Regulatory Instructions for NBFC-UL

Prudential Regulations

Common Equity Tier 1 (CET1)

NBFCs are required to maintain a Common Equity Tier 1 capital. This should be at least 9 percent of their Risk Weighted Assets. The CET1 ratio is calculated by dividing the Common Equity Tier 1 capital by the Total Risk Weighted Assets.

The components of CET1 capital include:

- Paid-up equity share capital.

- Share premium from equity shares.

- Capital reserves from asset sale proceeds.

- Statutory reserves.

- Revaluation reserves for property revaluation, subject to certain conditions and a 55 percent discount.

- Other disclosed free reserves.

- Retained earnings at the end of the previous financial year, minus accumulated losses.

- Current year profits, subject to audit or limited review, minus average dividend paid in the last three years.

Certain adjustments and deductions are applied in calculating CET1 capital. These include deductions for goodwill and other intangible assets, certain Deferred Tax Assets (DTAs), investments in other NBFCs and group companies, and other specified items.

Differential Standard Asset Provision in

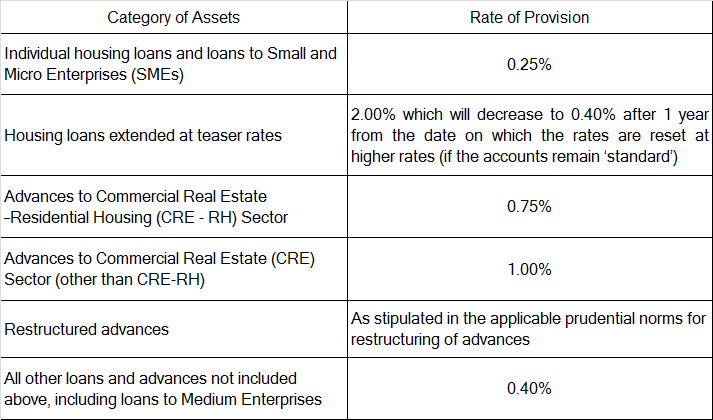

NBFCs must maintain provisions for ‘standard’ assets at specified rates. These rates vary based on the category of assets, such as individual housing loans, loans to SMEs, commercial real estate loans, and others. The provisioning requirements also apply to current credit exposures from permitted derivative transactions.

For NBFCs following Indian Accounting Standards (Ind AS), they must hold impairment allowances as required, subject to a prudential floor. The provisions mentioned above are included in the computation of this prudential floor but are not considered in calculating net NPAs.

Definitions and clarifications for terms like Micro, Small, and Medium Enterprises, Commercial Real Estate, and Commercial Real Estate – Residential Housing are provided for clarity.

Disclosures in Financial Statements

NBFCs must comply with the disclosure requirements as prescribed, ensuring transparency and accountability in their financial reporting.

Regulatory Restrictions and Limits

Large Exposure Framework (LEF)

The LEF is designed to manage credit risk concentration in NBFCs. It helps identify large exposures, defines criteria for grouping connected counterparties, and establishes reporting norms for these exposures. NBFCs are required to adhere to the LEF as outlined.

Definitions

“Tier 1 capital” is as defined earlier in these Directions. Profits accrued during the year can be considered as Tier 1 capital for LEF purposes after adjustments as per guidelines for NBFC-UL. NBFC-ULs must get an external auditor’s certificate on capital augmentation and submit it to the Reserve Bank’s Department of Supervision before adding to capital funds.

“Eligible capital base” refers to Tier 1 capital.

“Control” refers to the ability to appoint the majority of directors or to influence management or policy decisions. This can be through shareholding, management rights, agreements, or other means.

Scope of Application

- The LEF guidelines apply to NBFCs both individually and at a consolidated group level.

- Exposure includes both on and off-balance sheet exposures of the NBFCs.

Scope of Counterparties and Exemptions

The LEF considers NBFCs’ exposure to all counterparties and groups of connected counterparties, except for certain exempted exposures. The list of exemptions from the LEF will be specified.

Governance Guidelines

Qualification of Board Members

Board members of an NBFC must be capable of effectively managing the company. The Board should have a diverse mix of educational qualifications and experience. Depending on the NBFC’s business type, specific expertise in board members is essential.

Listing & Disclosures

An NBFC identified as NBFC-UL must get listed within three years. Even before actual listing, it should meet disclosure requirements similar to those for listed companies. These requirements should be in line with the NBFC’s Board-approved policy.

Transition Plan

When an NBFC is identified as an NBFC-UL (Upper Layer), the Reserve Bank’s Department of Regulation will notify it. The NBFC then enters a phase where it must comply with regulations specific to the Upper Layer. Here’s the timeline for this transition:

- Within three months of the Reserve Bank’s notification, the NBFC must develop a Board-approved policy. This policy will outline how to adopt the new regulatory framework and create a plan for compliance.

- The Board must ensure compliance with the NBFC-UL regulations within 24 months from the Reserve Bank’s notification. During this transition, business growth may be moderated through supervisory engagement. The initial three months for planning are included in this 24-month period.

- The NBFC must submit its implementation roadmap to the Reserve Bank for review.

Transition of NBFCs to the Upper Layer

- Once classified as NBFC-UL, the NBFC will be under enhanced regulatory requirements for at least five years, even if it doesn’t meet the criteria in subsequent years. It can only exit this framework if it doesn’t meet the classification criteria for five consecutive years.

- An NBFC-UL can exit the enhanced framework before five years if it strategically scales down operations as per a Board-approved policy. This doesn’t apply if the scale-down is due to adverse, specific situations affecting the NBFC’s financial health.

- NBFCs close to meeting the NBFC-UL criteria will be informed. This allows them to adjust operations if they prefer to remain as NBFC-ML (Middle Layer) long-term and not move to NBFC-UL.

Review of Assessment Methodology

The criteria and methodology for assessing NBFC-UL will be reviewed periodically to ensure relevance and effectiveness.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulations applicable for NBFC-ML

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Scoring Methodology for Identification of NBFC as NBFC-UL

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

Disclosures in Financial Statements – Notes to Accounts of NBFCs

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines for Credit Default Swaps – NBFCs as Users

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Guidelines on Liquidity Coverage Ratio (LCR)

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition