Regulations applicable for NBFC-ML

Prudential Regulations

Capital Requirement

Non-Banking Financial Companies (NBFCs) must maintain a minimum capital ratio. This ratio, made up of Tier 1 and Tier 2 capital, should be at least 15 percent of their risk-weighted assets. This includes both on-balance sheet and off-balance sheet items. For most NBFCs, Tier 1 capital should not be less than 10 percent at any time.

Capital Raising for Capital Adequacy

NBFCs can increase their capital funds by issuing Perpetual Debt Instruments (PDI). These are included in Tier 1 capital up to 15 percent of the total Tier 1 capital as of the previous financial year’s end.

Internal Capital Adequacy Assessment Process (ICAAP)

NBFCs must internally assess their capital needs based on their business risks. This process is similar to what commercial banks do. They should realistically assess risks like credit, market, operational, and other risks. The goal is to ensure enough capital for all risks and improve risk management.

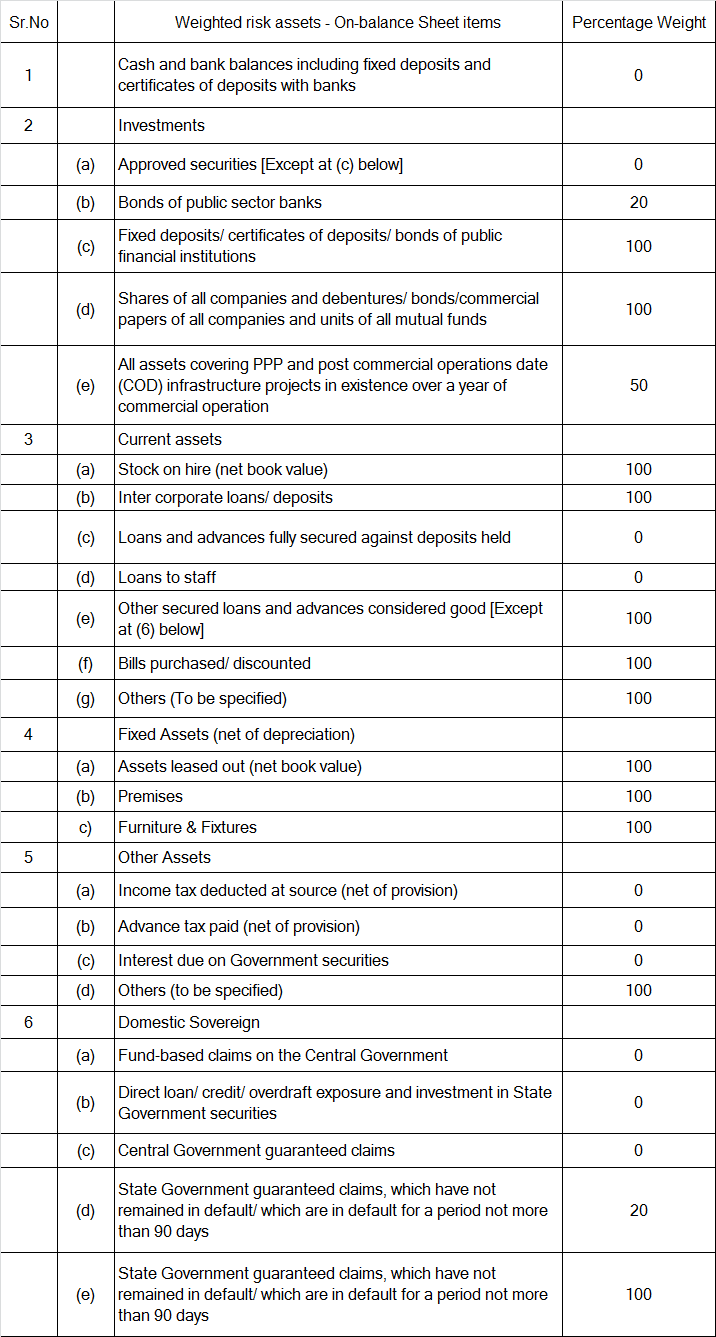

Treatment of On-Balance Sheet Assets for Capital Ratio

Different types of assets on the balance sheet have specific risk weights. These weights help calculate the risk-adjusted value of assets, which is used to determine the minimum capital ratio. For example, cash and bank balances have a 0 percent risk weight, while investments in shares or debentures have a 100 percent risk weight.

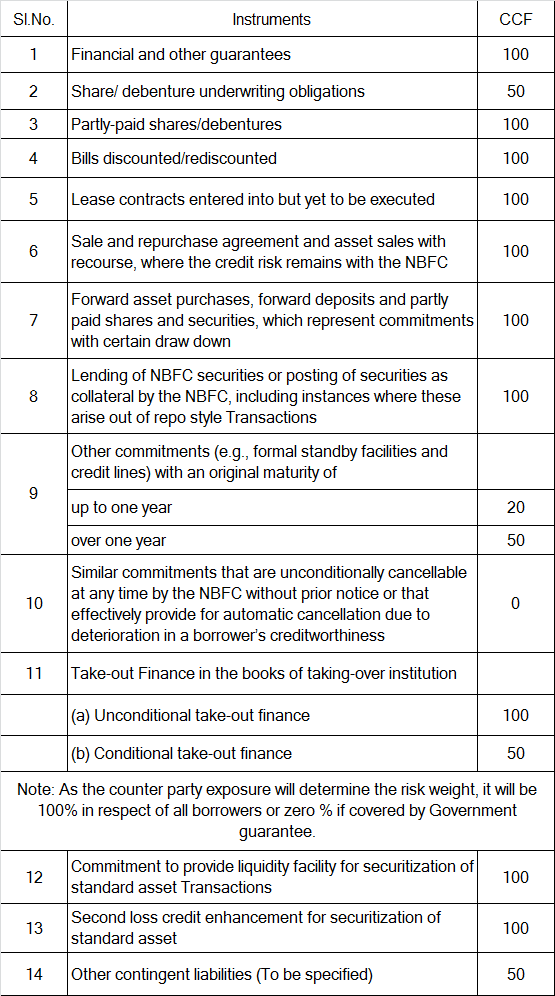

Non-market-related off-balance sheet items

Current Exposure Method (used for measuring capital charge for default risk)

Deferred Tax Assets and Liabilities

Deferred Tax Assets (DTA) and Deferred Tax Liabilities (DTL) affect a company’s balance sheet. DTL is not included in capital for adequacy purposes. DTA is treated as an intangible asset and deducted from Tier 1 capital.

Asset Classification

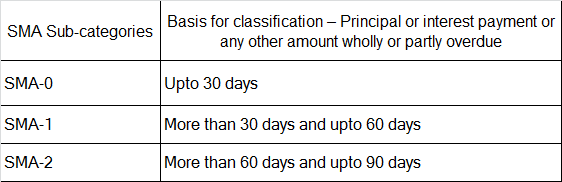

NBFCs must classify their assets into standard, sub-standard, doubtful, and loss assets based on repayment performance and reliance on collateral. An asset is non-performing if interest or principal is overdue for more than 90 days.

NBFC shall recognize incipient stress in loan accounts, immediately on default, by classifying such assets as special mention accounts (SMA) as per the following categories:

Standard Asset Provisioning

NBFCs should make a provision of 0.40 percent of their outstanding standard assets. This provision should be shown separately in the balance sheet.

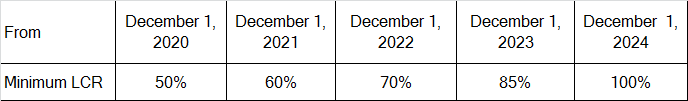

Liquidity Coverage Ratio (LCR)

Certain NBFCs must maintain a liquidity buffer known as the LCR. This ensures they have enough High-Quality Liquid Assets (HQLA) to survive a 30-day liquidity stress scenario. The LCR requirement will gradually increase to 100 percent by December1, 2024.

All non-deposit taking NBFCs with asset size of ₹5,000 crore and above but less than ₹10,000 crore shall also maintain the required level of LCR starting December 1, 2020, as per the timeline given below:

Disclosure in Financial Statements

NBFCs must regularly report to their Board of Directors about risk management systems, corporate governance, and other key aspects. They should also disclose in their Annual Financial Statements details like regulatory licenses, credit ratings, penalties, overseas operations, and asset-liability profiles.

Regulatory Restrictions and Limits

Credit/Investment Concentration Norms

NBFCs, except for certain types, must follow specific exposure limits. This means the amount of credit or investment in a single party or group of parties should not exceed a certain percentage of the NBFC’s Tier 1 capital. For a single party, the limit is 25%, and for a group of parties, it’s 40%. These limits can be slightly higher for infrastructure loans and investments. For NBFC-IFCs, the limits are 30% for a single party and 50% for a group.

Investments in shares of other companies are generally restricted, but there are exceptions, especially for investments in insurance companies, as specifically allowed by the Reserve Bank.

NBFCs that don’t use public funds or issue guarantees in India are not subject to these exposure norms. Also, investments in subsidiaries or companies within the same group, to the extent reduced from Owned Funds for Net Owned Fund (NOF) calculation, are exempt.

NBFCs should have a policy for exposures to a single party or group of parties. Government NBFCs serving specific sectors can ask the Reserve Bank for exemptions.

Sensitive Sector Exposure (SSE)

NBFCs must set internal limits for exposure to sensitive sectors like the capital market and commercial real estate. These limits should be based on periodic assessments of sector vulnerabilities. Within the overall SSE limit, NBFCs should have a specific sub-limit for financing land acquisition and a ceiling for IPO funding.

Regulatory Restrictions on Loans

Loans and Advances to Directors

NBFCs can’t give loans and advances of five crores or more to their directors, their relatives, or firms and companies associated with them without Board approval. For loans under five crores, they can be sanctioned by the appropriate authority but must be reported to the Board.

Loans and Advances to Senior Officers

Loans to senior officers must be reported to the Board. No senior officer or committee including a senior officer can sanction loans to their relatives. Such loans must be approved by a higher authority.

Loans and Advances to Real Estate Sector

NBFCs must ensure that borrowers seeking loans for real estate projects have the necessary government permissions. Loans can be sanctioned normally, but disbursements should only happen after these clearances are obtained.

In cases of loans to related parties of directors or senior officers, NBFCs need a declaration from the borrower about their relationship with these individuals for loans of five crores or more. If false declarations are found, the loan should be recalled. These guidelines and the total amount of such loans should be disclosed in the Annual Financial Statement.

The same norms apply to awarding contracts by NBFCs. However, the term ‘loans and advances’ does not include loans against government securities, life insurance policies, fixed deposits, stocks and shares, and certain employee benefits, provided the NBFC’s interest is legally enforceable.

Governance Guidelines

Constitution of Committees of the Board

Audit Committee

NBFCs must have an Audit Committee with at least three board members. If an NBFC already has an Audit Committee as per the Companies Act, 2013, it can serve for this purpose too. The committee should ensure an Information System Audit of internal systems and processes at least once every two years to assess operational risks.

Nomination and Remuneration Committee

NBFCs, except those run by the government, should form a Nomination and Remuneration Committee (NRC). This committee should function as per the Companies Act, 2013. Government NBFCs should form a Nomination Committee to check the suitability of directors. If an NBFC already has an NRC as per the Companies Act, it can be used for this purpose.

Appointment of Chief Risk Officer

NBFCs with significant assets should appoint a Chief Risk Officer (CRO) to enhance risk management. The CRO should be a senior official with relevant qualifications and experience. They should be appointed for a fixed tenure and report directly to the MD, CEO, or Risk Management Committee. The CRO’s role is advisory in credit decisions and they should not have business targets or dual responsibilities.

‘Fit and Proper Criteria’ for Directors

NBFCs must ensure their directors meet ‘fit and proper’ criteria at appointment and continuously. They should get declarations and undertakings from directors and have them sign a Deed of Covenant. Changes in directors and compliance with these criteria should be reported to the Reserve Bank quarterly.

Key Managerial Personnel

Key Managerial Personnel should not hold positions in multiple NBFCs, with certain exceptions. They have two years from October 2022 to comply with these norms.

Independent Director

An independent director should not be on the board of more than three NBFCs at the same time. The board should ensure no conflicts of interest arise. They have two years from October 2022 to comply with these norms.

Guidelines on Compensation of Key Managerial Personnel and Senior Management

NBFCs must have a Board-approved compensation policy. This policy should include a Remuneration Committee, principles for pay structures, and mauls/claw back provisions. The policy should comply with statutory mandates and guidelines.

Framing of Internal Guidelines on Corporate Governance

NBFCs should create their own corporate governance guidelines, approved by the Board. These guidelines should be published on the company’s website for stakeholders’ information. The internal guidelines should expand on the principles in Chapter XI without losing their essence.

Miscellaneous Instructions

Participation in Currency Options

Non-deposit taking NBFCs can participate in currency options exchanges approved by SEBI. This is only for hedging their fore exposures. They must follow the Reserve Bank’s Foreign Exchange Department guidelines. Their balance sheet should include details of these transactions as per SEBI’s guidelines.

Introduction of Interest Rate Futures

These NBFCs can also join the interest rate futures market on recognized stock exchanges. They must follow the ‘Rupee Interest Rate Derivatives (Reserve Bank) Directions, 2019’ and its updates.

Ready Forward Contracts in Corporate Debt Securities

Non-deposit taking NBFCs are eligible for repo transactions in corporate debt securities. They need to follow the ‘Repurchase Transactions (Repo) (Reserve Bank) Directions, 2018’ and its updates. The risk weights for credit risk and counterparty credit risk apply as per specific paragraphs of these Directions. Balances in accounts like repo and reverse repo should be classified similarly to banks. For other aspects of these transactions, they should follow the Reserve Bank’s Financial Markets Regulation Department’s guidelines.

Undertaking Point of Presence Services for National Pension System

NBFCs meeting certain CRAR criteria and having made a profit in the previous year can offer Point of Presence services for the National Pension System. They must register with the Pension Fund Regulatory and Development Authority (PFRDA). They should deposit NPS subscriptions on the same day they are collected. They must follow PFRDA’s regulations strictly. Violations could lead to supervisory actions, including cancellation of their POP services permission.

Licensing as Authorized Dealer- Category II

Non-deposit taking NBFC-ICC can apply for an Authorized Dealer- Category II license. They must have a minimum investment grade rating and a board-approved policy for managing risks and handling customer grievances related to forex services. They should monitor these services monthly. Interested NBFCs should apply to the Reserve Bank’s Foreign Exchange Department in Mumbai for this license.

Appointment of Internal Ombudsman

NBFCs meeting the criteria in the ‘Appointment of Internal Ombudsman by Non-Banking Financial Companies’ circular should appoint an Internal Ombudsman. They must follow the corresponding guidelines.

Introduction to RBI – NBFC Scale Based Regulation

Regulations applicable for NBFC-BL

Regulatory Instructions for NBFC-UL

Directions for NBFC – Micro Finance MFIs

Specific Directions for NBFC-Factors and NBFC-ICCs

Specific Directions for Infrastructure Debt Funds IDFs-NBFC

Scoring Methodology for Identification of NBFC as NBFC-UL

Regulatory Guidance on Implementation of Ind AS by NBFCsv

Norms on Restructuring of Advances by NBFCs

Early Recognition of Financial Distress

Flexible Structuring of Long Term Project Loans to Infrastructure and Core Industries

Guidelines on Liquidity Risk Management Framework

Disclosures in Financial Statements – Notes to Accounts of NBFCs

Managing Risks and Code of Conduct in Outsourcing of Financial Services by NBFCs

Guidelines for Credit Default Swaps – NBFCs as Users

Guidelines on Private Placement of NCDs by NBFCs

Guidelines for Entry of NBFCs into Insurance

Guidelines on Issue of Co-Branded Credit Cards

Guidelines on Distribution of Mutual Fund Products by NBFCs

Guidelines on Perpetual Debt Instruments

Guidelines on Liquidity Coverage Ratio (LCR)

Balance Sheet Disclosure Guidelines for NBFCs in Middle Layer and Above

Self-Regulatory Organization (SRO) for NBFC-MFIs – Criteria for Recognition