Lease accounting, lease period extended after year 1 – Journal entries

Details for lease accounting for lease extension

Let us assume the following details for lease accounting:

Lease start date: 1-Apr-2019

Lease end date: 31-Mar-2024

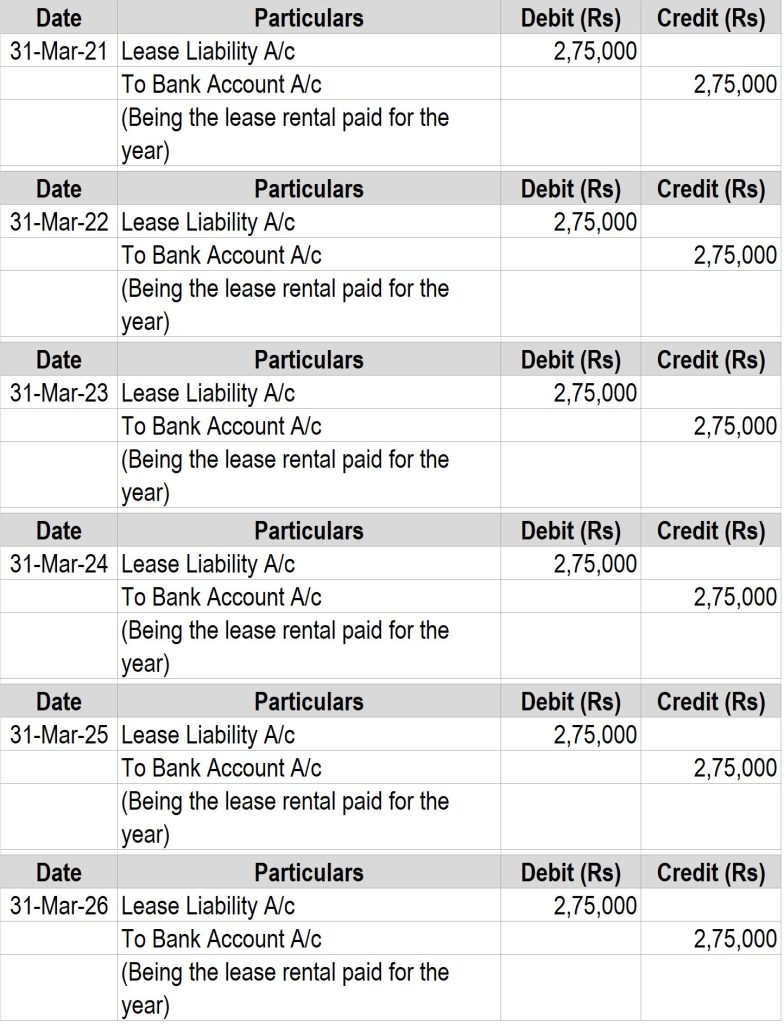

Lease payments: Rs. 2,75,000

Payment frequency: Annual – payable at the end

Incremental borrowing rate: 9%

Lease extension on 1-4-2020:

Lease Modification effective date: 1-Apr-2020

Lease end date extended up to: 31-Mar-2026

All other terms remain the same

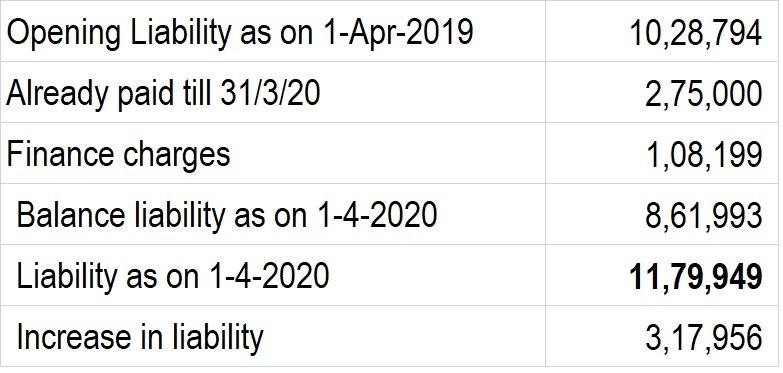

When the lease is modified without any increase in the scope of the lease then lease liability and the right-of-use are recomputed on the effective date of such modification. This would result in amortising an additional amount and the finance charges based on the revised lease liability should be recomputed.

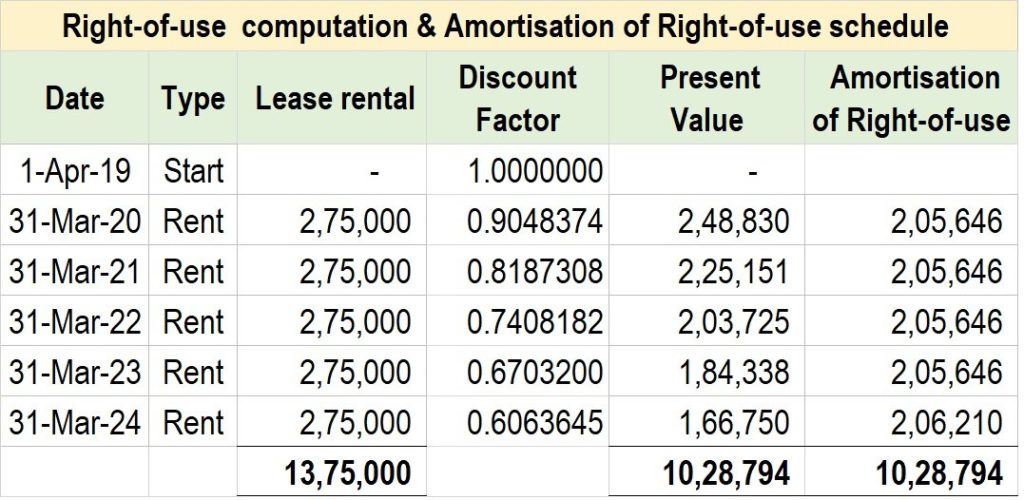

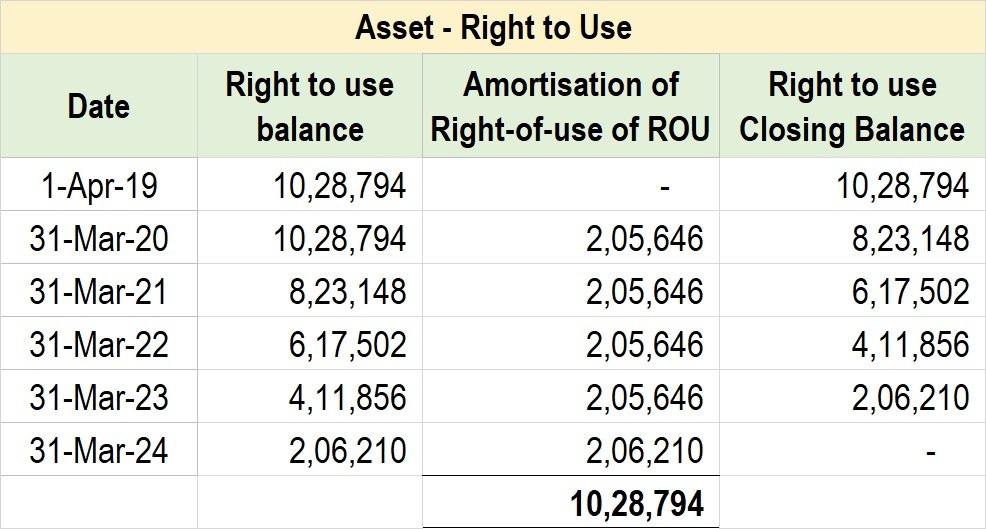

Right-of-use

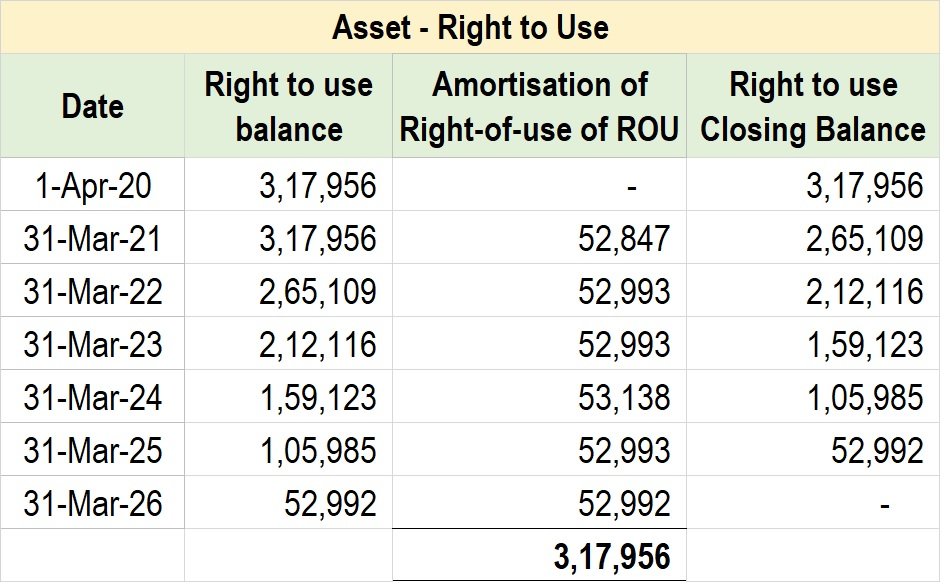

Extension of Lease period known on 1-Apr-2020

Lease extended to 31-Mar-2026 (from 31-Mar-2024)

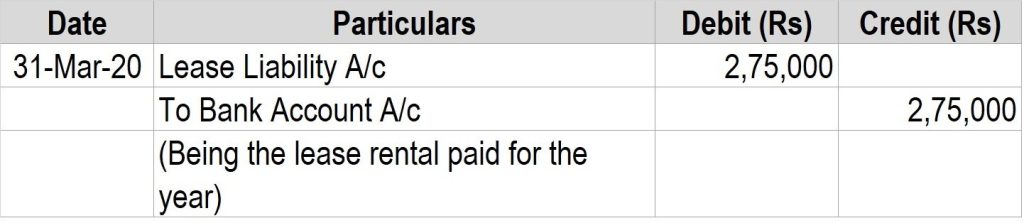

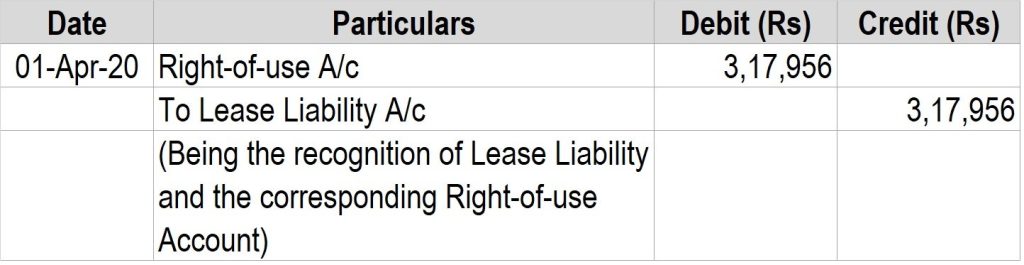

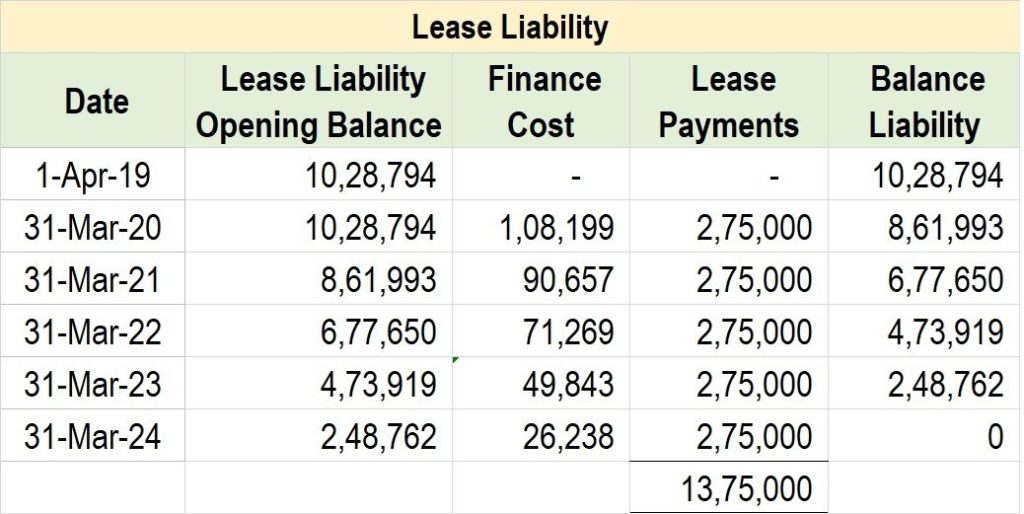

Recognition of Lease liability

Impact of Lease extension:

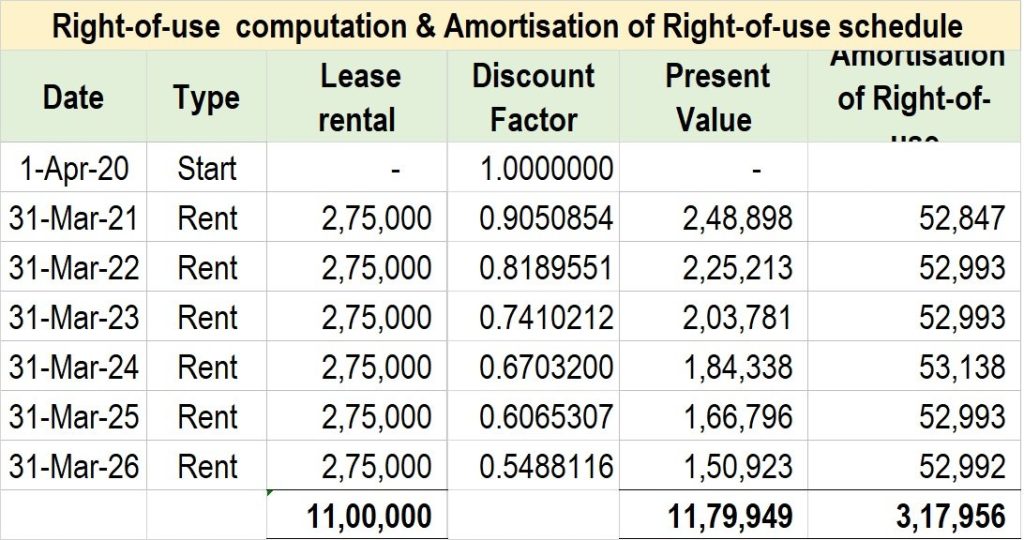

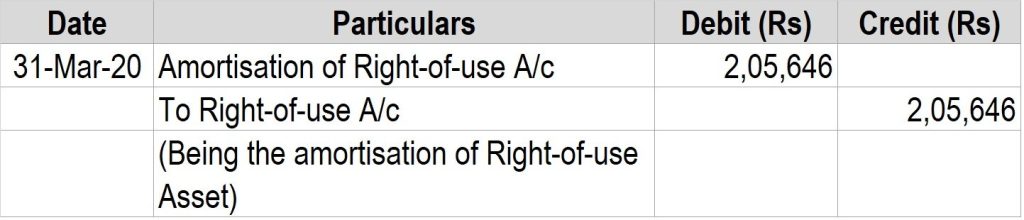

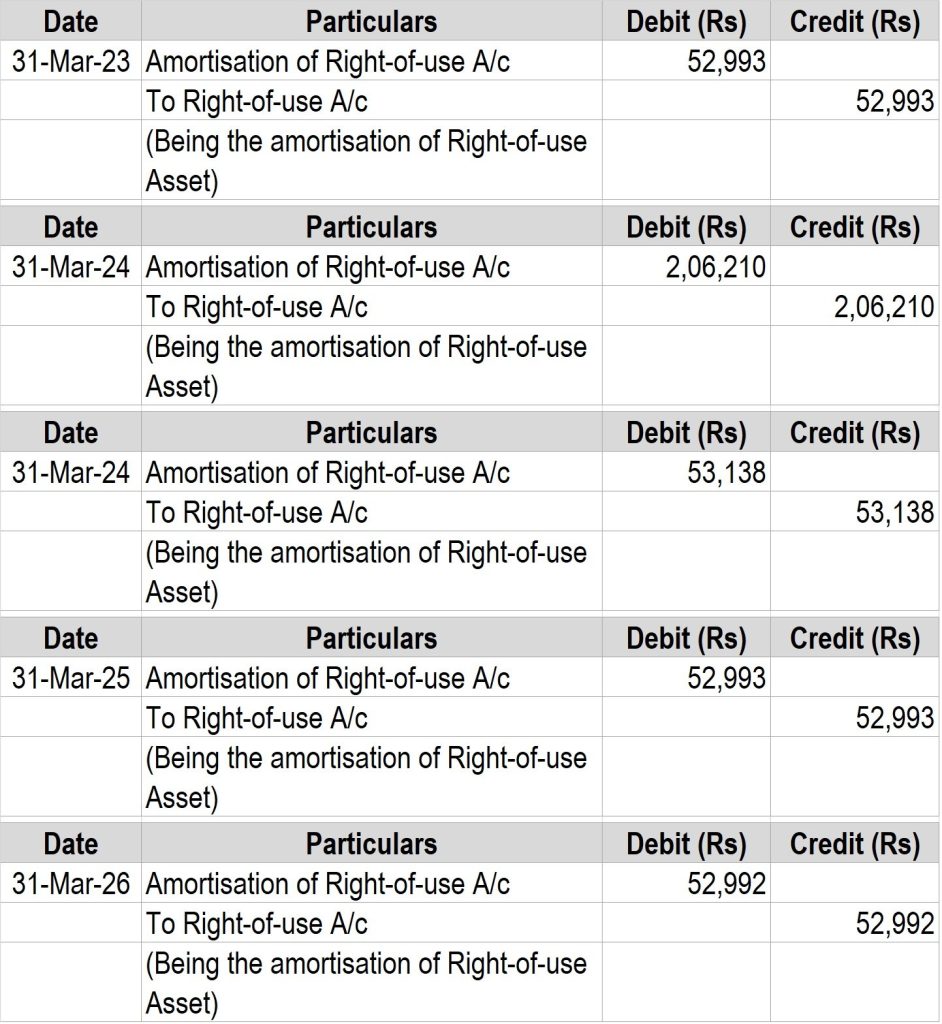

Amortisation of Right-of-use

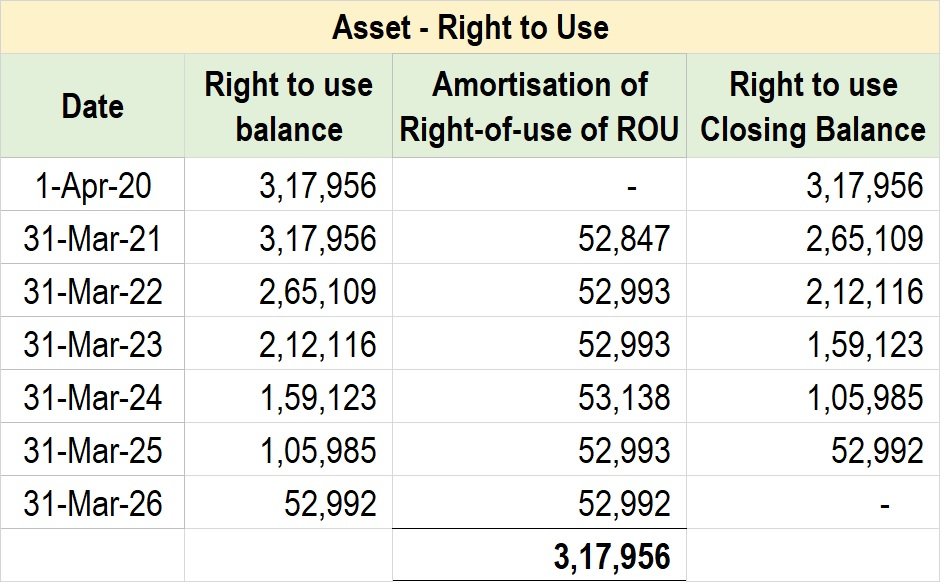

Revised table of amortisation:

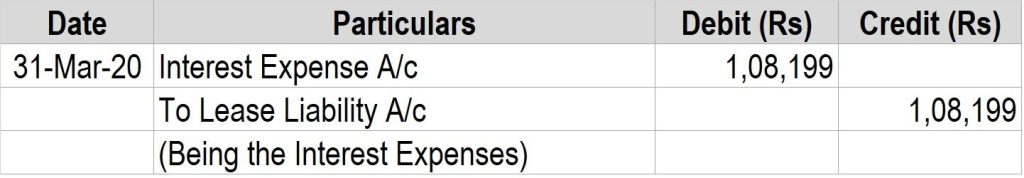

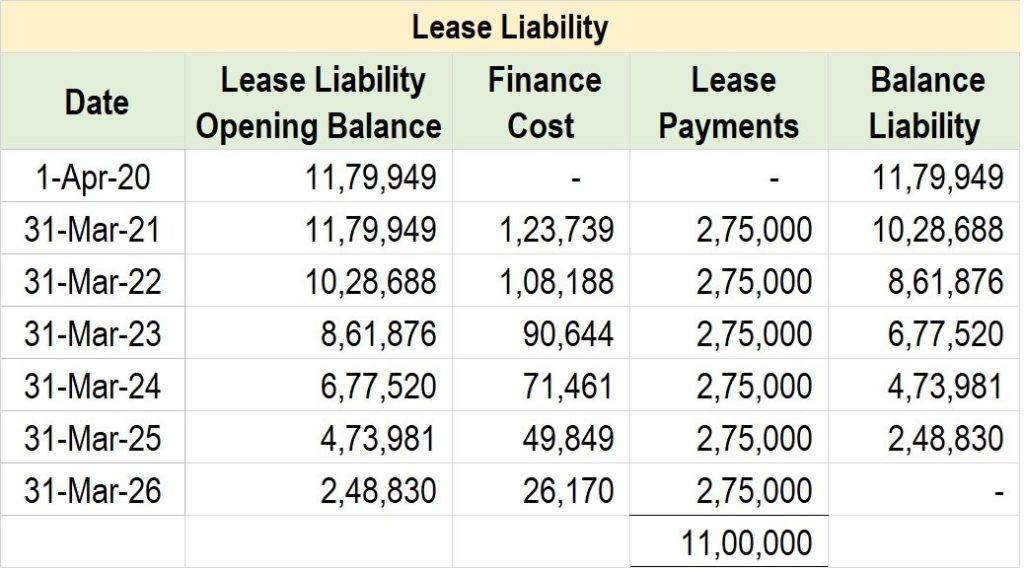

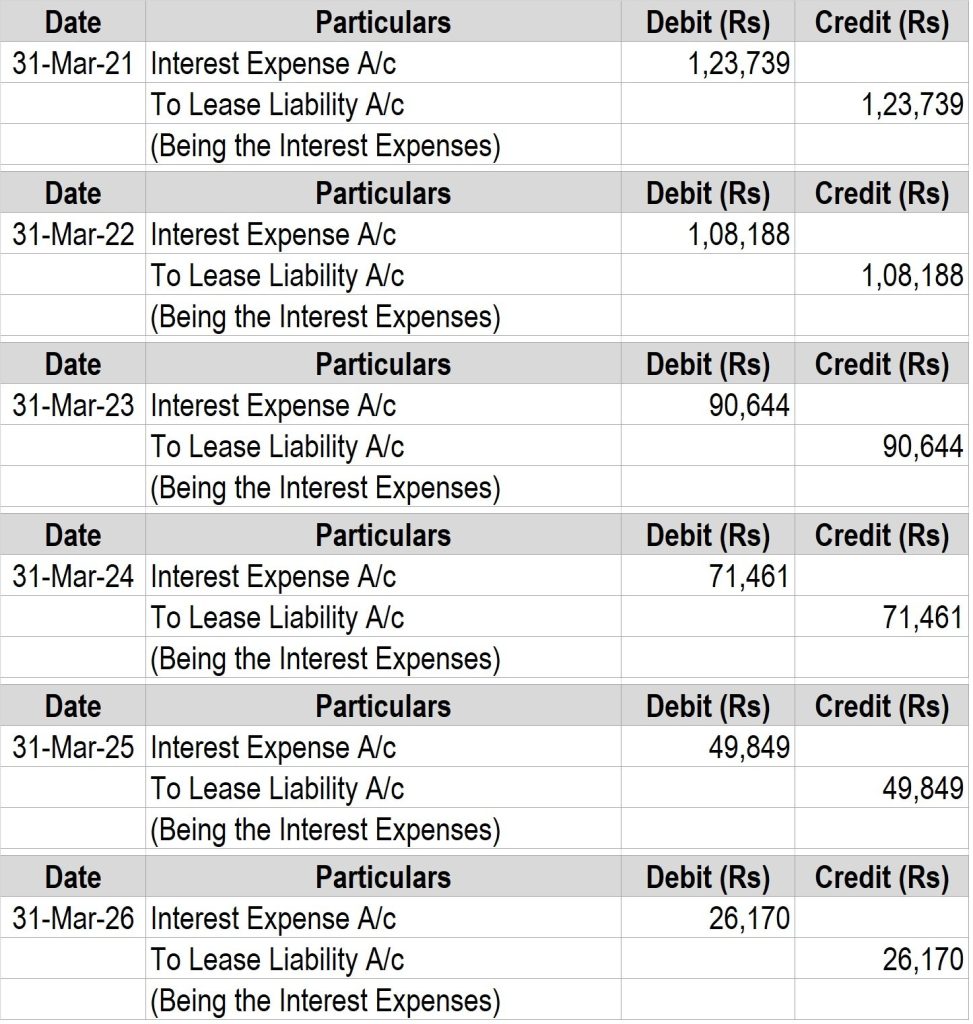

Finance cost

Impact of lease extension:

