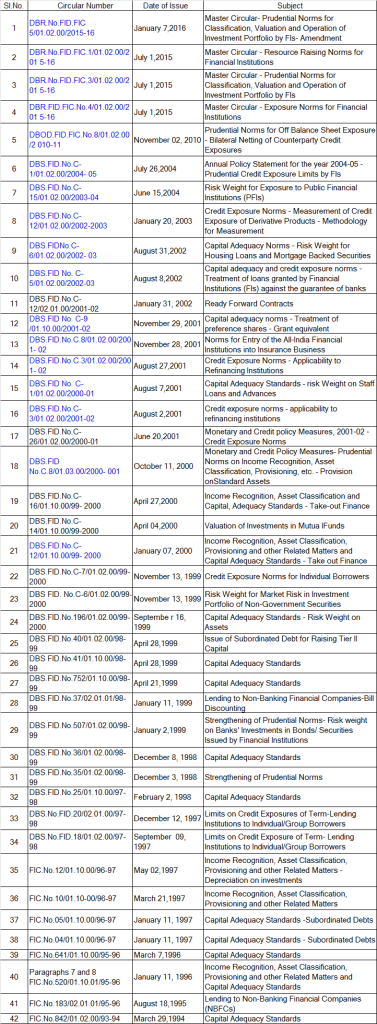

With the introduction of these new Directions, several previous circulars and guidelines are now repealed. This change is effective from the date these new Directions were issued or from the date of applicability specified in them.

This repeal affects a wide range of circulars that covered various subjects. These subjects include prudential norms for classification, valuation, and operation of investment portfolios by financial institutions, resource raising norms, exposure norms, and several others related to capital adequacy, credit exposure, and regulatory compliance.

The repealed circulars span several years and cover a broad spectrum of regulatory guidance. They range from detailed instructions on specific financial instruments to broader guidelines on financial operations and risk management.

It’s also important to note that any approvals or acknowledgements that were given under the now-repealed circulars are considered as granted under these new Directions. This ensures a smooth transition and continuity in regulatory compliance for All-India Financial Institutions.

This step marks a significant update in the regulatory framework, aiming to streamline and modernize the guidelines for financial institutions. It reflects an effort to consolidate and simplify the regulatory process, making it more efficient and easier to follow.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Elements of Regulatory Capital – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III