Lease accounting with an interest-free deposit

Details for lease accounting

Let us assume the following details for lease accounting:

Lease start date: 1-Apr-2019

Lease end date: 31-Mar-2024

Lease payments: Rs. 2,75,000

Lease Deposit: Rs. 3,00,000

Payment frequency: Annual – payable at the end

Incremental borrowing rate: 9%

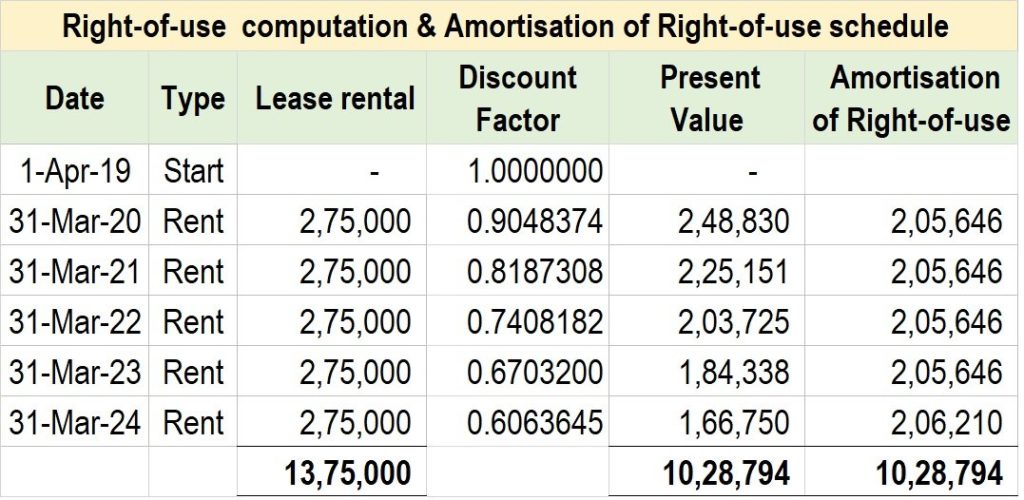

Right-of-use

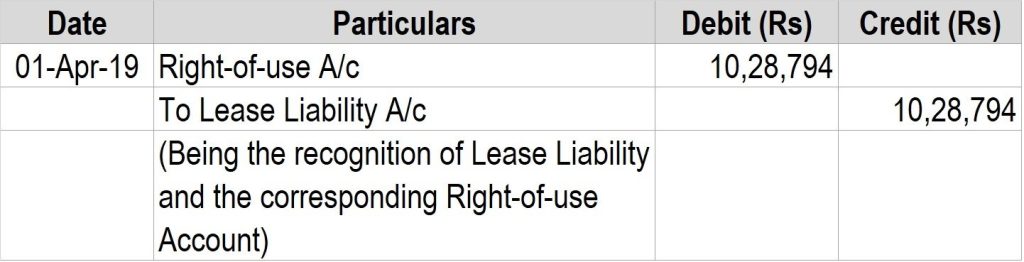

Recognition of Lease liability

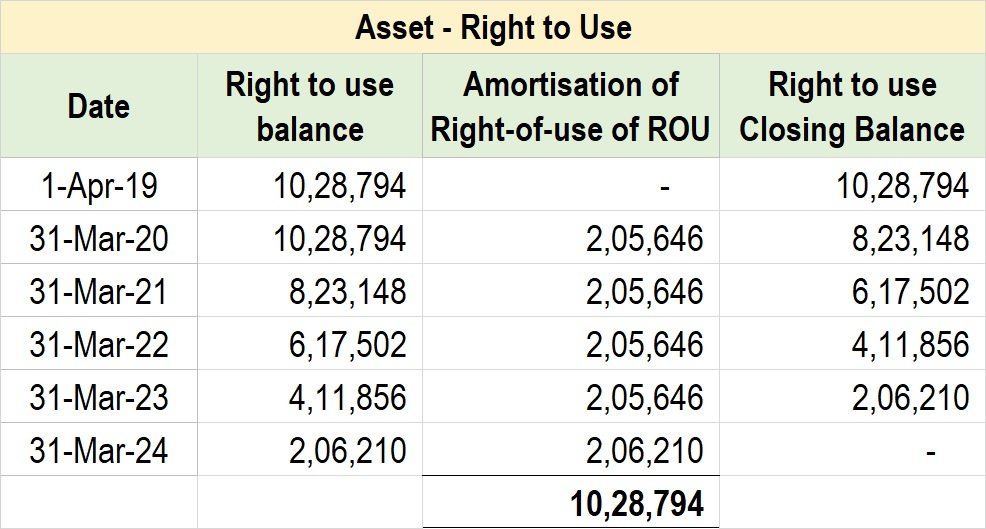

Amortisation of Right-of-use

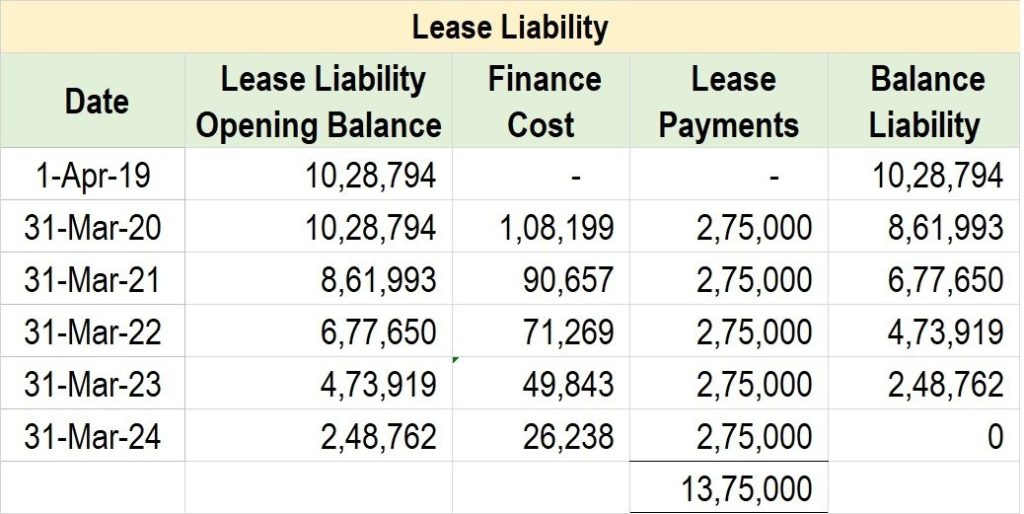

Finance cost

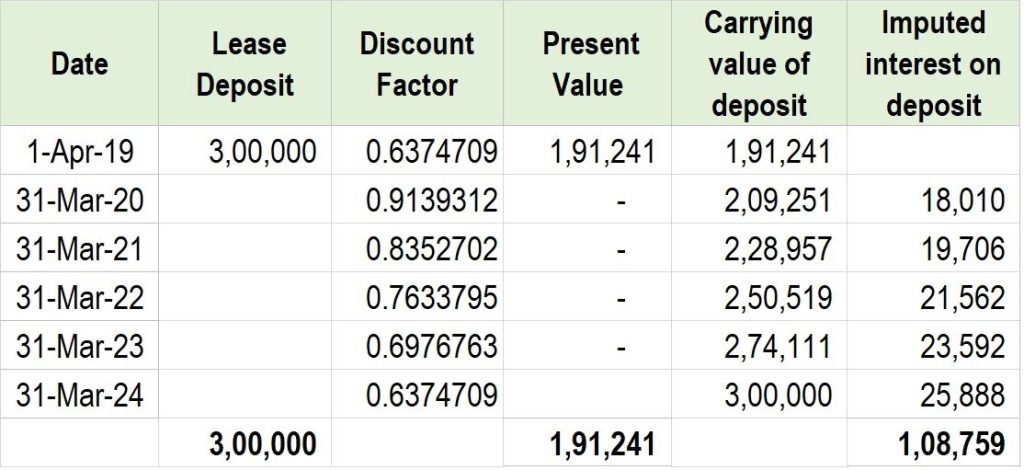

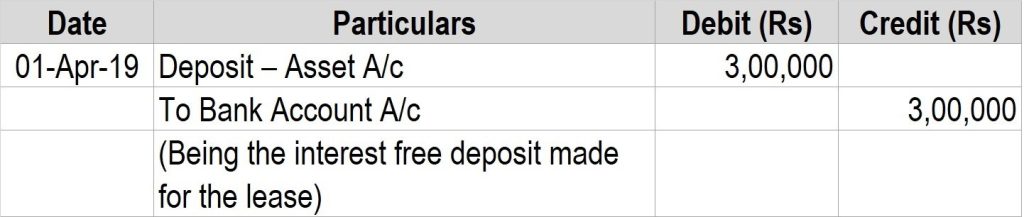

Interest free deposit

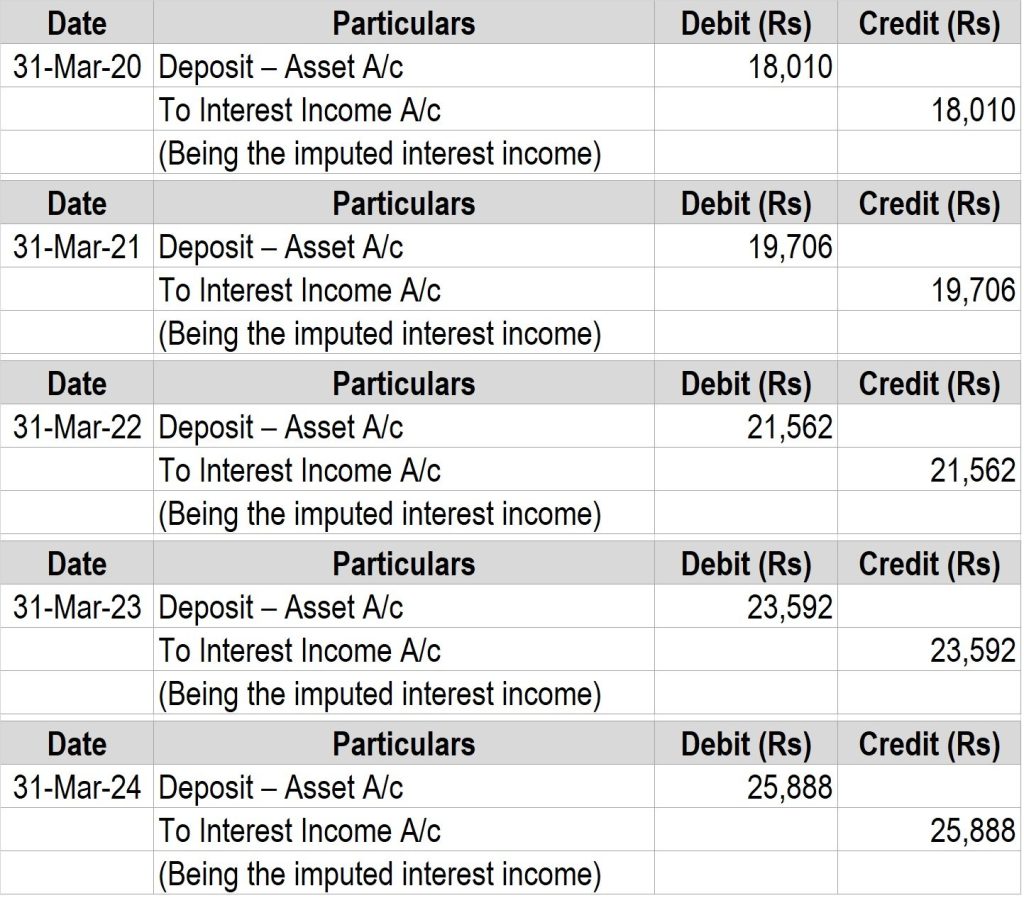

Imputed interest income

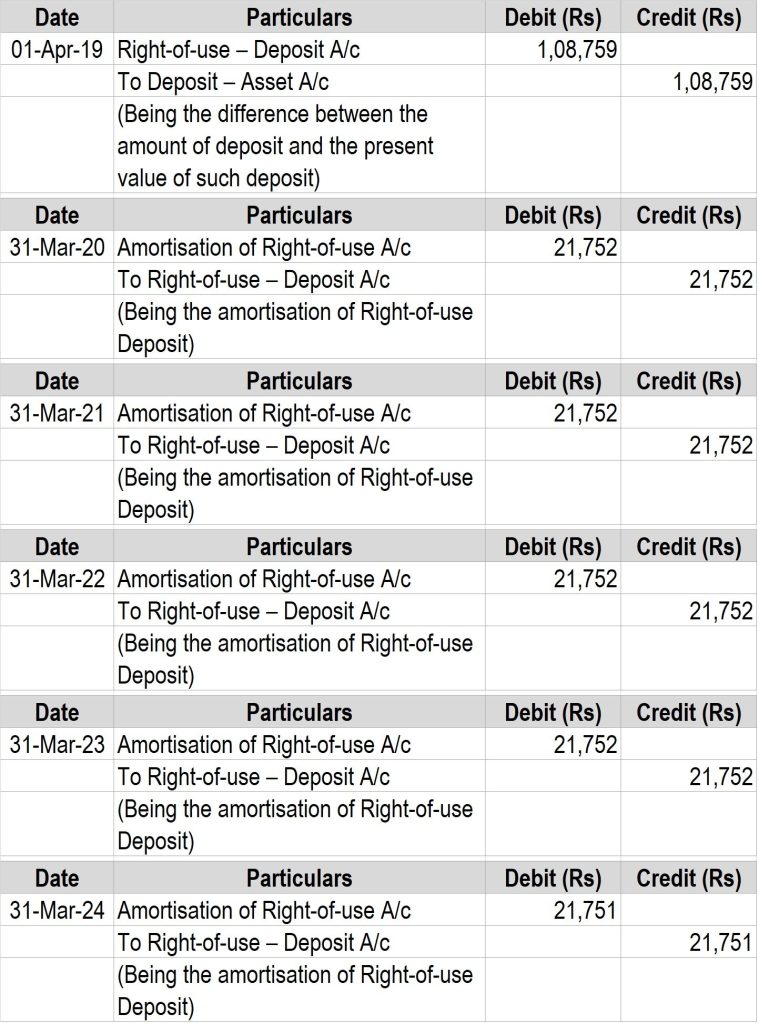

Amortisation of Right-of-use

Trial balance

Profit and Loss Account

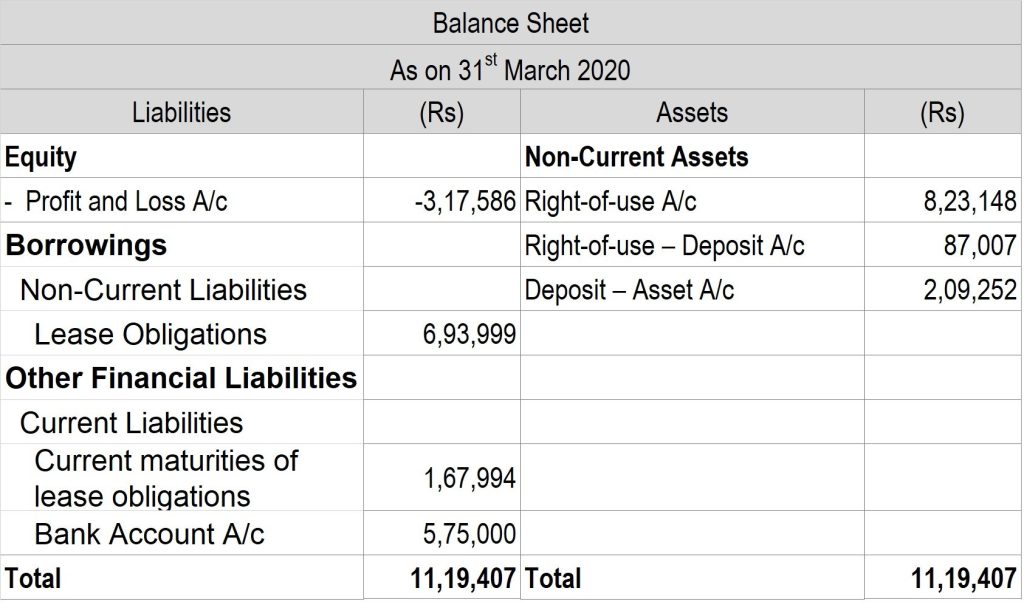

Balance Sheet

Lease Accounting Software Pricing

No post found!

What is the difference between operating lease and finance lease?

Lease accounting, lease period extended after year 1 – Journal entries

Lease accounting, interest-free deposit lease period extended after year 1

Lease accounting Journal Entries for Modification

Journal entries for lease accounting

Operating lease vs financing lease

Lease Accounting as per IFRS 16 vs. AS 19

How to compute right-to-use asset

How to determine the lease term as per the standard

How to separate the components of a lease contract

How to identify a lease contract as per the lease accounting standard

Lease Accounting as per Ind AS 116

Presentation & Disclosure – lease accounting standard

What is the new lease accounting standard

Lease Accounting as per IFRS 16

Extracts from Annual reports – Lease Accounting

Exemptions that can be availed in lease accounting