Guidance for computation of ECL – NFRS-9

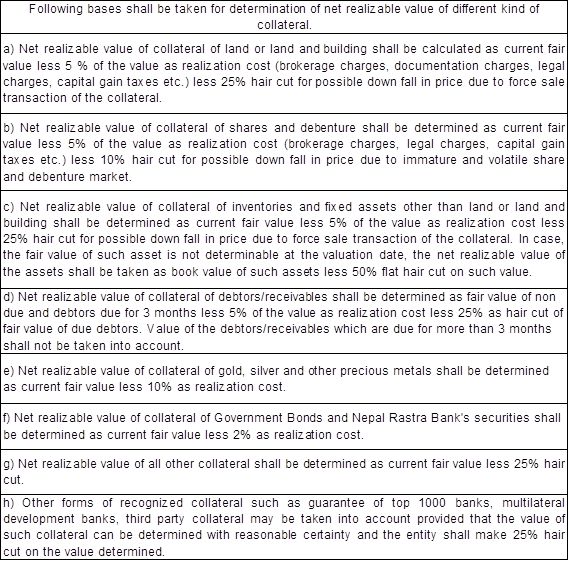

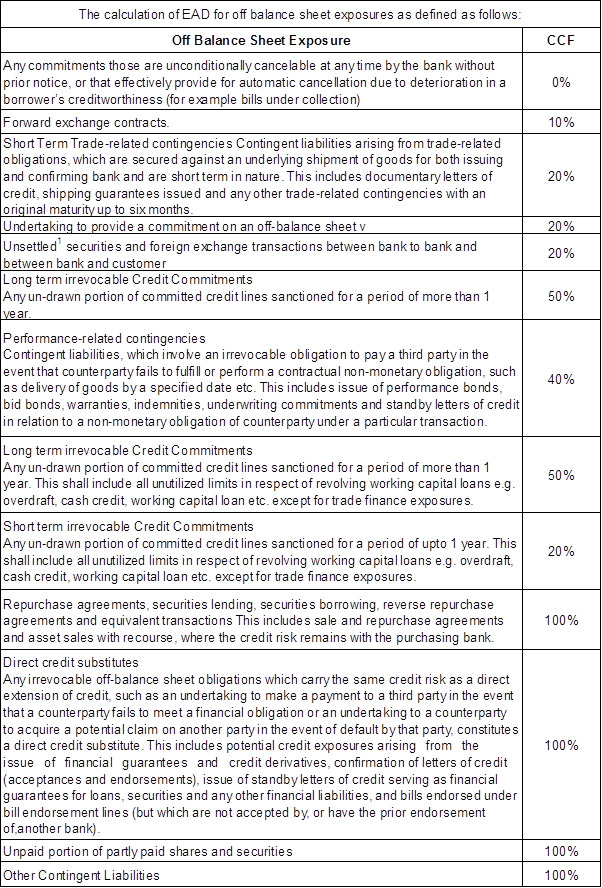

Banks must consider factors like Probability of Default, Loss Given Default, and Exposure at Default when computing ECL. They should use historical data, forward-looking information, and consider regulatory backstop measures.

ECL Model Governance & Validation

Banks must identify and document ECL assessment methods, ensure consistency with NFRS 9 objectives, and have effective model validation policies and procedures.

Role of Internal Audit

Internal auditors should evaluate the effectiveness of credit risk assessment and measurement processes and report their findings to the audit committee.

Transitional Regulatory Requirements

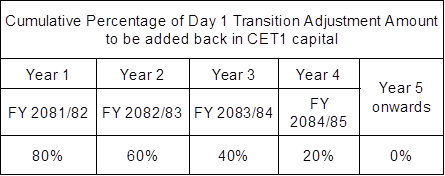

To address the initial impact of transitioning to ECL accounting, a transitional arrangement will be introduced for adjusting Common equity Tier 1 capital over a maximum of 4 years.

Regulatory Backstop Measures

Banks must recognize impairment on credit exposures as the higher of ECL calculated as per NFRS 9 and existing regulatory provisions.

Guidance on staging for expected credit losses

Financial instruments must be segregated into three stages for measuring expected credit loss, with different criteria for each stage.

Forward Looking Information

Banks should have policies for using a range of forward-looking information in their economic analysis and forecasting for ECL measurement. They should consider multiple economic scenarios and use forecasts from credible sources.