Guidelines on Liquidity Coverage Ratio (LCR)

These guidelines apply to non-deposit taking NBFCs with assets of ₹5,000 crore and above, and all deposit taking NBFCs, except for certain types like Core Investment Companies and others. They outline how to calculate the Liquidity Coverage Ratio (LCR).

Definitions:

- High Quality Liquid Assets (HQLA) are assets easily converted into cash or used as collateral in stress scenarios.

- LCR is calculated as the ratio of HQLA to total net cash outflows over the next 30 days.

- Unencumbered assets are free from restrictions on their liquidity.

General Guidelines:

- NBFCs must maintain enough unencumbered HQLA to meet 30-day liquidity needs under severe stress.

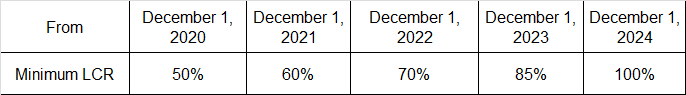

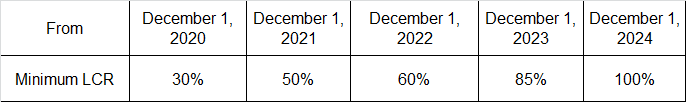

- The LCR should be at least 50% from December 1, 2020, progressively reaching 100% by December 1, 2024. For smaller NBFCs (₹5,000 crore to ₹10,000 crore), the initial LCR is 30%.

- From December 1, 2024, the LCR must be continuously 100%.

- NBFCs can use their HQLA during financial stress but must report this to the Reserve Bank.

Stress Scenarios for LCR:

- These include deposit run-offs, loss of funding, impacts of credit rating downgrades, and other market and operational stresses.

- High Quality Liquid Assets:

- HQLAs include cash, government securities, and certain marketable securities.

- Different assets have different liquidity levels and are subject to haircuts.

- Assets must be managed effectively as part of the liquidity pool.

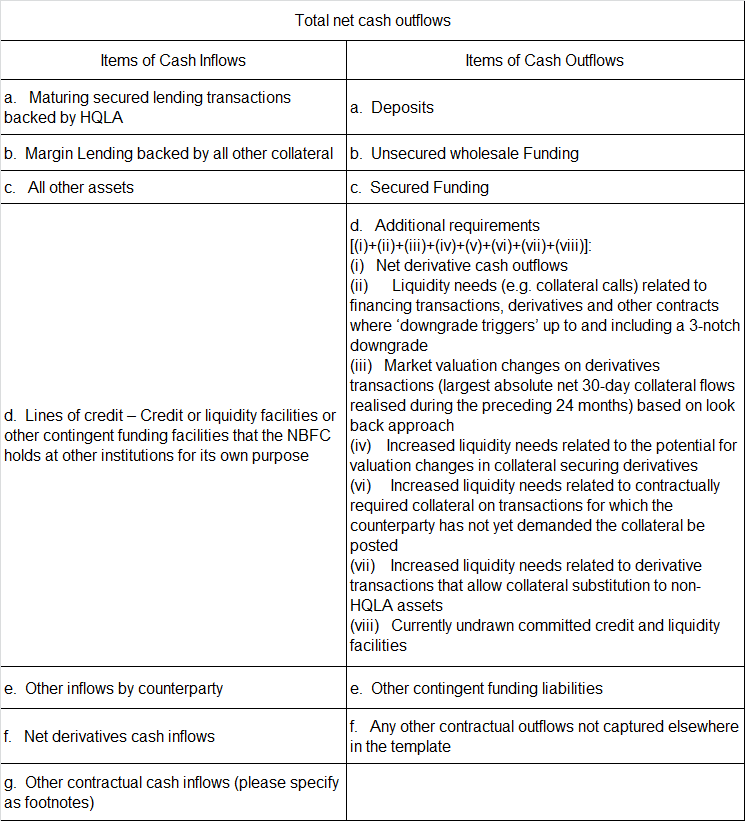

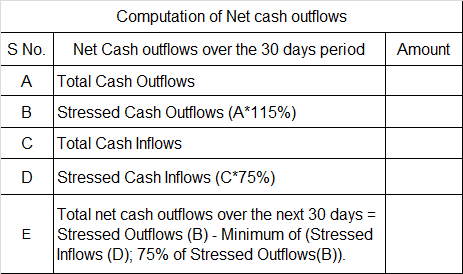

Total Net Cash Outflows:

- Defined as total expected cash outflows minus inflows over 30 days.

- Calculated by applying stress percentages to various inflow and outflow categories.

- Cash inflows are capped at 75% of total outflows.

LCR Disclosure Standards:

- NBFCs must disclose LCR information quarterly and in annual financial statements.

- Data should be averages of monthly observations, moving to daily observations from March 31, 2022.

- Disclosures should include qualitative discussions on LCR, including factors affecting it.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulations applicable for NBFC-ML

Regulatory Instructions for NBFC-UL

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Scoring Methodology for Identification of NBFC as NBFC-UL

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

Disclosures in Financial Statements – Notes to Accounts of NBFCs

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines for Credit Default Swaps – NBFCs as Users

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition