Guidelines for Credit Default Swaps – NBFCs as Users

Definitions

In these guidelines, we use specific terms. A ‘Credit event payment’ is what the credit protection seller pays to the buyer after a credit event. It’s paid through physical settlement. The ‘Underlying asset/obligation’ is what the buyer wants to protect. A ‘Deliverable asset/obligation’ is what must be delivered if a credit event happens. It should be at least equal or lower in rank than the underlying obligation. The ‘Reference obligation’ is used to figure out the payment after a credit event.

Operational Requirements for CDS

A CDS contract should be a direct claim on the protection seller and clearly cover specific exposure. It should be irrevocable, except for non-payment of premium by the buyer. The contract must not allow the seller to cancel the cover unilaterally or increase the cost if the credit quality of the hedged exposure worsens. The contract should be unconditional and not contain clauses that could prevent timely payment by the seller in case of a credit event.

The credit events covered should include failure to pay, bankruptcy, insolvency, and restructuring of the underlying obligation that leads to a credit loss event. If the CDS doesn’t cover restructuring but meets other requirements, only part of the CDS can be recognized as covered.

If the CDS specifies different deliverable obligations from the underlying one, this mismatch should be managed. The CDS should not end before any grace period for default due to non-payment. The terms should allow transfer of the underlying obligation to the seller if needed. The parties responsible for determining a credit event should be clear, and this responsibility should not lie solely with the seller. The buyer should be able to inform the seller of a credit event.

Asset and obligation mismatches are allowed under certain conditions, like sharing the same obligor and having enforceable cross-default clauses.

Treatment of Exposures Below Materiality Thresholds

Materiality thresholds in CDS contracts are like first loss positions and have a high risk weight for capital adequacy purposes.

Prudential Treatment Post-Credit Event

If the credit event payment is delayed, the NBFC should ignore the CDS protection and maintain capital for the exposure. Once the payment is received, the underlying asset should be removed or its book value reduced, with provisions for the reduced value.

Capital Adequacy

CDS contracts create counterparty exposure. The exposure is on the protection seller. NBFCs should calculate the credit risk charge for bought CDS positions.

Treatment of Exposure to the Protection Seller

The exposure to the underlying asset is considered substituted by exposure to the protection seller if certain conditions are met. If there’s a maturity mismatch, the amount of recognized protection is adjusted. Asset and maturity mismatches are detailed, with specific calculations for adjustments.

NBFCs must adhere to criteria for transferring exposures to the protection seller. They should manage their exposure limits and maintain enough capital for exposures beyond normal limits. No netting of marked-to-market values is allowed for exposure norms.

General Provisions Requirements

NBFCs should hold general provisions for the gross positive marked-to-market values of CDS contracts.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulations applicable for NBFC-ML

Regulatory Instructions for NBFC-UL

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Scoring Methodology for Identification of NBFC as NBFC-UL

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

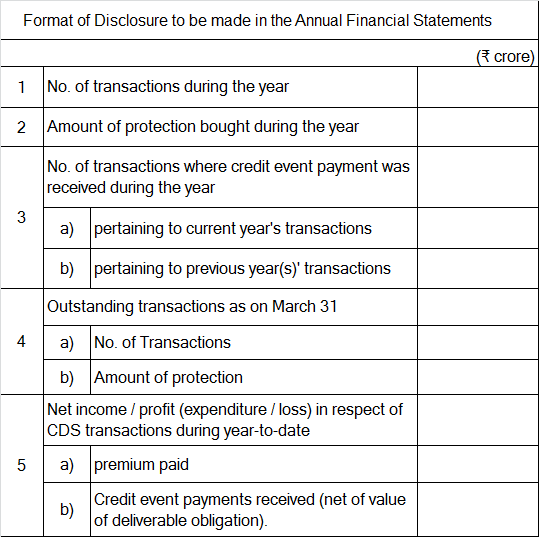

Disclosures in Financial Statements – Notes to Accounts of NBFCs

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Guidelines on Liquidity Coverage Ratio (LCR)

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition