Disclosures in Financial Statements – Notes to Accounts of NBFCs

General

The disclosure formats provided here are designed for all types of Non-Banking Financial Companies (NBFCs), including Investment and Credit Companies, Housing Finance Companies, and Core Investment Companies. NBFCs can exclude certain disclosures if they are not relevant, not allowed, or if there were no related transactions in the current or previous year.

It’s important to understand that including an activity or transaction in these disclosures does not automatically mean it is permitted. NBFCs must always refer to current laws and regulations to determine what is allowed.

NBFCs are required to provide comparative information for the previous period for all amounts reported in the current period’s financial statements. This also applies to narrative and descriptive information, if it helps in understanding the current financial statements.

Disclosure Templates

Section I

(For annual financial statements of NBFC-BL, NBFC-ML, and NBFC-UL)

Exposure

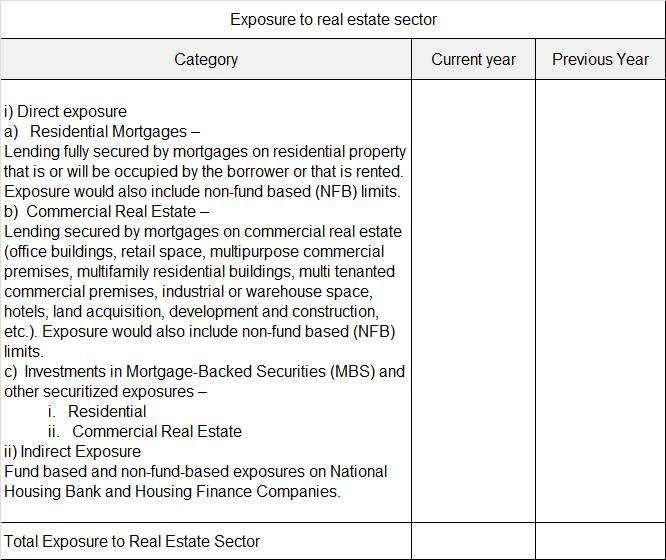

- Exposure to the real estate sector includes direct and indirect exposures, such as residential mortgages, commercial real estate lending, and investments in Mortgage-Backed Securities. The total exposure to the real estate sector should be disclosed.

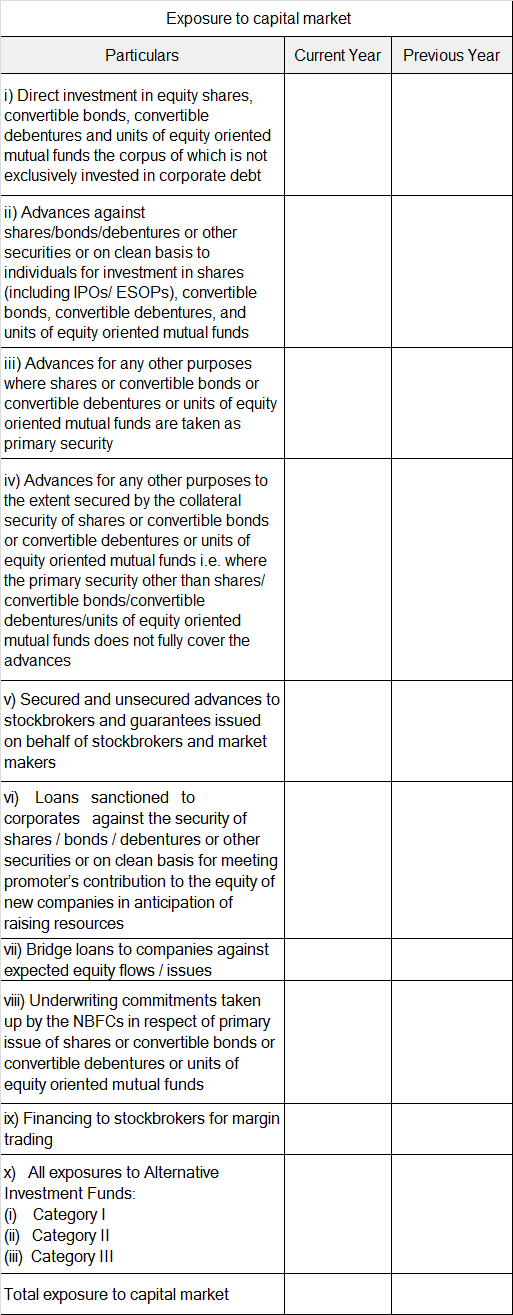

- Exposure to the capital market involves various forms of investments and advances, including direct investment in equity shares and advances against shares. The total exposure to the capital market should be disclosed.

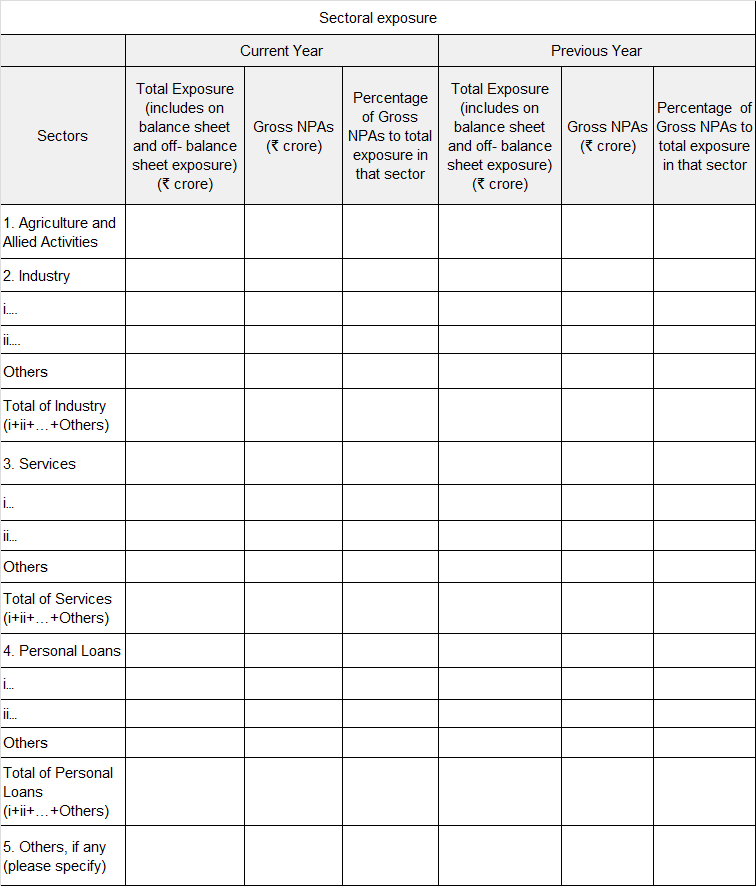

- Sectoral exposure details the total exposure, Gross Non-Performing Assets (NPAs), and the percentage of Gross NPAs in various sectors like agriculture, industry, services, personal loans, and others.

- Intra-group exposures should include the total amount of such exposures, the top 20 intra-group exposures, and their percentage to the total exposure of the NBFC.

- Unhedged foreign currency exposure details and policies to manage currency-induced risk should be disclosed.

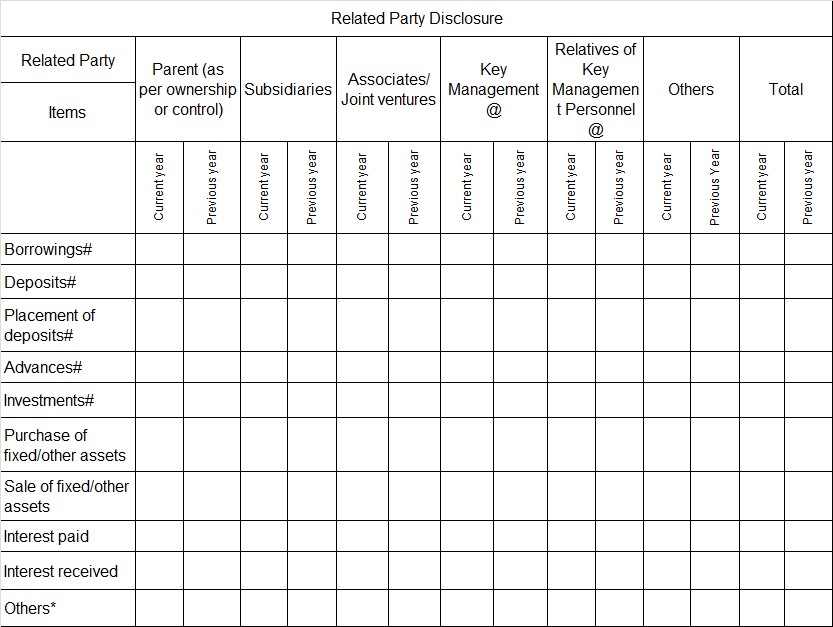

Related Party Disclosure

This includes transactions with various related parties like parent companies, subsidiaries, associates, joint ventures, key management personnel, and their relatives. Disclosures should cover aspects like borrowings, deposits, investments, and interest paid or received.

The definition of a related party is in line with the applicable accounting standards and includes directors, key managerial personnel, and their relatives, among others.

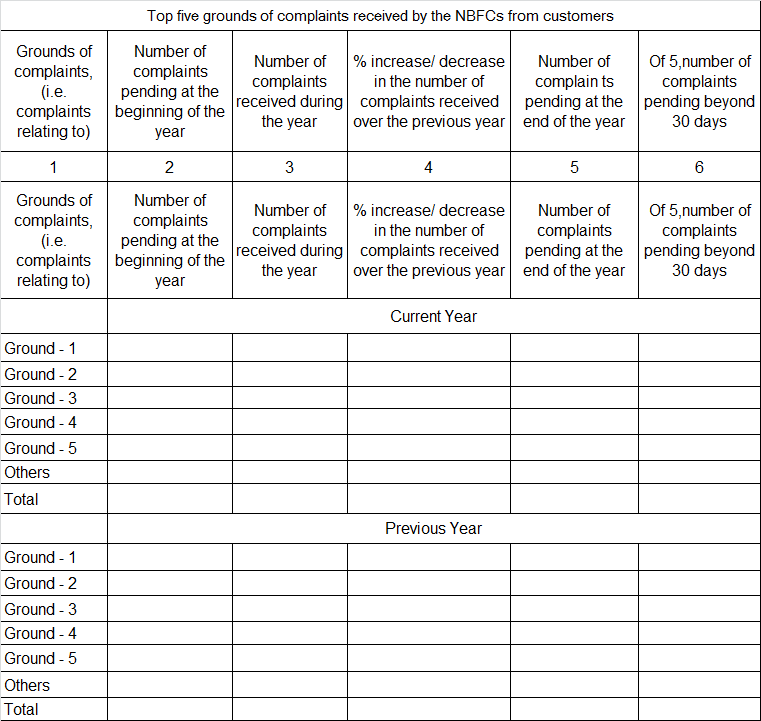

Disclosure of Complaints

This section covers the number of customer complaints received, including those from the Offices of Ombudsman. It should detail the number of complaints at the beginning of the year, received during the year, disposed of, and pending at the end of the year. The top five grounds for complaints should also be disclosed.

Section II

(For financial statements of NBFC-ML and NBFC-UL)

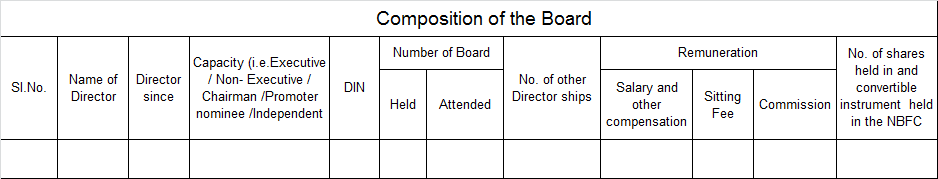

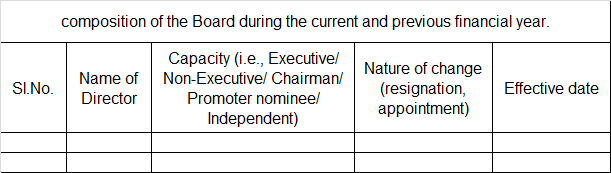

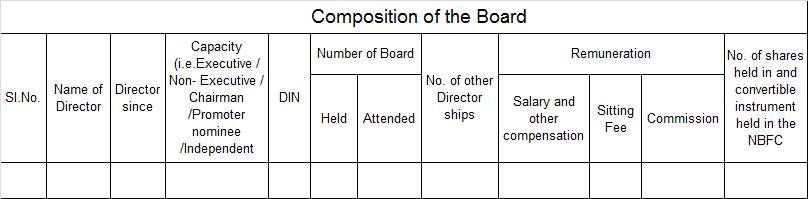

Corporate Governance

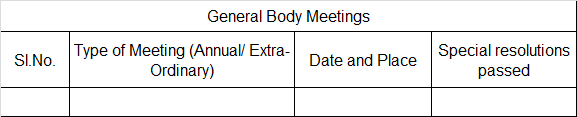

Non-listed NBFCs should strive to disclose information in line with the SEBI [Listing Obligations and Disclosure Requirements (LODR)] Regulations, 2015. This includes the composition of the Board, details of Board committees, General Body Meetings, non-compliance with the Companies Act, 2013, penalties, and breaches of covenant.

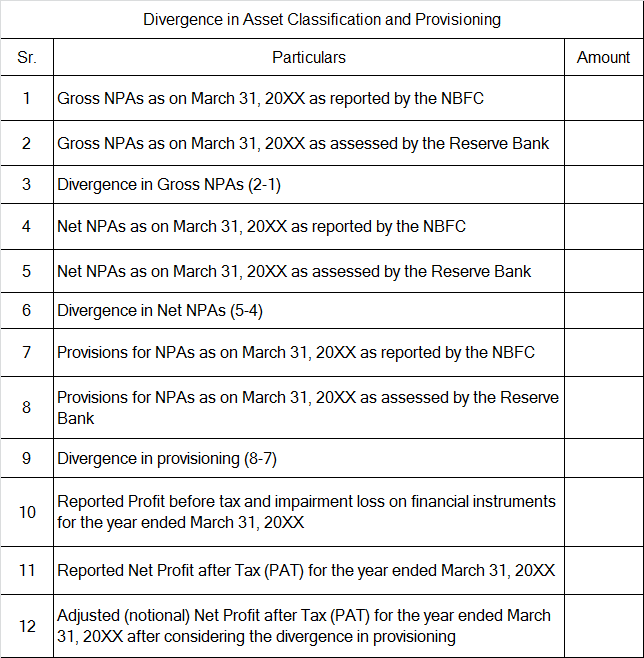

Divergence in Asset Classification and Provisioning

NBFCs must disclose details of divergence in asset classification and provisioning if certain conditions regarding additional provisioning requirements or Gross NPAs are met.

Section III

(For annual financial statements of NBFC-UL)

Disclosure for NBFCs-UL

NBFCs under the Upper Layer (NBFC-UL) category, which are not yet listed, should prepare a roadmap for compliance with the disclosure requirements of a listed company under the SEBI (LODR) Regulations, 2015, within three years of being identified as NBFC-UL.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulations applicable for NBFC-ML

Regulatory Instructions for NBFC-UL

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Scoring Methodology for Identification of NBFC as NBFC-UL

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines for Credit Default Swaps – NBFCs as Users

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Guidelines on Liquidity Coverage Ratio (LCR)

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition