Scoring Methodology for Identification of NBFC as NBFC-UL

Criteria for NBFC-UL Identification:

- The top 50 NBFCs, excluding the ten largest by asset size (which are automatically in the Upper Layer), are selected based on their total exposure, including off-balance sheet exposure.

- NBFCs that were classified as NBFC-UL in the previous year.

- Additional NBFCs may be included based on supervisory judgment.

Scores for all NBFCs in this group are calculated annually as of March 31 each year.

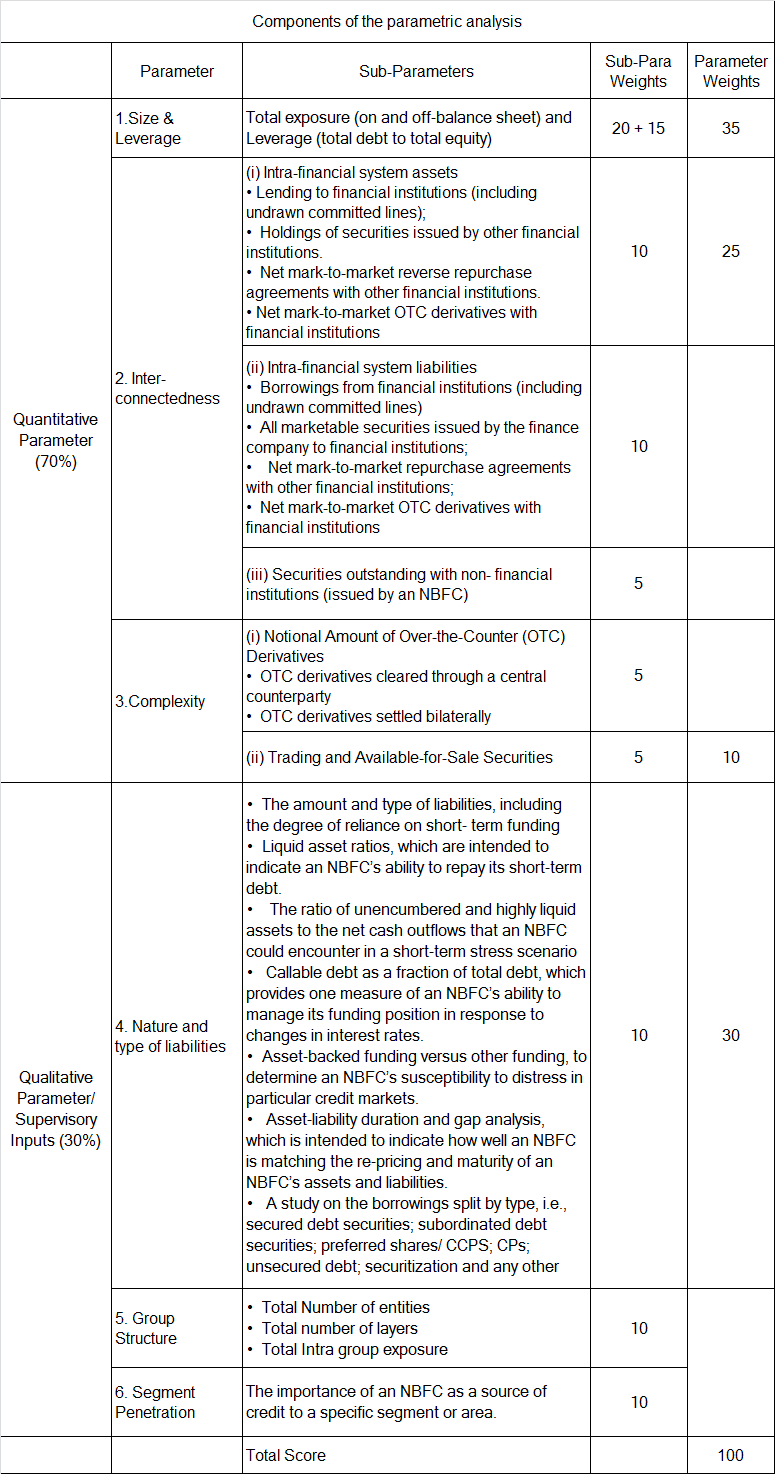

Components of the Parametric Analysis:

Quantitative Parameter (70%):

- Size & Leverage (35%): Total exposure and leverage (debt to equity ratio).

- Interconnectedness (25%): This includes assets and liabilities within the financial system and securities with non-financial institutions.

- Complexity (10%): Factors like the notional amount of Over-the-Counter (OTC) Derivatives and trading securities.

Qualitative Parameter/Supervisory Inputs (30%):

- Nature and Type of Liabilities (30%): This covers aspects like the mix and type of liabilities, liquid asset ratios, callable debt, and asset-liability management.

- Group Structure (10%): The total number of entities, layers, and intra-group exposure.

Segment Penetration (10%): The importance of an NBFC in providing credit to specific segments or areas.

Each parameter and sub-parameter has its own weight, contributing to a total score out of 100. This scoring system helps in accurately assessing which NBFCs should be placed in the Upper Layer, ensuring a robust and comprehensive evaluation.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulations applicable for NBFC-ML

Regulatory Instructions for NBFC-UL

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

Disclosures in Financial Statements – Notes to Accounts of NBFCs

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines for Credit Default Swaps – NBFCs as Users

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Guidelines on Liquidity Coverage Ratio (LCR)

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition