Large Exposures Framework – Basel III

In this chapter, we discuss how regulators and financial entities use exposure limits to handle concentration risk. These guidelines focus on the prudential norms for credit and capital market exposures of All India Financial Institutions (AIFIs).

Scope and Applicability

AIFIs must consistently apply these exposure norms, just like they do for risk-based capital requirements. This applies both at the consolidated group level and at the individual (solo) level. It’s important to note that these norms are concerned only with counterparty exposures, not with exposures to specific sectors or industries.

Exemptions

There are certain situations where AIFIs’ exposure to counterparties doesn’t fall under these limits. These include:

- The refinance portfolios of AIFIs. However, AIFIs need to have a Board-approved policy to set credit exposure limits for their refinancing portfolio. This policy and its assessments are subject to supervisory review.

- Exposures to the Government of India and State Governments that qualify for a zero percent risk weight, as outlined in Chapter II.

- Exposures to the Reserve Bank of India.

- Exposures where the principal and interest are fully guaranteed by the Government of India.

- Exposures secured by financial instruments issued by the Government of India, provided they meet the criteria for credit risk mitigation as mentioned in section 22 of this chapter.

- Intra-day exposures to banks.

- Exposures related to AIFIs’ clearing activities with Qualified Central Counterparties (QCCPs), as detailed in section 24.

Exposure Ceilings

1. Single Counterparty

An AIFI’s total exposure to one counter party should not exceed 20% of its eligible capital base at any time. However, the AIFI’s Board can allow an additional 5% exposure, but only up to a maximum of 25% of the AIFI’s eligible capital base. This is subject to two conditions:

- The AIFI must have a specific policy, approved by its Board, outlining the conditions under which exposure beyond 20% may be considered.

- The AIFI must document the exceptional reasons for allowing exposure beyond 20% for each specific case.

Moreover, an AIFI can go over the exposure limit by 5% of its Tier I capital for a single counterparty if the extra exposure is due to an infrastructure loan or investment. But remember, the limit for a single counterparty should never exceed 25%.

2. Group of Connected Counterparties

When it comes to a group of connected counterparties, the total exposure of an AIFI should not be more than 25% of its eligible capital base. However, for infrastructure loans or investments, this limit can be exceeded by 10% of the AIFI’s Tier I capital.

3. Eligible Capital Base

The eligible capital base we’re talking about here is the effective amount of Tier 1 capital, as defined in Chapter II of these Directions, based on the last audited balance sheet.

4. Capital Infusion Considerations

If there’s a capital infusion after the balance sheet date, it can be considered for exposure norms. Also, profits earned during the year can count as Tier I capital for these purposes, after making the necessary adjustments as prescribed. But, AIFIs need to get an external auditor’s certificate confirming the capital infusion and submit it to the Reserve Bank (Department of Supervision) before adding this to their eligible capital base.

Definition of connected counterparties

When a financial institution like an AIFI deals with a group of businesses or individuals, it’s important to understand how they are connected. Sometimes, these parties are linked in such a way that if one has financial trouble, the others are likely to face problems too. We call this group of connected parties a single counterparty for simplicity.

There are two main ways these connections can happen:

- Control Relationship: This is when one party has control over the others, or they are all controlled by a third party. If the controlling party faces financial issues, it might pull resources from the others, putting them at risk too. This domino effect means we see them as one risk.

- Economic Interdependence: Here, the financial health of one party is closely tied to the others. If one struggles to pay back loans or needs funding, the others are likely to face similar issues.

To decide if parties are connected, we look at whether their combined exposure is more than 5% of the AIFI’s eligible capital. If it is, we dig deeper into their relationships.

For control relationships, we consider factors like voting agreements, influence over management, and connections to a common third party. We also look at accounting standards for more guidance. Sometimes, different parties might have common owners or managers, or they might be managed together in some way. We examine these cases too.

However, there are exceptions. Sometimes, even if there’s control, it doesn’t mean the parties are financially dependent on each other. For example, a special purpose entity controlled by another client might be insulated from risks, so we wouldn’t see them as connected.

For economic interdependence, we check things like how much business they do with each other, if they guarantee each other’s debts, or if they rely on the same funding source. But again, there are exceptions. If a party can quickly find new partners or funding sources, they might not be considered connected, even if they meet the other criteria.

It’s also important to note that control and economic dependence are assessed separately. However, sometimes they overlap, and in those cases, all involved parties might be seen as a single risk.

AIFIs need to have clear policies, approved by their Board, for determining these connections. These policies are closely monitored to ensure they’re effective and appropriate.

Values of Exposure

When we talk about exposure to a counterparty, we’re including both visible (on-balance sheet) and not-so-visible (off-balance sheet) exposures. These are calculated using specific methods set for capital computation. It’s possible to balance these exposures with certain credit risk reduction techniques. For off-balance sheet items, we convert them into credit exposure equivalents using set conversion factors, with a minimum limit of 10 percent.

1. Recognizing Exposures to Credit Risk Mitigation Providers

If a financial institution reduces its risk to a counterparty because of a credit risk mitigation (CRM) tool provided by another party, it must also recognize this new exposure to the CRM provider. The exposure amount to the CRM provider is usually the amount reduced from the original counterparty. However, in cases involving credit default swaps, where the swap provider or the referenced entity is not a financial entity, the exposure amount is calculated differently, based on the counterparty credit risk exposure value.

For clarity, financial entities include regulated financial institutions like banks, insurance companies, and broker/dealers, as well as unregulated ones involved in financial services activities.

2. Exposures to Banks

Exposures to banks, except for certain short-term exposures, are capped at 25 percent of a financial institution’s Tier 1 capital.

3. Approach for Collective Investment Undertakings and Securitization Vehicles

When a financial institution invests in structures like funds or securitizations, it’s important to understand the exposures of these structures to their underlying assets. This is known as the “Look Through Approach” (LTA). If the exposure to each underlying asset is less than 0.25% of the institution’s capital, the institution can treat the structure itself as the counterparty. Otherwise, it needs to identify each significant underlying asset and add these exposures to any other exposures to the same counterparty.

If a financial institution can’t identify the underlying assets, and if the total exposure to a structure is less than 0.25% of its capital, it can treat the structure as a distinct counterparty. If the exposure is more, it’s categorized under ‘unknown client’, and certain limits apply.

When the LTA isn’t required, the institution needs to ensure that this decision isn’t a way to avoid exposure limits. If LTA isn’t applied, the exposure is simply the amount invested in the structure.

For structures where all investors are treated equally, the exposure value to a counter party is the institution’s share in the structure multiplied by the value of the underlying asset. In structures with different seniority levels among investors, the exposure value is calculated for each level, considering the value of the tranche and the institution’s share in it.

4. Identifying Additional Risks

Financial institutions should also identify third parties in these structures that might pose additional risks. These could be entities like fund managers or credit protection providers. The Reserve Bank may review these and suggest actions like reducing exposure or raising additional capital. If multiple third parties are seen as risk factors, the institution should assign the exposure from the investment to each of these parties.

Exposure to Non-Banking Financial Companies (NBFCs)

When financial institutions lend to NBFCs, they need to follow certain limits. These limits apply both to individual NBFCs and to groups of connected NBFCs.

However, there are specific areas where financial institutions are not allowed to finance NBFCs. These include:

- Financing against bills that NBFCs have discounted or rediscounted, except those related to the sale of commercial vehicles, including light commercial vehicles. Even in these cases, standard lending precautions should be taken.

- Financing for investments made by NBFCs in short-term assets like shares and debentures.

- Financing for investments or loans that NBFCs make to their subsidiaries, group companies, or other related entities.

- Financing for investments or inter-corporate loans and deposits that NBFCs make in other companies.

- Providing any form of bridge loans to NBFCs, regardless of their category.

Exposures to Central Counterparties

When financial institutions have clearing exposure to Qualified Central Counterparties (QCCPs), these are not included in the large exposure framework. However, they must still report these exposures as required by regulations.

For non-QCCPs, financial institutions need to add up both their clearing and non-clearing exposures. The total exposure should not exceed 25 percent of their eligible capital base.

It’s important to note that the usual rules about connected counterparties don’t apply to exposures related to clearing activities with Central Counterparties (CCPs).

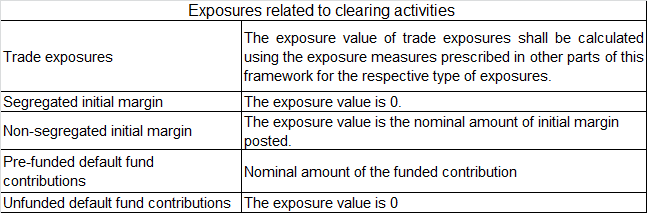

Calculating Exposures for Clearing Activities

Financial institutions must identify and sum up their exposures to a CCP that are specifically for clearing activities. They need to figure out which counterparty these exposures belong to, following the rules for risk-based capital requirements. Here’s a quick guide:

- Trade exposures: Calculate the exposure value using the measures prescribed in this framework.

- Segregated initial margin: The exposure value is zero.

- Non-segregated initial margin: The exposure value is the actual amount of initial margin posted.

- Pre-funded default fund contributions: Use the nominal amount of the funded contribution.

- Unfunded default fund contributions: The exposure value is zero.

Other Exposures

For exposures not directly related to clearing services, like equity stakes, funding facilities, credit facilities, and guarantees, financial institutions must measure these according to the standard rules. These exposures are then added together and are subject to the same 25 percent limit of the eligible capital base.

Reporting System and Disclosures

Financial institutions must conduct an annual review of how they manage exposures. This review should be completed and presented to their Boards by the end of June, or September for the National Housing Bank. A copy of this report must be sent to the Department of Supervision.

Breach of Exposure Limits

If a financial institution exceeds its exposure limits, this should only happen under exceptional circumstances that are beyond its control. These breaches must be fixed immediately and reported to the Reserve Bank of India’s Department of Supervision right away. If a financial institution is over its exposure limit, it cannot take on any new exposures until the situation is corrected. Not adhering to these limits could result in penalties.

Regulatory Reporting

Financial institutions are required to report their large exposures to the Reserve Bank’s Department of Supervision every month. This report should include:

- All exposures that qualify as large exposures.

- All other exposures, calculated without reducing the value for any credit risk mitigation, that qualify as large exposures.

- Any exempted exposures that still meet the criteria of large exposures.

- The 20 largest exposures, regardless of how they compare to the institution’s eligible capital base.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Elements of Regulatory Capital – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Operational Aspects of ICAAP – Basel III

Leverage Ratio Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III