Mutual Agreement Procedure

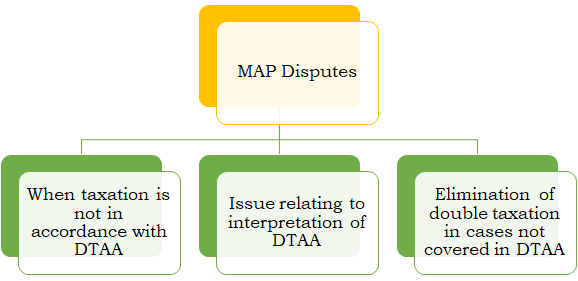

- Mutual Agreement Procedure (‘MAP’) is a procedure set out in most treaties which permit designated Government representatives to work together to resolve international tax disputes including issues involving double taxation, questions regarding residential status, tax recovery etc.

- MAP is used to eliminate double taxation that can arise from transfer pricing adjustments.

Eligibility for MAP

- MAP application can be filed by a person when he considers that he has not been taxed in accordance with the Treaty.

- Even if such person has other remedies such as appeal process under the domestic laws, MAP can be initiated. MAP can be applied in the country in which he is a resident or a national.

- This can be presented within three years from the date of receipt of notice of the action which gives rise to taxation not in accordance with convention.

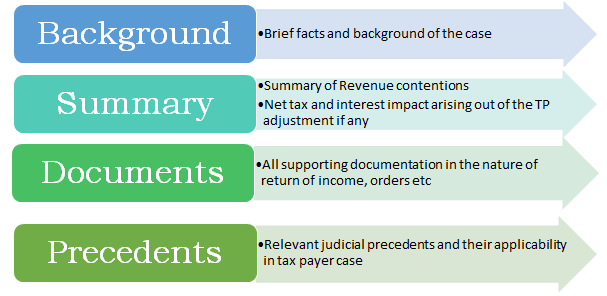

Steps in MAP application

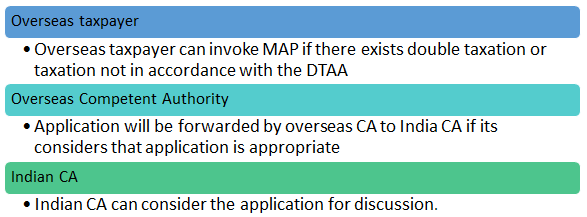

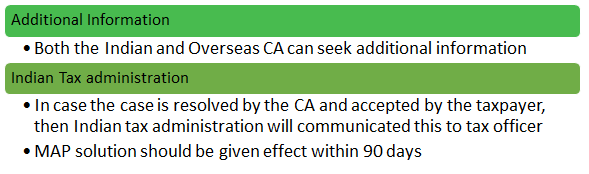

MAP process in India

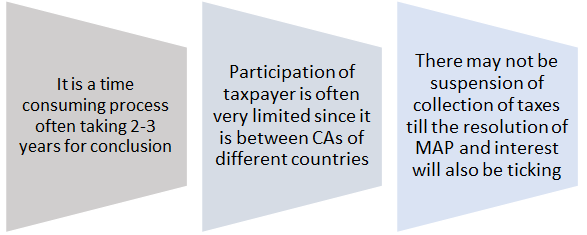

Drawbacks of MAP

Income from transaction with Non-Residents – Transfer Pricing

Transfer pricing adjustment and consequence

Dispute Mitigation strategies in transfer pricing

Advance Pricing Agreements (APA)

Fundamentals of Base Erosion and Profit Shifting – Transfer Pricing

Anti-Avoidance measures in certain jurisdictions – Transfer pricing

Returns, Audit and other miscellaneous provisions – Transfer pricing

Determination of ALP – Transfer Pricing

Arm’s Length Principle – Transfer Pricing

Specified Domestic Transactions – Transfer Pricing

Secondary Adjustment – transfer pricing

International Transaction [Section 92B] – Transfer Pricing

Additional reporting by Multinational companies – Transfer pricing

Economic analysis – Transfer Pricing

Limitation of interest deductions – transfer pricing

Penalties for non-compliance – Transfer Pricing