Operational Aspects of ICAAP – Basel III

The operational aspect delves into the range of risks that All India Financial Institutions (AIFIs) should typically consider in their Internal Capital Adequacy Assessment Process (ICAAP).

Identifying and Measuring Material Risks in ICAAP

The primary goal of ICAAP is to identify all significant risks. AIFIs should rigorously treat risks that can be measured and quantified. The methods for measuring these risks will vary among AIFIs. Common risks include credit, market, operational, interest rate, credit concentration, and liquidity risks. AIFIs should align their risk management processes, including ICAAP, with the Reserve Bank’s guidelines. However, they should also pay attention to risks like reputational and business risks, which are equally important. For instance, AIFIs involved in businesses with high fixed costs and fluctuating activity levels might face unexpected losses requiring adequate capital. Strategic activities, like business expansion or acquisitions, also introduce significant risks.

If AIFIs use risks mitigation techniques, they must understand the risks being mitigated and the potential impact of these techniques on their risk profile.

Credit Risk

AIFIs should have methods to assess credit risk at both individual and portfolio levels. They need to be particularly aware of credit risk concentrations and assess their impact. This includes considering dependencies among exposures and the effects of extreme outcomes and stress events. AIFIs should also assess counterparty credit risk, especially in less liquid markets, and understand how these might affect their capital adequacy.

Counterparty Credit Risk (CCR)

AIFIs should have robust policies, processes, and systems for managing CCR, considering market, liquidity, and operational risks associated with it. The Board and senior management should actively involve themselves in CCR control processes. AIFIs should monitor credit lines daily and assess current and potential future exposures. Stress testing methodologies should be in place to evaluate the impact of market volatilities and changes in counterparty creditworthiness on CCR.

Market Risk

AIFIs should identify risks in trading activities due to market price movements. This includes considering factors like instrument illiquidity, concentrated positions, and potential shifts in correlations. Stress testing should capture key portfolio vulnerabilities.

Operational Risk

AIFIs should assess risks from inadequate or failed internal processes, people, and systems, as well as external events. This includes considering the effects of extreme events and shocks related to operational risk.

Interest Rate Risk in the Banking Book (IRRBB)

AIFIs should identify risks from changing interest rates in their banking book, considering both short-term and long-term impacts. This includes assessing the impact of various interest rate scenarios and supporting assumptions about the behaviour of non-maturity deposits and other liabilities and assets.

Credit Concentration Risk

AIFIs should assess risks from single exposures or groups of exposures that could significantly impact their health or core operations. They should consider their exposure to sector-specific risks and diversify their credit portfolios across various dimensions. AIFIs should also evaluate credit concentration in specific economic sectors or geographical areas and consider the impact of key personnel on concentration risk.

Liquidity Risk

AIFIs need to understand risks from their inability to meet obligations due to difficulties in liquidating assets or obtaining funding. This includes analyzing sources and uses of funds, understanding funding markets, and assessing the efficacy of contingency funding plans. Senior management should consider the relationship between liquidity and capital, as liquidity risk can impact capital adequacy.

Off-Balance Sheet Exposures and Securitization Risk

Risks from securitization activities, often not fully captured under Pillar 1, should be addressed in ICAAP. This includes credit, market, liquidity, and reputational risks from securitized exposures and exposures to credit lines or liquidity facilities to special purpose entities.

Reputational Risk and Implicit Support

AIFIs should assess reputational risks that can affect their ability to maintain or establish business relationships and access funding. They should also consider the impact of providing implicit support to securitization transactions, which can lead to credit, liquidity, market, and legal risks.

Risk Evaluation and Management

AIFIs should not solely rely on external credit ratings when investing in structured products. They should understand the credit quality and risk characteristics of underlying exposures in structured credit transactions and track credit risk at both the transaction level and across securitization exposures.

Valuation Practices

Valuing complex structured products is challenging due to factors like market inactivity and unique cash flows. AIFIs should have robust governance structures and control processes for valuing exposures, ensuring consistency across the firm.

Sound Stress Testing Practices

Stress testing is a crucial tool for AIFIs, providing forward-looking assessments of risk and helping in capital and liquidity planning. It should form an integral part of an AIFI’s risk management culture, with active involvement from the Board and senior management.

Compensation Practices

Compensation policies should align with long-term capital preservation and financial strength, not just short-term profit generation. AIFIs should ensure that compensation practices do not encourage undue risk-taking.

Quantitative and Qualitative Approaches in ICAAP

While quantitative approaches are foundational in risk measurement, qualitative tools, including judgment and experience, are also important, especially where quantitative methods are limited. AIFIs should recognize the limitations and inherent biases in both approaches.

Risk Aggregation and Diversification Effects

Effective ICAAP should assess risks across the entire AIFI, considering potential concentrations across multiple risk dimensions. Assumptions about diversification should be supported by analysis and evidence.

Market Discipline

Market discipline complements the minimum capital requirements and the supervisory review process. Its goal is to foster transparency through disclosure requirements. These disclosures help market participants understand an institution’s capital adequacy by providing information on capital, risk exposures, and risk assessment processes.

Disclosures should reflect the senior management and Board’s view of the institution’s risks. They are based on the methodologies used under Pillar 1 for risk measurement and capital requirements. A common framework for these disclosures aids in clarity and comparability.

Appropriate Disclosure

Market discipline is crucial for a stable banking and financial sector. Non-compliance with disclosure requirements may result in penalties, including financial ones. However, additional capital requirements are not typically imposed for non-disclosure, except in specific circumstances outlined under Pillar 1.

Interaction with Accounting Disclosures

The Pillar 3 disclosure framework aligns with accounting standards but has a narrower focus, specifically on capital adequacy. The Reserve Bank may update these disclosure requirements as needed, based on industry developments and on-going monitoring.

Validation

Disclosures should undergo thorough validation. Information accompanying audited financial statements should be consistent with those statements. Other published materials, like Management’s Discussion and Analysis, should also be scrutinized to ensure accuracy. However, Pillar 3 disclosures are not required to be audited externally unless specified.

Materiality

Institutions should base their disclosures on the concept of materiality. Information is material if its omission or misstatement could influence a user’s economic decisions. This aligns with International Accounting Standards. The Reserve Bank encourages institutions to use their judgment in determining materiality, though some specific thresholds are provided for certain disclosures.

Proprietary and Confidential Information

Disclosures must balance the need for transparency with the protection of proprietary and confidential information. This includes details about products, systems, and customer information.

General Disclosure Principle

Institutions should have a formal policy, approved by the Board, guiding their disclosures and the internal controls over this process. They should also regularly assess the appropriateness of their disclosures.

Implementation Date

Institutions are expected to make their first set of disclosures under Basel III by June 30, 2024, or September 30, 2024, for some institutions.

Scope and Frequency of Disclosures

Pillar 3 disclosures apply at the group level and should be made at least semi-annually. Certain disclosures, like capital adequacy and credit risk, must be made quarterly. These can be included in financial statements or made available on the institution’s website.

Regulatory Disclosure Section

Institutions must maintain a section on their websites dedicated to regulatory disclosures, easily accessible and updated regularly. An archive of past disclosures should be kept for at least three years.

Pillar 3 under Basel III Framework

The disclosure requirements under Basel III are detailed in specific templates. These include a common template for regulatory capital, reconciliation requirements, and a template for the main features of capital instruments. These templates ensure consistency and comparability in disclosures.

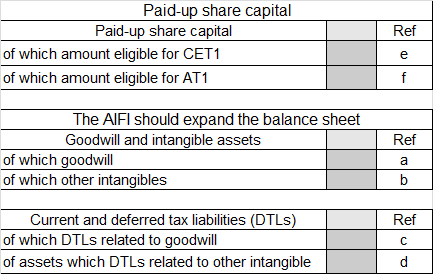

Reconciliation Requirements

Institutions must provide a detailed reconciliation of their regulatory capital elements to their balance sheet. This involves a three-step process to ensure clarity and traceability of the reported figures.

Other Disclosure Requirements

Institutions must disclose the full terms and conditions of all capital instruments on their websites. This transparency allows for a deeper understanding of each instrument’s specific features.

The Disclosure Templates

All Pillar 3 disclosure templates are provided in a structured format, with additional definitions and explanations to aid in understanding and compliance.

Basel III Reforms – Introduction

Simple Guide on Minimum Capital Requirements – Basel III

Elements of Regulatory Capital – Basel III

Capital Charge for Credit Risk – Basel III

Credit Risk Mitigation – Basel III

Capital Charge for Market Risk – Basel – III

Operational Risk Capital Charge Calculation Methods– Basel – III

Guidelines for Internal Capital Adequacy Assessment Process (ICAAP) – Basel III

Guidelines for the SREP of RBI and ICAAP of AIFIs– Basel – III

Leverage Ratio Framework – Basel III

Large Exposures Framework – Basel III

Permitted exposures & other prudential exposure limits – Basel III

Significant Investments of AIFIs – Basel III

Prudential Norms for Investment Portfolio Management by AIFIs – Basel III

Accounting and Provisioning in AIFIs – Basel III