Steps in lease accounting

Details for lease accounting

Let us assume the following details for lease accounting as per Ind AS 116

Lease start date: 1-Apr-2019

Lease end date: 31-Mar-2024

Lease payments: Rs. 2,75,000

Payment frequency: Annual – payable at the end

Incremental borrowing rate: 9%

Step 1: Calculate the right-of-use

The right-of-use is first calculated as follows:

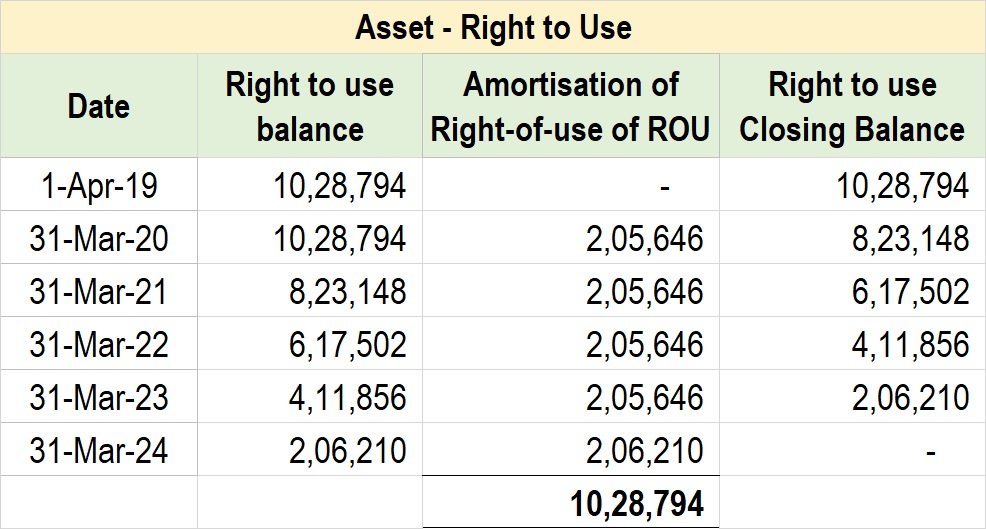

Step 2: Prepare amortisation schedule

The amortisation schedule based on straight line method is calculated as follows:

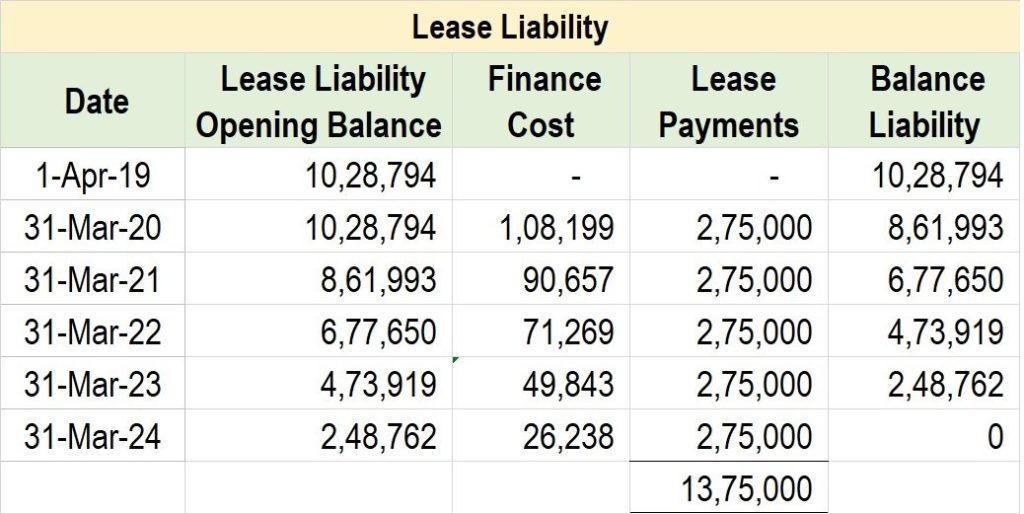

Step 3: Calculate Lease Liability

The lease liability is computed as follows:

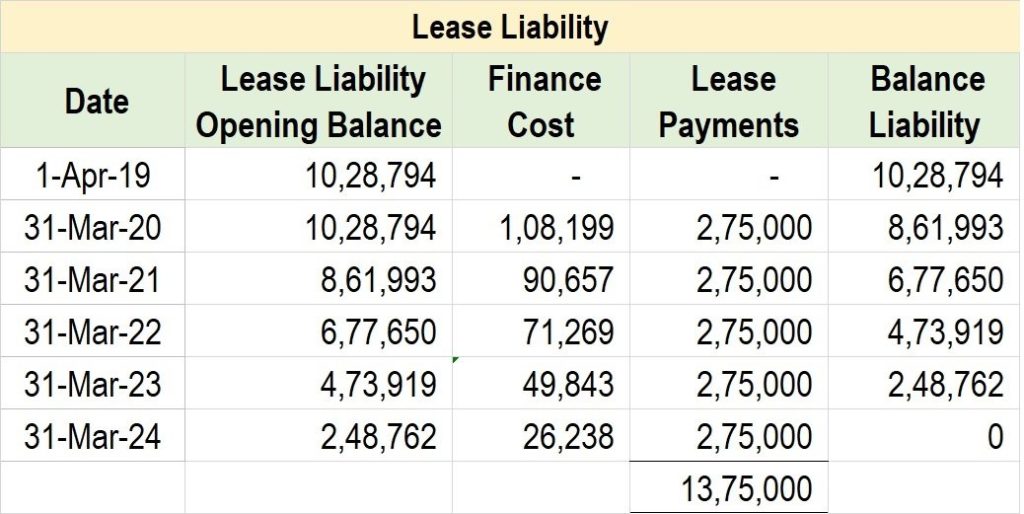

Step 4: Calculate the finance charges

The finance charges for the lease liability is calculated as follows:

Lease Accounting Software Pricing

No post found!

What is the difference between operating lease and finance lease?

Lease accounting, lease period extended after year 1 – Journal entries

Lease accounting, interest-free deposit lease period extended after year 1

Lease accounting Journal Entries for Modification

Lease accounting with an interest-free deposit

Journal entries for lease accounting

Operating lease vs financing lease

Lease Accounting as per IFRS 16 vs. AS 19

How to compute right-to-use asset

How to determine the lease term as per the standard

How to separate the components of a lease contract

How to identify a lease contract as per the lease accounting standard

Lease Accounting as per Ind AS 116

Presentation & Disclosure – lease accounting standard

What is the new lease accounting standard

Lease Accounting as per IFRS 16

Extracts from Annual reports – Lease Accounting

Exemptions that can be availed in lease accounting