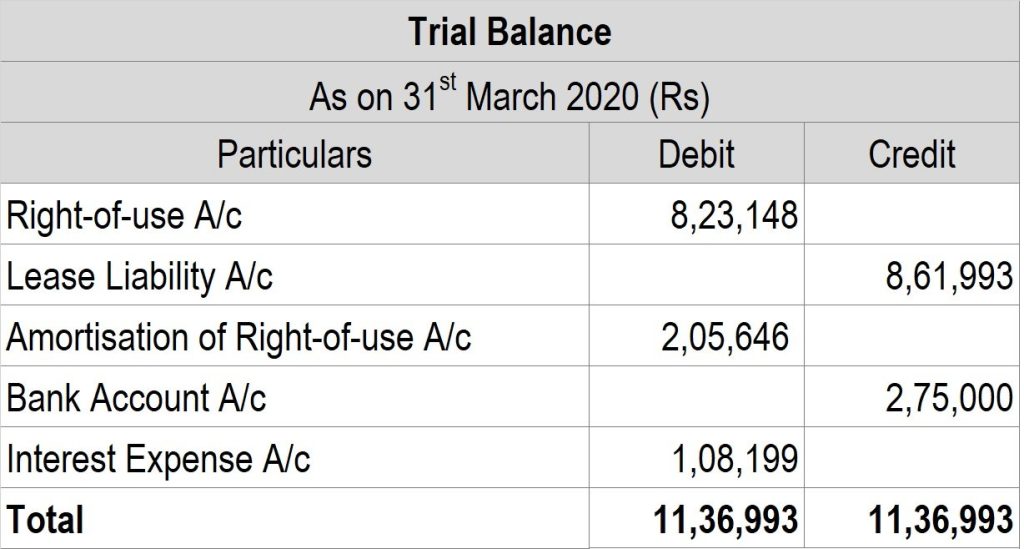

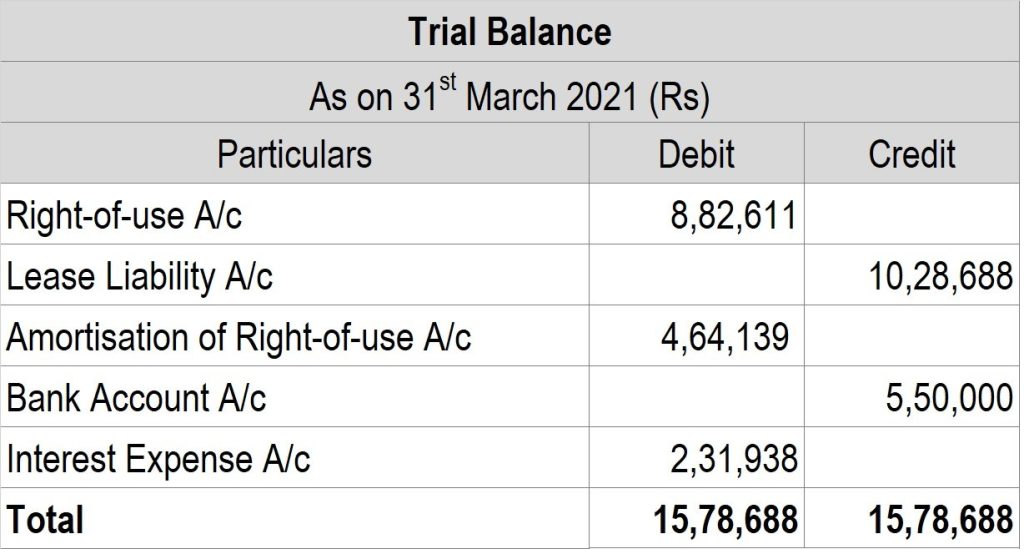

Trial balance

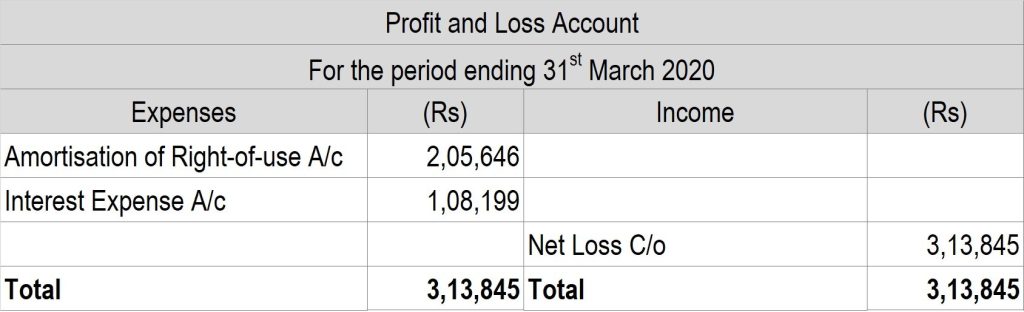

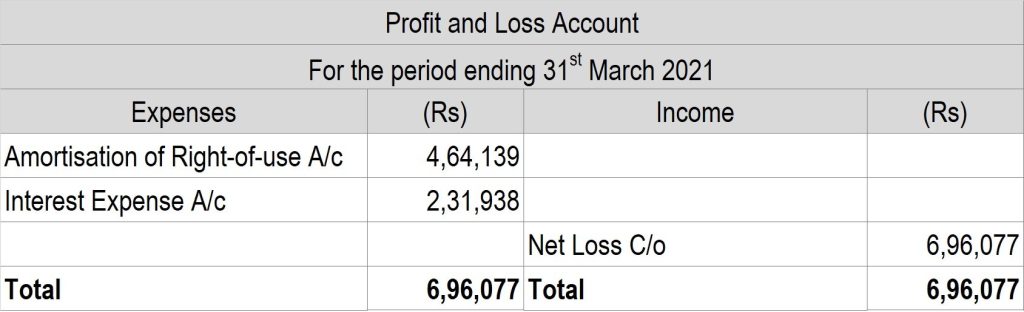

Profit and Loss Account

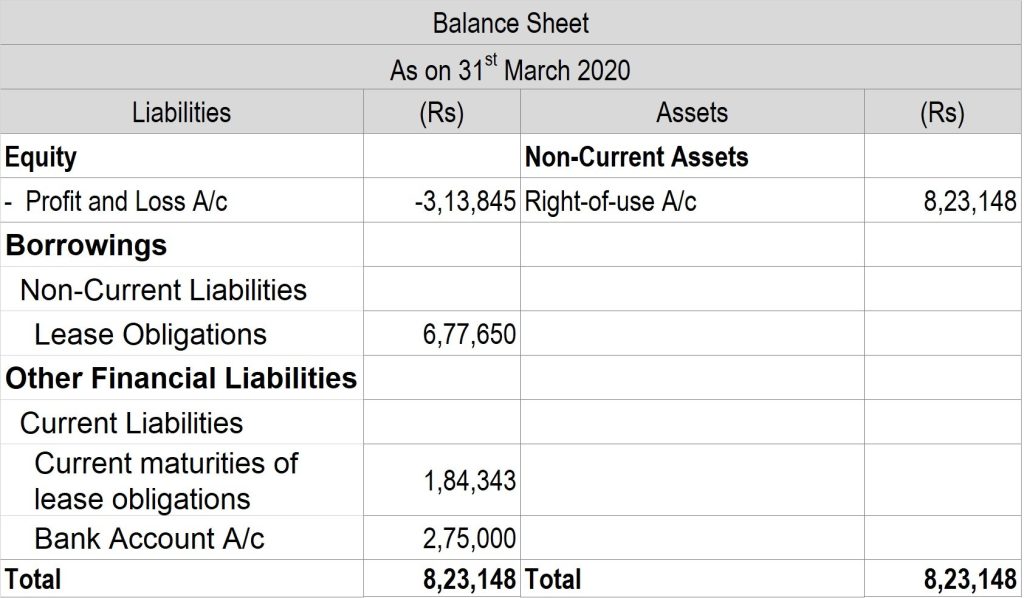

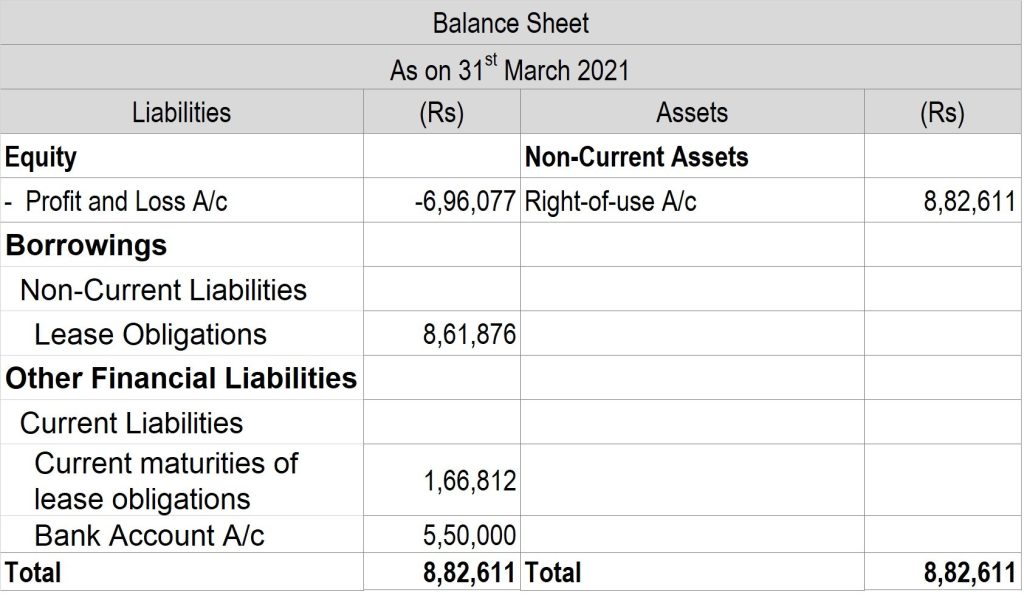

Balance Sheet

No post found!

What is the difference between operating lease and finance lease?

Lease accounting, interest-free deposit lease period extended after year 1

Lease accounting Journal Entries for Modification

Lease accounting with an interest-free deposit

Journal entries for lease accounting

Operating lease vs financing lease

Lease Accounting as per IFRS 16 vs. AS 19

How to compute right-to-use asset

How to determine the lease term as per the standard

How to separate the components of a lease contract

How to identify a lease contract as per the lease accounting standard

Lease Accounting as per Ind AS 116

Presentation & Disclosure – lease accounting standard

What is the new lease accounting standard

Lease Accounting as per IFRS 16

Extracts from Annual reports – Lease Accounting

Exemptions that can be availed in lease accounting